Cambodia Investment Review

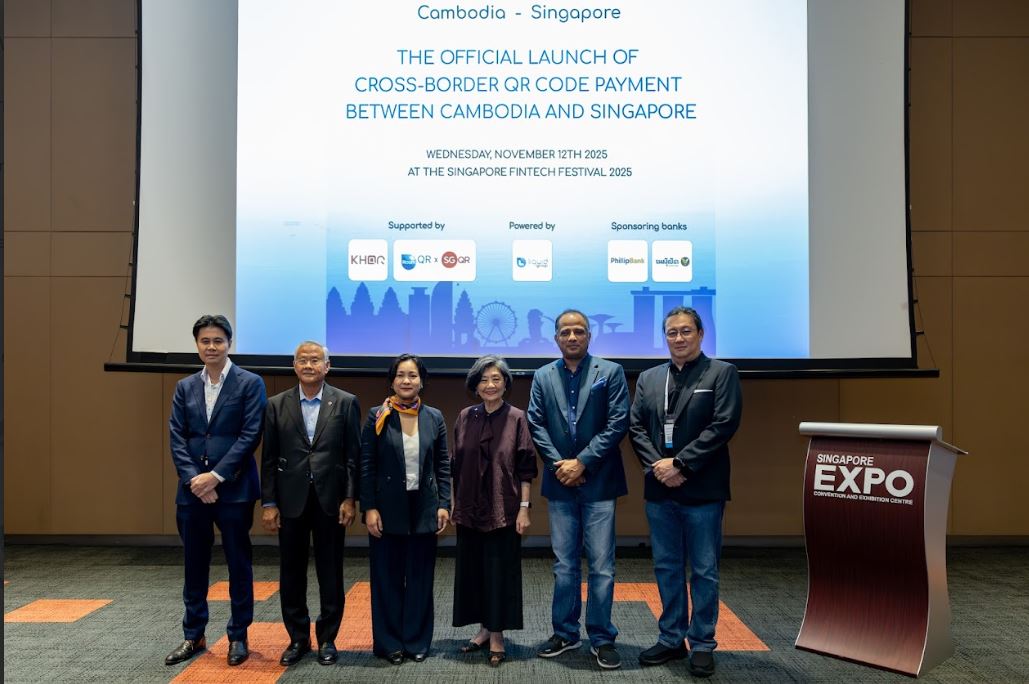

Phillip Bank is making shopping abroad easier than ever for Cambodian travelers with the launch of RoamQR, a new cross-border payment solution powered by Liquid Group. Whether visiting Singapore or transiting through Changi Airport, Phillip Bank customers can now scan to pay from their Khmer Riel (KHR) accounts at participating RoamQR merchants, with payments automatically converted to Singapore Dollars (SGD) — no hassle, no hidden fees. This innovative service marks a significant step forward in making international travel and spending more seamless, convenient, and accessible for Cambodian travelers.

Building on its commitment to innovation and convenience, Phillip Bank introduces RoamQR to give Cambodian travelers a simple, secure, and cash-free way to pay abroad. With just a few taps on the Phillip Mobile App, customers can scan the RoamQR code at all merchants in Changi Airport and Jewel Singapore, and the amount in Singapore Dollars (SGD) will be instantly deducted from their Khmer Riel (KHR) account without any exchange hassle or additional fees.

Read More: Phillip Bank Recognized for Digital Innovation and Singaporean Excellence

“Every year, tens of thousands of Cambodians travel to Singapore for tourism, business, and transit through Changi Airport. With Cambodia’s payments ecosystem now firmly QR-first, our integration with RoamQR enables customers to take that same convenience with them abroad,” said Mr. Chan Mach, Chief Executive Officer, Phillip Bank.

“By connecting Khmer Riel accounts directly to Liquid Group’s merchant network in Singapore, we’re giving travellers more freedom and flexibility to pay seamlessly — without the need for physical cash or currency exchange. This is a meaningful step in making cross-border payments simpler, safer, and truly borderless for all Cambodians.”

To pay, simply look for participating merchants displaying the RoamQR logo. Open your Phillip Mobile App, ensure your KHR account has sufficient balance, and scan to pay. The merchant will receive payment in SGD, while the amount is automatically deducted from your account in KHR.

About Phillip Bank

Phillip Bank is a member of the Phillip Capital Group, a Singapore-based financial institution established in 1975. As part of a network spanning more than 15 countries, the Group offers a full spectrum of quality and innovative financial services to retail, corporate, and institutional clients worldwide.

In Cambodia, Phillip Bank stands as a medium-sized commercial bank, operating over 70 branches nationwide. Together with its sister companies Phillip Trustee, Phillip General Insurance, and Phillip Life Assurance; Phillip Bank connects Cambodia’s financial landscape to the world.

Contact the team for more information:

Learn more at www.phillipbank.com.kh or contact our Contact Center team via 086 930 000 / 089 989 818 / 088 465 9999 available 24/7.

About Liquid Group

Liquid Group is a Singapore-based fintech company specialising in cross-border digital payments. Through its role in the RoamQR network and regional partnerships, Liquid Group enables secure, interoperable, and seamless transactions across Asia and is actively working to extend RoamQR’s interoperability to additional markets.

About RoamQR™

RoamQR™ is Singapore’s interoperable QR payment network, developed and operated by Liquid Group. It connects banks, wallets, non-bank financial institutions, and acquirers — including 10 payment apps and digital wallets together with 11 merchant acquirers across multiple financial institutions in Singapore.

As the network continues to grow its reach locally and beyond Singapore, RoamQR™ serves as a payment orchestration framework that links Singapore’s payment ecosystem with partner national networks and regional payment systems, enabling seamless, interoperable cross-border transactions across regional and international markets. Its open architecture supports both bilateral interoperability between Singapore and partner systems and multi-network connectivity, paving the way for future cross-linkages among participating payment networks and fostering seamless regional and global payment integration.