Cambodia Investment Review

CBRE Cambodia has released its highly anticipated Phnom Penh Mid-Year Review for 2024, providing a comprehensive analysis of the city’s economic indicators and market trends. The report, unveiled on July 16th, 2024, highlights key metrics in various sectors, offering valuable insights for investors, developers, and policymakers.

The report indicates stable economic growth with an estimated GDP increase of 5.8% and highlights a significant rebound in tourism with 2.6 million international arrivals in May. While the construction sector saw a year-on-year decline in approved investment value at $786 million in Q1, the real estate market remains dynamic with notable activity in the office, retail, condominium, and industrial sectors. This review provides essential insights for stakeholders to navigate the economic landscape and make informed decisions for the remainder of 2024.

Office: Phnom Penh Continues To Demonstrate Regional Competitiveness

The office market in Phnom Penh continues to demonstrate regional competitiveness, with rental rates and occupancy levels reflecting a stable yet dynamic landscape. According to CBRE Cambodia’s mid-year review, Phnom Penh’s average office quoting rental rates and occupancy rates are comparable to major regional cities like Bangkok and Ho Chi Minh City. In the first half of 2024, the average office quoting rental rate in Phnom Penh remained competitive at $27.0 per square meter, slightly lower than Bangkok but more affordable compared to Ho Chi Minh City. The city’s office occupancy rate stands at 61.8%, showcasing resilience amid market fluctuations.

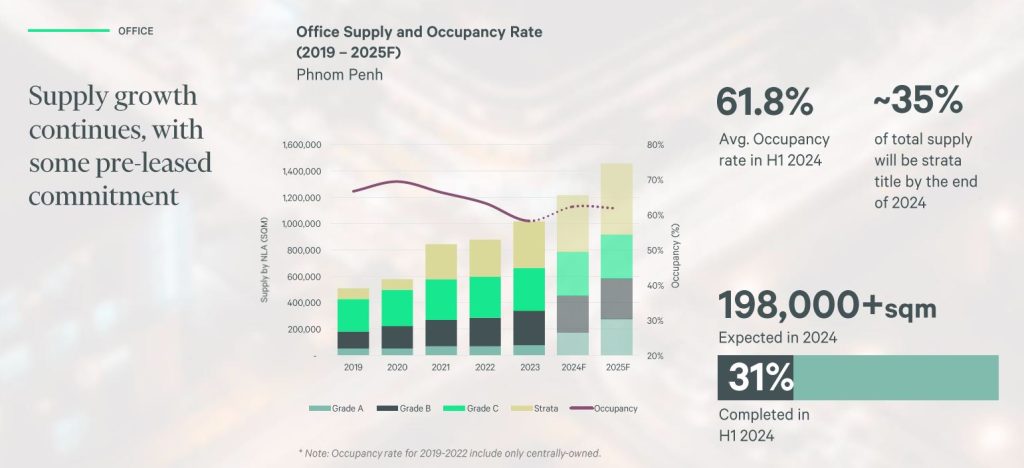

Supply growth in Phnom Penh’s office market is on an upward trajectory, with over 198,000 square meters expected to be completed in 2024, a 31% increase from the first half of the year. This growth is driven by new developments and expansions in the Grade A and B office segments. Despite the influx of new supply, the market maintains a healthy occupancy rate, indicating strong demand for office spaces. Approximately 35% of the total supply by the end of 2024 is anticipated to be strata-titled, reflecting a trend towards ownership rather than leasing.

Looking ahead, the office market in Phnom Penh is expected to remain robust, with several key trends shaping its future. Renewal negotiations over relocation are becoming increasingly common as tenants seek to avoid the high costs associated with moving and fitting out new spaces. Additionally, there is a noticeable trend of space consolidation among large-scale tenants, who are optimizing their office footprints following the pandemic-induced shift towards leaner operations. Developers are also prioritizing sustainability in future projects to enhance their attractiveness and align with global trends. These factors collectively position Phnom Penh’s office market for continued growth and adaptation in the evolving economic landscape.

Retail: Supply Projected To Exceed 800,000 Square Meters By 2025

Phnom Penh’s retail market displays a mix of growth potential and challenges as observed in CBRE Cambodia’s 2024 mid-year review. The report highlights that the average quoting rental rates for prime retail spaces vary significantly within the region. Phnom Penh’s rates are lower than those of Bangkok and Ho Chi Minh City’s CBD, which suggests both competitive pricing and room for growth. The retail occupancy rate in Phnom Penh stands at 58.7%, indicating a steady demand despite the competitive landscape.

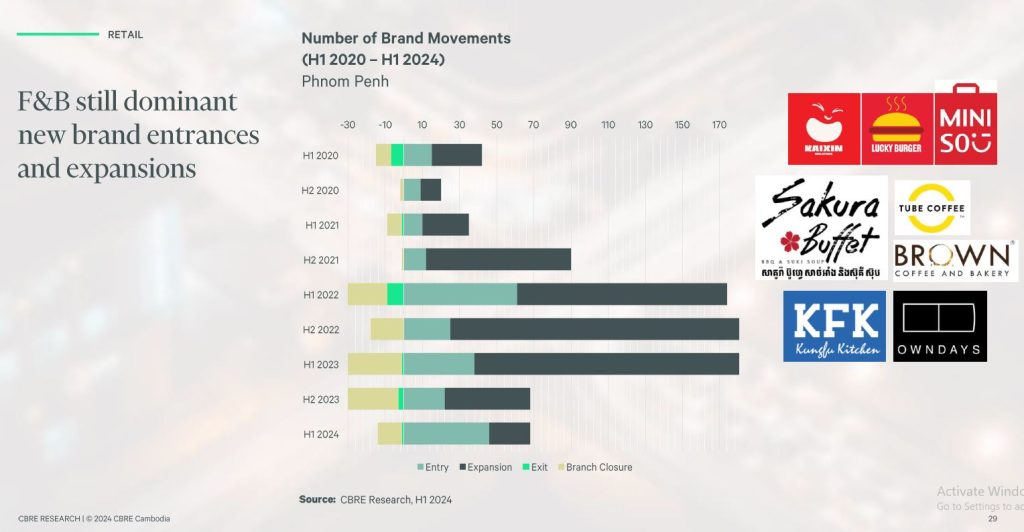

The retail supply in Phnom Penh has seen continued growth, with the total supply projected to exceed 800,000 square meters by 2025. However, the market is experiencing sluggish take-up rates, leading to delayed openings of new retail spaces. Shopping malls dominate the current supply, accounting for 45% of the total retail space. Despite these challenges, the market shows resilience with stable occupancy rates and a gradual increase in retail space offerings.

Looking ahead, the retail sector in Phnom Penh faces a cautious yet optimistic future. The entry of new F&B brands continues to drive retail growth, though fashion retailers are consolidating their store locations. Anchor tenants are expanding more cautiously due to uncertain consumer demand, opting to merge store footprints for increased efficiency. To sustain footfall, retail operators must innovate in their marketing strategies, focusing on engagement and sales stimulation. These trends highlight the sector’s adaptability and potential for sustained growth amid evolving market conditions.

Condominiums: Phnom Penh Market Experiencing A Noticeable Slowdown

The condominium market in Phnom Penh is experiencing a noticeable slowdown in new launches, with over 2,200 units introduced in the first half of 2024. This marks a decline compared to previous years, reflecting a cautious approach by developers amid changing market dynamics. The distribution of new launches is predominantly in the high-end and mid-range segments, with a smaller portion in the affordable segment. This trend indicates a shift towards targeting higher-income buyers and expatriates, though there is still a significant presence of more budget-friendly options.

Despite the slowdown in new launches, the overall condominium supply continues to rise, with over 2,400 units completed in the first half of 2024 and a total of 14,000 units expected by the end of the year. This influx has pushed the total supply to unprecedented levels, leading to competitive pricing pressures. The average quoting sales price for condominiums has shown varying trends across different market segments. High-end units have maintained relatively stable prices, while mid-range and affordable units have seen slight declines, reflecting the market’s efforts to attract a broader range of buyers.

Looking ahead, the condominium market in Phnom Penh is poised for further evolution, with several key trends shaping its trajectory. Developers are introducing loft units to cater to the growing demand for unique living spaces among local buyers. Additionally, there is increasing interest from branded residence operators, indicating a potential influx of high-quality international standards into the market. However, the overall market strategy appears to be shifting towards more affordable and mid-range units, as developers adjust their positioning to meet the preferences of local buyers in the absence of significant international investor transactions. This strategic pivot highlights the market’s adaptability and potential for sustainable growth in the coming years.

Landed: Secondary Market Role In Correcting Property Prices

The landed property market in Phnom Penh has experienced a slowdown in new launches, with a notable decline in the number of projects introduced in the first half of 2024 compared to previous years. The market saw over 29 projects completed in this period, with a significant portion of these developments in the mid-range and affordable segments. High-end launches have been minimal, reflecting a cautious approach by developers amid economic uncertainties and shifting market demands.

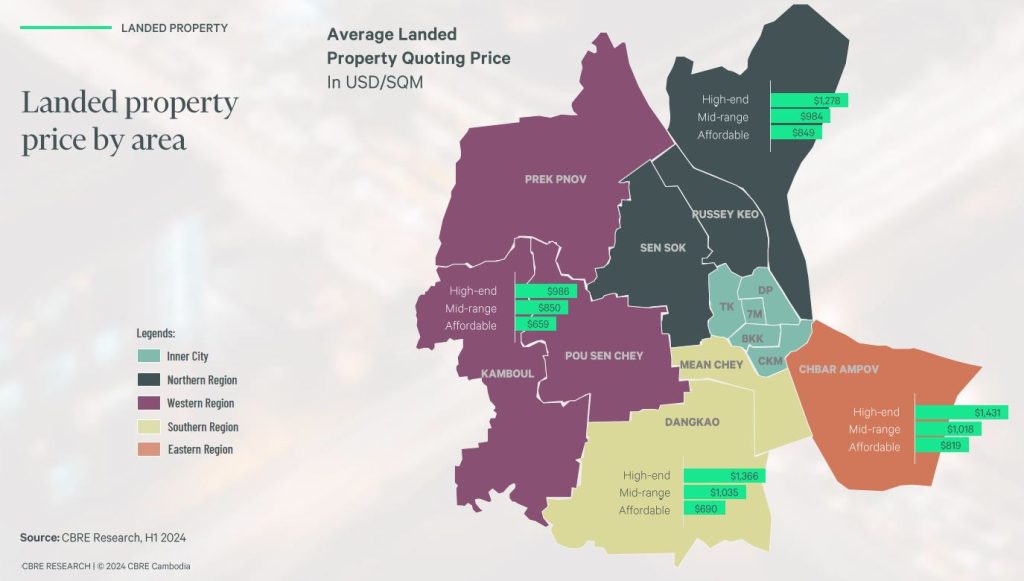

Despite the reduction in new project launches, the supply of landed properties continues to expand, driven by the completion of existing projects. The total supply is expected to increase steadily, with a projected rise in the proportion of affordable and mid-range properties. The average quoting prices for landed properties vary significantly across different regions of Phnom Penh, with high-end areas such as Chbar Ampov and Dangkor commanding higher prices compared to more affordable regions like Kamboul and Pou Senchey.

The outlook for the landed property market in Phnom Penh suggests a cautious yet adaptive approach by developers. There is a noticeable reluctance to launch new projects, with a preference for extending existing developments. The secondary market is playing an increasingly influential role in correcting property prices, as buyers exert more control over market dynamics. Additionally, there has been a notable increase in refinancing transactions, driven by rising non-performing loans (NPLs). These trends indicate a market in transition, with developers and investors adjusting strategies to navigate the evolving economic landscape.

Future Outlook for Phnom Penh’s Real Estate Market

The future of Phnom Penh’s real estate market appears cautiously optimistic, with several key trends shaping its trajectory across various segments. The office market is expected to remain robust, with ongoing supply growth and a focus on sustainability and space optimization. As tenants prioritize cost-effective and efficient office spaces, developers are likely to introduce more strata-titled properties and sustainable features to meet demand. The retail sector, despite its challenges, shows potential for sustained growth driven by new F&B brands and innovative marketing strategies aimed at maintaining footfall and consumer engagement.

In the condominium and landed property markets, developers are adopting adaptive strategies to navigate the changing economic landscape. The introduction of unique living spaces such as loft units and increased interest from branded residence operators indicate a shift towards higher quality and diversified offerings. Meanwhile, the landed property segment is witnessing a cautious approach with a focus on existing developments and increased refinancing activities due to rising NPLs. Overall, Phnom Penh’s real estate market is poised for evolution, with stakeholders adapting to market demands and economic conditions to ensure sustainable growth and investment opportunities.