Cambodia Investment Review

Mekong Strategic Capital (MSC) has released its latest Cambodia Economic Update – A Two-Speed Economy? for December 2025, highlighting an increasingly divided economic landscape. While manufacturing and domestic consumption are showing strong resilience, sectors such as tourism, property, and financial services are facing ongoing pressure. This divergence is shaping a more complex recovery path than many had anticipated earlier in the year.

Manufacturing and Consumption Remain the Core Drivers

The report shows Cambodia’s economic outlook improving modestly from earlier projections, with expected GDP growth of around 4% for both 2025 and 2026. Upward revisions are driven primarily by the sustained performance of manufacturing and a stronger-than-expected rebound in consumption.

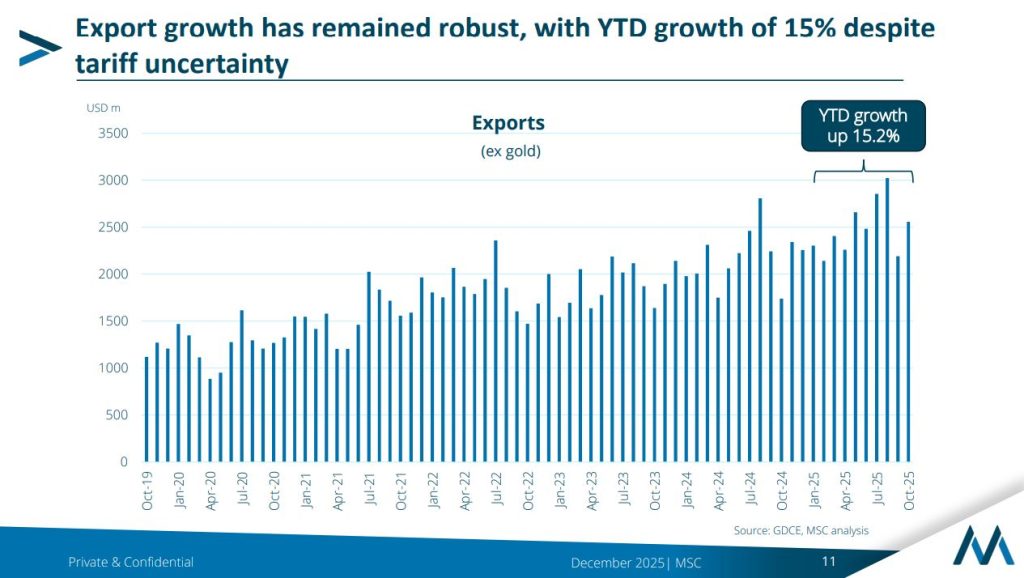

Exports—excluding gold—have grown above 15% year-to-date, reflecting solid expansion across factories and supply chains. Imports of machinery and electrical equipment have also surged, signalling new investment cycles within production-heavy sectors. MSC interprets this as a positive indicator for Cambodia’s competitiveness in labour-intensive manufacturing.

On the domestic front, VAT and excise collections have rebounded sharply, reversing last year’s contraction and pointing toward renewed household spending. Vehicle imports have risen significantly, further supporting the view that consumer confidence and purchasing power are stabilising.

Tourism Slowdown and Remittance Shock Weigh on Short-Term Growth

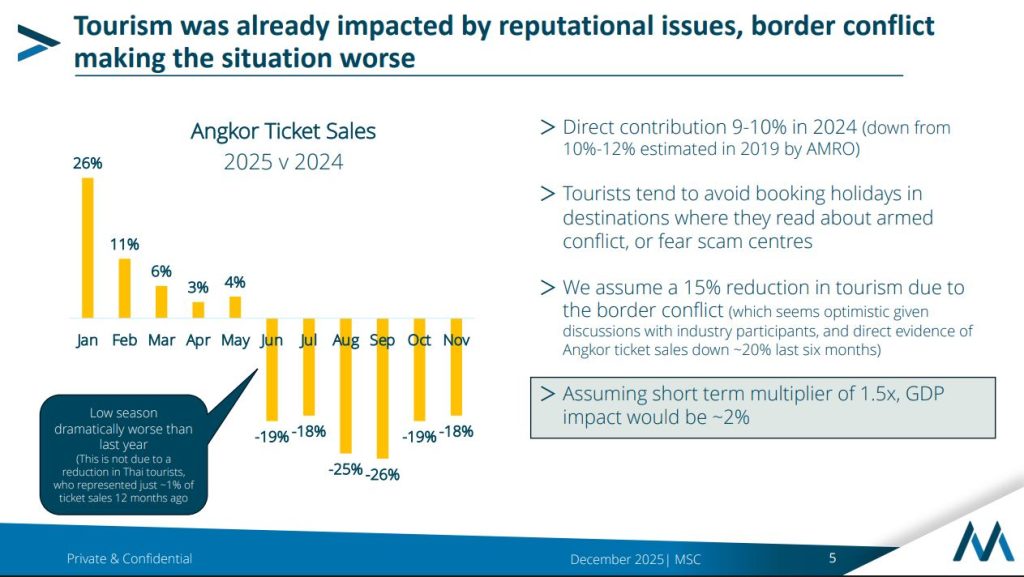

The report notes continued weakness in the tourism sector, with reputational issues linked to scam centres and the Thai border conflict pushing arrivals downward. Angkor Wat ticket sales have fallen by about 20% in recent months, and visitor numbers from East Asia—traditionally one of Cambodia’s strongest markets—remain far below pre-pandemic levels.

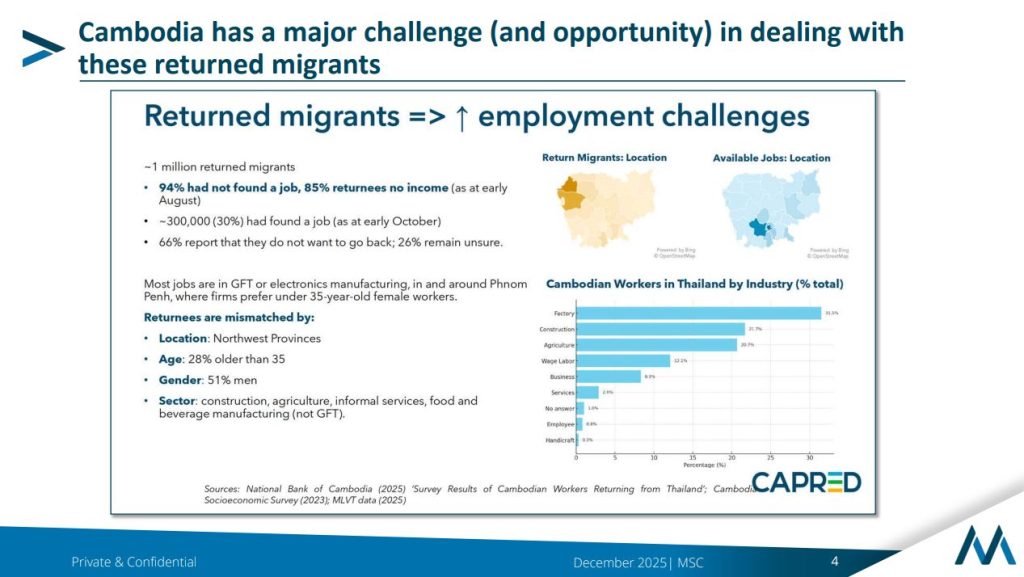

At the same time, the sudden return of more than 900,000 Cambodian migrant workers from Thailand is creating an additional economic burden. The loss of over US$1 billion in remittances is already affecting household incomes, while job absorption has been slow due to mismatches in skills, location, and industry demand. MSC warns that these dynamics will continue to exert pressure on the labour market and consumption, particularly in rural areas.

Property Market Weakness Continues to Feed Financial-Sector Stress

The property sector remains one of the most challenging parts of the economy. Residential oversupply now stretches to roughly a decade of inventory, while transaction volumes remain weak. This slowdown is reflected within the banking sector, where approximately 17.5% of all loans have either been restructured or are in arrears.

Although some easing in restructuring activity has been observed, MSC cautions that banks may still need to liquidate property-backed collateral, potentially extending financial tightening well into next year. This could also weigh on sentiment among developers and homebuyers, delaying a broader recovery.

A Two-Speed Outlook Heading Into 2026

Key considerations and recommendations highlighted by MSC

- Manufacturing, consumption, and capital imports are expected to remain the country’s most reliable growth drivers.

- Tourism recovery is likely to stay uneven without coordinated efforts to address reputational issues and regional confidence.

- The return of migrant workers will require targeted employment programs focused on skills alignment and geographic distribution.

- Property and banking pressures may persist unless inventory levels fall and collateral restructuring stabilises.

- MSC recommends that Cambodia utilise its strong fiscal position to introduce temporary, targeted stimulus—particularly in job creation, tourism promotion, and sectoral support.

- Demographic trends remain a long-term advantage, with growth in the working-age population expected to underpin economic potential for decades.

Long-Term Fundamentals Remain Supportive

Despite near-term challenges, MSC underscores Cambodia’s structural strengths. The country’s demographic outlook is one of the most favourable in the region, and public debt levels remain low, offering significant fiscal flexibility. Combined with ongoing investment in manufacturing capacity, these factors position Cambodia for stronger medium- to long-term growth once immediate pressures begin to ease.

MSC concludes that Cambodia’s economic path entering 2026 will continue to be shaped by a blend of resilience in some sectors and fragility in others. Strategic policy choices over the next year—particularly around employment absorption, banking stability, and tourism recovery—will determine how quickly the economy can close the gap between its two speeds.