Cambodia Investment Review

Cambodia’s rapid expansion of digital payments — led by the National Bank of Cambodia’s blockchain-based Bakong platform — has positioned the country to make a significant leap in financial inclusion. However, analysts from the ASEAN+3 Macroeconomic Research Office (AMRO) argue that the system’s long-term economic impact will depend on policy execution rather than technology alone.

The insights were shared during the ASEAN+3 Financial Stability Report (AFSR) 2025 Outreach on November 19, 2025, presented by Andrew Tsang, who underscored that “the infrastructure is now in place — the next phase is inclusion”.

Digital adoption surges, but access remains uneven

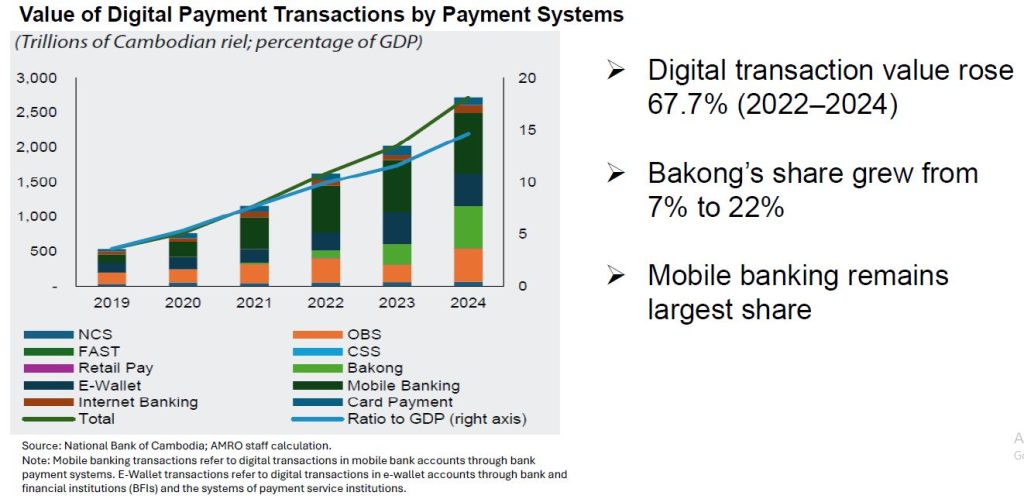

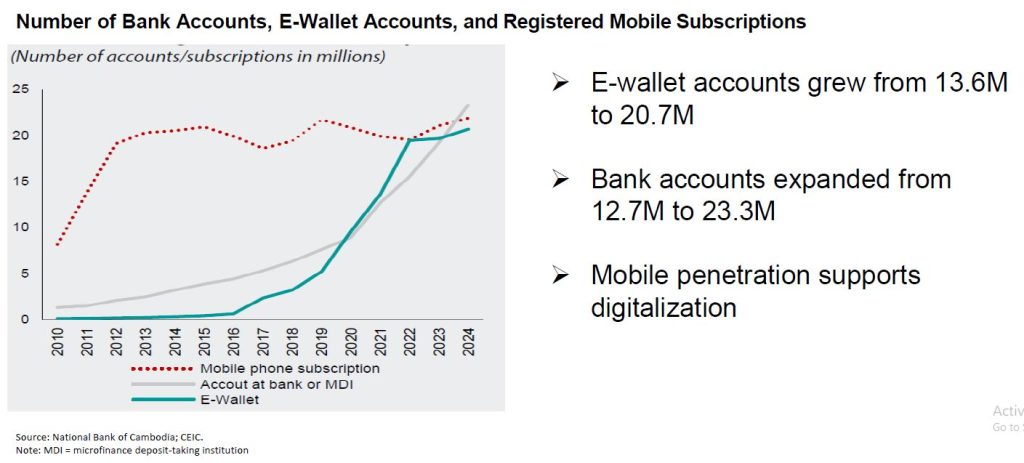

Digital payments have scaled rapidly across the economy, supported by NBC’s payment innovations and interoperability between banks and e-wallet providers. Transaction values grew sharply between 2022 and 2024, with Bakong rising from 7% to 22% of total digital payment share. The number of bank accounts and e-wallet accounts has also surged, driven by high mobile penetration.

Despite this progress, financial access remains unequal. Adult account ownership in Cambodia still lags regional peers, and uptake is slower in rural areas — reinforcing concerns that digital payments alone will not ensure broad-based financial participation.

Cash wages remain the biggest obstacle

Wage payments continue to be overwhelmingly cash-based, particularly in the informal sector. This limits digital participation, reduces financial transparency and prevents individuals and SMEs from building the transaction histories needed to access loans, savings and insurance products.

Pilot projects digitizing payroll — particularly in the garment sector — have shown promise, but have not yet reached scale. AMRO cautioned that without action on wage formalization, financial inclusion progress could stall.

Policy priorities shift from infrastructure to trust

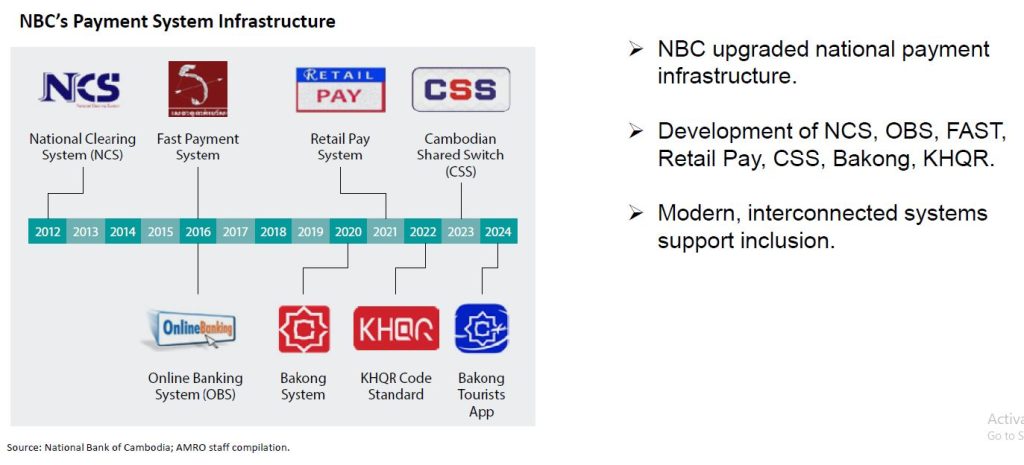

AMRO’s assessment suggests that Cambodia has already completed the “technology phase” of digital finance, with Bakong and other NBC platforms providing reliable, low-cost and interoperable payments. The next phase requires policies that drive confidence and usage.

Key policy outcomes identified include:

• Prioritizing cybersecurity and consumer protections to strengthen trust

• Raising digital and financial literacy to boost participation across demographics

• Accelerating digital wage payments to reduce cash dependency

• Ensuring rural connectivity and merchant acceptance keep pace with adoption

• Promoting inclusive digital finance models that support long-term savings and credit access

The report emphasized that digital payments must translate into broader financial security — not just convenience.

The turning point for Cambodia’s digital finance strategy

With infrastructure in place and adoption accelerating, Cambodia stands at a pivotal stage. Bakong has already positioned the country as a regional leader in payment innovation, but its true economic benefit will be realized only when digital finance becomes the default route for wages, savings and credit.

Whether Cambodia can move from digital access to digital empowerment — and from payments to financial inclusion — now depends on how effectively policy addresses trust, literacy and cash-dominant labor markets.