Cambodia Investment Review

Cambodia’s property market is heading into 2026 with cautious stabilisation rather than rapid recovery, according to the APS Fearless Forecast 2026 presented by industry veteran Marc Townsend on November 27 in Phnom Penh. The Advantage Property Services (formally CBRE Cambodia) annual outlook highlights improving leasing demand, steady residential pricing, and continued industrial expansion supported by large infrastructure projects, even as private debt levels, confidence gaps, and global uncertainty remain key constraints.

Residential market indicators turn positive as affordability reshapes demand

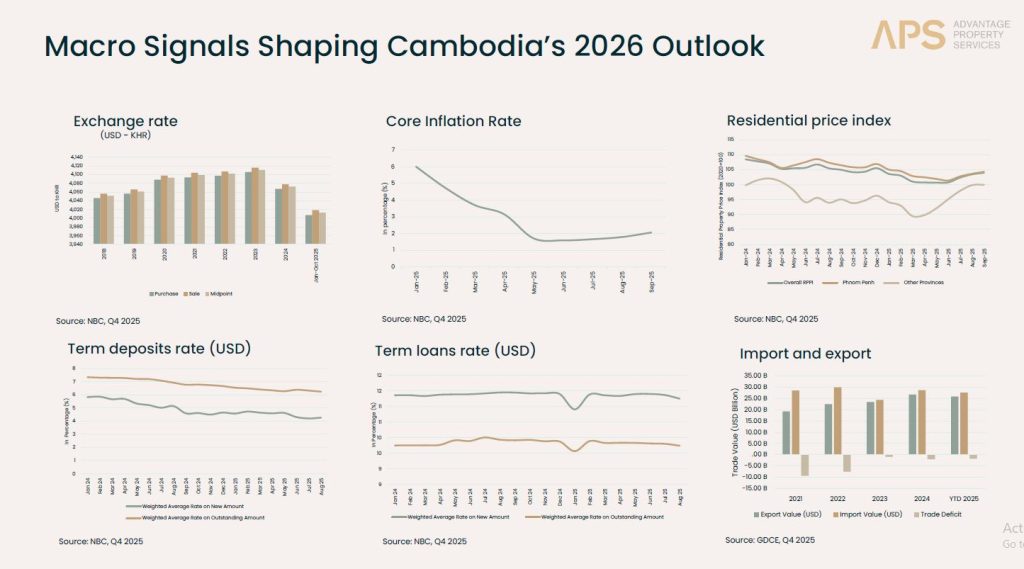

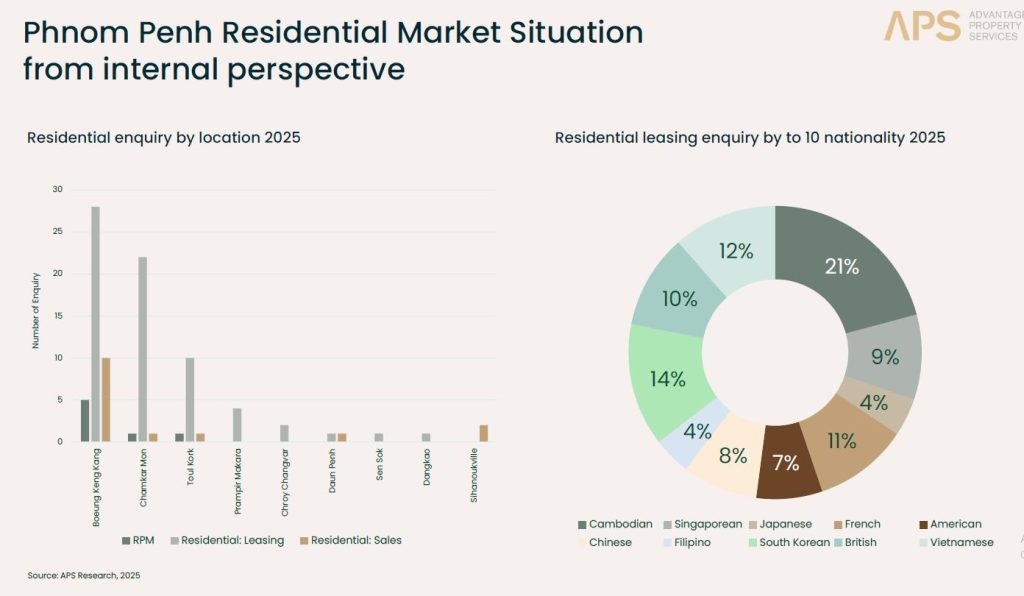

The residential segment continues to recalibrate toward more affordable and mid-tier developments as demand concentrates in smaller units. APS data shows overall pricing has remained broadly stable through 2025, offering a more balanced platform for 2026 compared with the oversupply pressures of recent years.

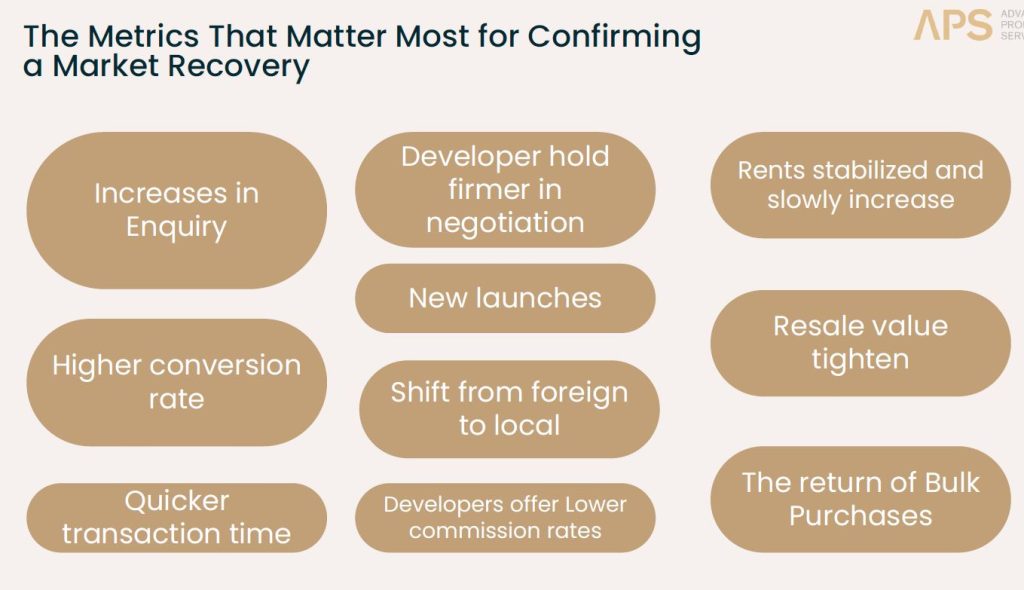

Leading recovery indicators highlighted during the presentation include:

• Higher enquiry volumes across both sales and leasing

• Faster transaction cycles and higher conversion rates

• Return of bulk purchases among experienced buyers

• Developers holding firmer during negotiation

• Resale values tightening in selected locations

Leasing performance is gaining momentum, with modest rent increases projected for both condominium units and serviced apartments driven by demand from local residents and regional expatriates near commercial clusters. Although scheduled residential supply through 2027 remains substantial, APS expects the affordability shift to help absorption rather than suppress demand.

Office, retail and hospitality sectors remain tenant-favoured, yet stabilisation is visible

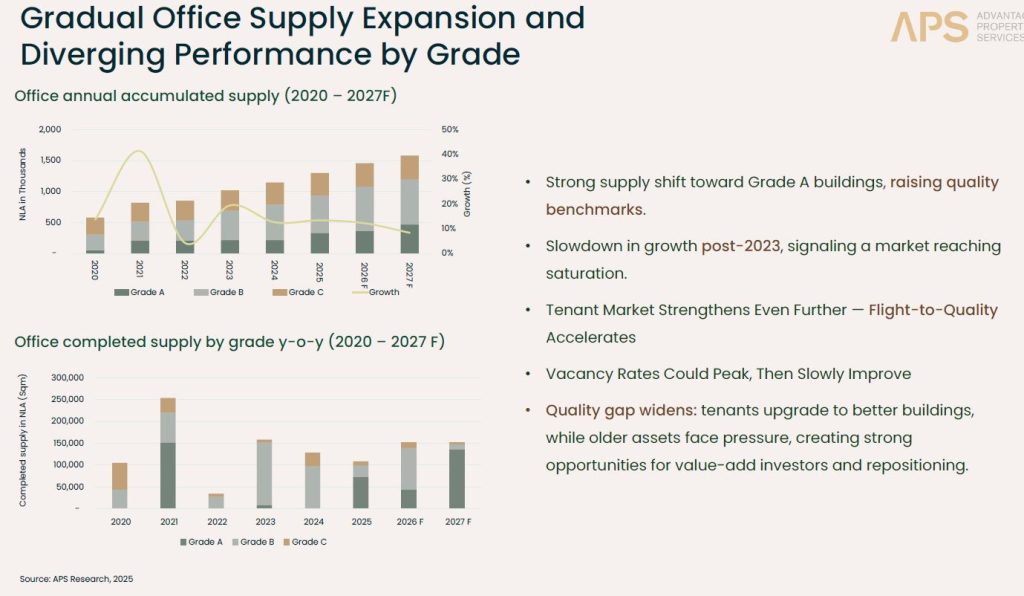

The office sector continues to favour occupiers, with landlords prioritising flexibility and incentives to maintain occupancy. While advertised rents remain relatively firm, achieved rents continue to reflect a discount in practice. APS expects vacancy to peak before moderating in late 2026 as tenants consolidate into higher-quality space.

Key office trends outlined in the forecast:

• Structural shift toward Grade A supply elevating quality benchmarks

• Continued flight-to-quality as tenants pursue newer, energy-efficient buildings

• Increased pressure on ageing stock, creating opportunities for repositioning strategies

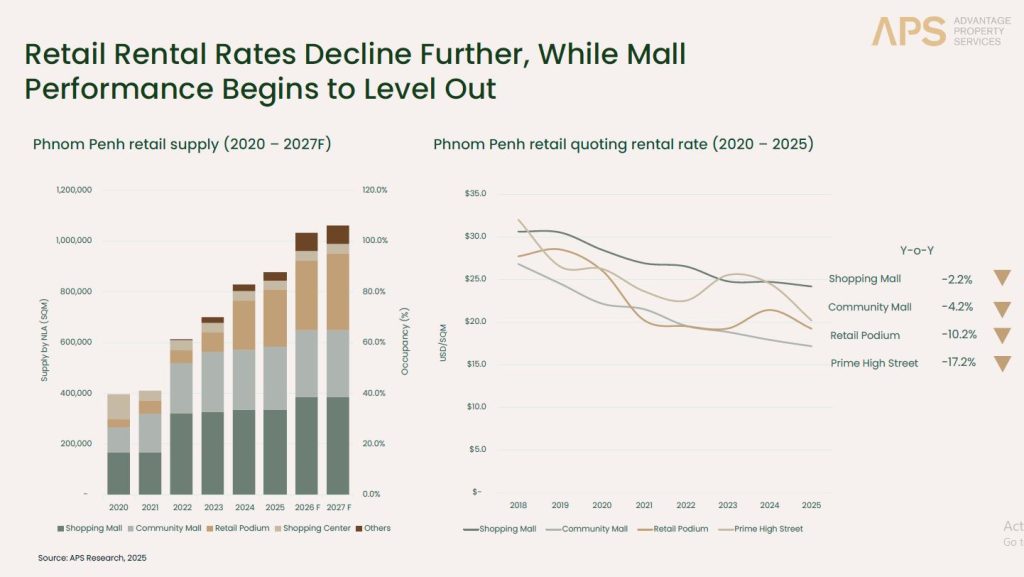

Retail rental rates softened through 2025 across community malls, podium retail and high-street formats, but occupancy has begun to stabilise. Food and beverage operators remain the dominant growth driver for new and expanding retail brands, offsetting higher closure rates in non-F&B categories.

The hospitality sector is showing momentum as international connectivity increases. APS expects stronger demand scaling from 2026 as new direct flights and tourism infrastructure translate into more material volume rather than incremental gains.

Industrial expansion and national infrastructure continue to stabilise the wider market

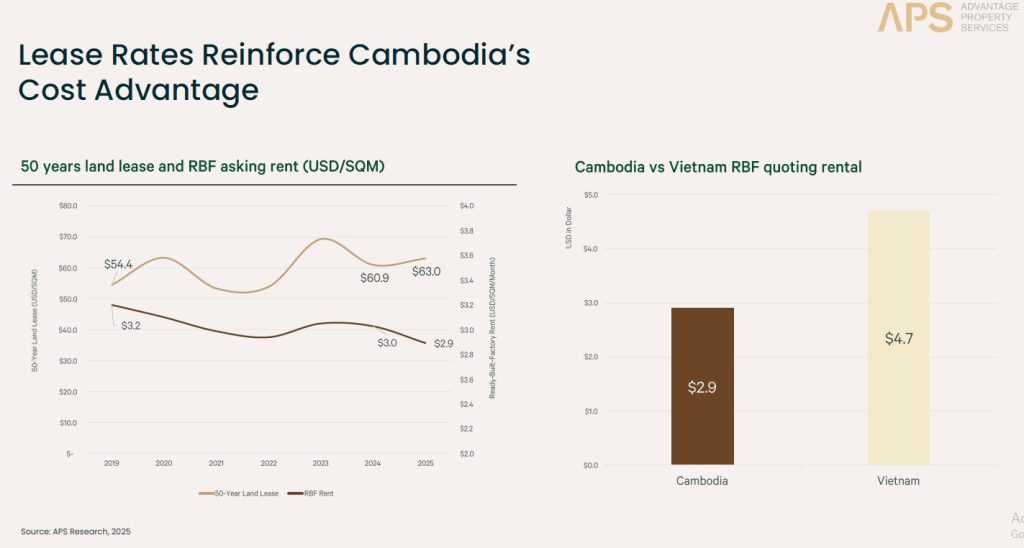

The industrial segment remains the strongest contributor to the overall property outlook. APS notes continued growth in agro-processing, assembly manufacturing and logistics-intensive activity, supported by increasing demand for cold-chain facilities, specialised warehousing and last-mile fulfilment.

Supporting datapoints highlighted in the presentation:

• More than 1,900 ha of new industrial investment land launched in 2025

• Furniture manufacturing exports reached USD 1 billion as of September 2025

• Strengthened interest in logistics parks and SEZ-based assets

Infrastructure was also positioned as a pillar of forward confidence. The Techo International Airport, set to commence operations in late 2025, and the Funan Techo Canal, a 180-km trade waterway linking Phnom Penh to the Gulf of Thailand, are expected to enhance competitiveness and trade resilience while shaping long-term development corridors.

However, analysts emphasised that liquidity and confidence remain disconnected. Deposits in the banking system continue to rise sharply, yet risk perception is limiting deployment. Systemic challenges cited include non-performing loans, private debt exposure, elevated operating costs and the global political environment.

Outlook for 2026 — fundamentally improving, not overheated

The APS Fearless Forecast 2026 signals a shift toward a slow but steady recovery shaped by fundamentals rather than speculative investment. Industrial performance, leasing demand, and affordability-aligned housing are expected to drive momentum, while income-producing assets are forecast to regain priority among investors.

Although confidence remains subdued, APS expects sentiment to improve if liquidity continues to build and systemic risks ease. The firm concluded that resolutions to structural issues — rather than sudden price growth — will determine the pace of Cambodia’s next property cycle.

Closing note — APS rebrand

Rebrand Announced: After 17 years in Cambodia, CBRE Cambodia will officially transition to Advantage Property Services (APS) on January 1, 2026, following CBRE Group’s global corporate restructuring. The Fearless Forecast 2026 marks the first major market outlook issued under the APS identity, symbolising the firm’s repositioning for the next stage of Cambodia’s property and investment landscape.