Cambodia Investment Review

The United States Department of State has released its long-delayed 2025 Trafficking in Persons (TIP) report, which for the first time designates Cambodia as a “state sponsor” of human trafficking. The classification carries the possibility of sanctions and may affect the Kingdom’s investment climate at a time when foreign direct investment is increasingly important for economic growth.

Business and Diplomatic Implications

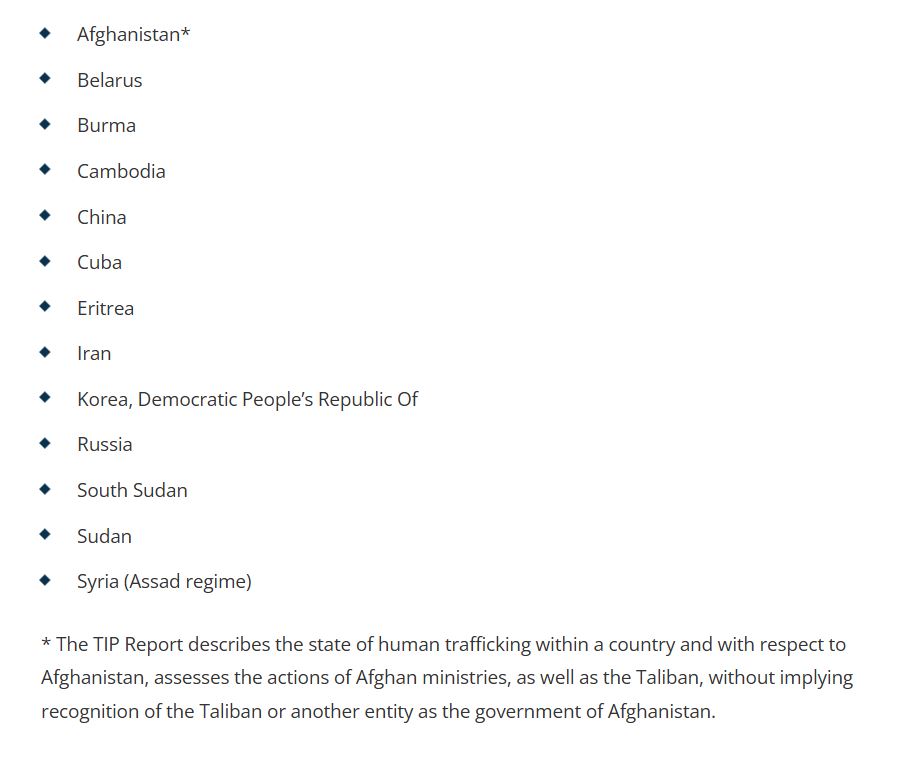

The report alleges that senior Cambodian government officials have profited from human trafficking by allowing properties they own to be used by online scam operators engaged in forced labor and forced criminality. This marks a significant escalation in how Cambodia is viewed internationally, aligning it with other countries identified as sponsors of trafficking such as Afghanistan, China, Iran, North Korea, and Russia.

From an investment perspective, the designation could complicate Cambodia’s economic ties with key partners, particularly the United States. Sanctions or increased scrutiny could limit access to capital, disrupt international banking relations, and raise compliance costs for companies doing business in or with Cambodia. Multinational corporations and financial institutions may become more cautious in their engagement, particularly those subject to strict US regulatory oversight.

Regional Context and Market Outlook

The TIP report’s findings come at a time when Cambodia is seeking to attract new foreign direct investment in sectors such as manufacturing, construction, real estate, and technology. While the country continues to position itself as a destination for regional trade and supply chain diversification, reputational risks linked to trafficking and online scam operations could become a barrier to investment flows.

Neighboring ASEAN economies are also under scrutiny. The report placed Brazil and South Africa on a “watchlist” for insufficient efforts to combat trafficking, while Russia and China remain criticized for forced labor practices. Cambodia’s inclusion in the highest category of concern places it at the more severe end of the spectrum, which could affect regional perceptions of stability and governance.

Impact on Investors and Next Steps

For foreign investors, the key risks are likely to revolve around enhanced due diligence, reputational considerations, and potential sanctions compliance. Companies operating in Cambodia may face pressure from shareholders, regulators, and civil society groups to demonstrate transparency in their supply chains and labor practices.

Cambodia’s response to the designation will be critical. Any government action to address the allegations—such as enforcement measures, regulatory reforms, or cooperation with international partners—could influence how markets and investors assess the long-term risks. Without such steps, Cambodia risks reduced investor confidence at a time when regional competition for capital is intensifying.