Cambodia Investment Review

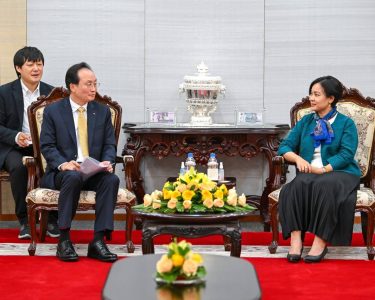

Credit Guarantee Corporation of Cambodia (CGCC) and Sathapana Bank, one of the leading commercial banks in Cambodia jointly organized the agreement signing ceremony to officially announce partnership on the Wholesale Guarantee Scheme (WGS) and Economic Stimulus Guarantee Scheme (ESGS). These initiatives are set to significantly enhance access to finance for businesses across the Kingdom. This strategic collaboration is crucial in driving economic growth, particularly for Micro, Small, and Medium Enterprises (MSMEs) and larger firms for expansion and operational resilience.

As Cambodia continues its economic development, the combined efforts of CGCC and Sathapana Bank, through these newly launched guarantee schemes, will play an increasingly vital role. They will ensure that businesses, regardless of their size or collateral capacity, have the financial support needed to thrive and contribute to Cambodia’s economic landscape.

Helping Businesses Access Vital Financing

Mr. No Lida, CEO of CGCC mentioned “Five years ago, Sathapana Bank and CGCC joined forces to launch the Business Recovery Guarantee Scheme, aiming at helping businesses access vital financing during the challenging times of the COVID-19 pandemic. Since then, our collaboration has empowered many businesses to survive, grow, and thrive. Through this journey, we’ve built a strong foundation of mutual understanding, enabling us to enhance the effectiveness of our guarantee schemes.”

“Today’s signing of the Wholesale Guarantee Scheme (WGS) and Economic Stimulus Guarantee Scheme (ESGS) demonstrates our shared commitment to deepen this partnership and increase the impact of credit guarantees. The WGS and ESGS will support Sathapana Bank in managing their risk exposure and enable them to lend more to potential small and medium-sized enterprises, especially during times of economic uncertainty”, said by Mr. No Lida.

Unleash The Entrepreneurial Potential Of Cambodians

“Our partnership with CGCC, particularly through the new Economic Stimulus Guarantee Scheme and the Wholesale Guarantee Scheme, allows us to extend our credit lines through our nationwide networks to a broader segment of the market,” says Mr. Henk G. Mulder, CEO of Sathapana Bank. “This will enhance financial inclusion and unleash the entrepreneurial potential of Cambodians.”

“Our collaboration with CGCC ensures that our lending aligns with Cambodia’s national development priorities, fostering growth in areas that are key to long-term prosperity and improving livelihoods for Cambodian families,” he adds.