Myanmar Investment Review

Myanmar’s economy recorded a fragile recovery in FY2023/24, with GDP growth reaching 3.5%, up from 3.4% the previous year, according to the latest ASEAN+3 Macroeconomic Research Office (AMRO) Regional Economic Outlook 2025. The report—published before the recent earthquake in the country—details a challenging economic environment shaped by persistent geopolitical tensions, rising inflation, a depreciating currency, and pressure on foreign reserves.

While the outlook cautiously acknowledges improving economic momentum compared to the post-2021 contraction, it underscores the precarious nature of Myanmar’s macroeconomic landscape, which may face additional headwinds following the earthquake’s impact on infrastructure, commerce, and already-strained supply chains.

Economic Growth Rebounds, But Under Pressure

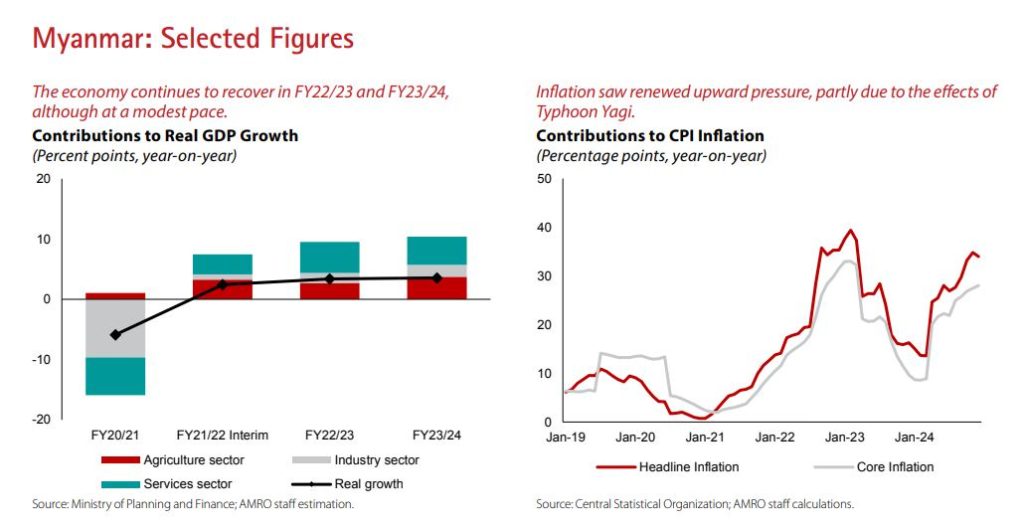

Following a sharp -5.9% contraction in FY2020/21, Myanmar’s economy returned to growth over the past three years: 2.4% in FY2021/22, 3.4% in FY2022/23, and 3.5% in FY2023/24. The recovery has been driven largely by modest improvements in the agriculture and services sectors. The agriculture sector in particular benefitted from rural labor shifts and a continued reliance on informal trade and subsistence-level activities.

However, the industrial sector struggled due to continued disruptions from power outages, shortages of imported materials, and reduced labor availability. The September 2024 Typhoon Yagi significantly impacted agricultural production and worsened logistics across key rural areas.

Meanwhile, the manufacturing sector remained fragile, with foreign-owned factories facing operational challenges and supply chain bottlenecks. Investment sentiment stayed weak amid regulatory uncertainties and political instability.

Inflation Accelerates Amid Supply and Currency Pressures

Inflation surged to 27.5% in FY2023/24, up from 24.4% the previous year, reflecting supply-side disruptions, volatile fuel prices, currency depreciation, and tightened import controls. Core inflation also remained elevated, underpinned by structural constraints in production and distribution.

The CBM introduced several monetary tightening measures in response. In May 2024, it raised the reserve requirement ratio to 3.75% and increased the interest rate on excess reserves. Then, in September 2024, it hiked the policy rate to 9%—up from 7%—in a bid to anchor inflation expectations and stabilize the kyat.

Despite these actions, the inflationary trend has continued, with particular stress on transportation and food costs. The broadening of import licensing requirements—now covering consumer goods, intermediate inputs, and industrial materials—has intensified shortages and driven price hikes across urban and rural areas alike.

Currency Depreciation and External Accounts Under Strain

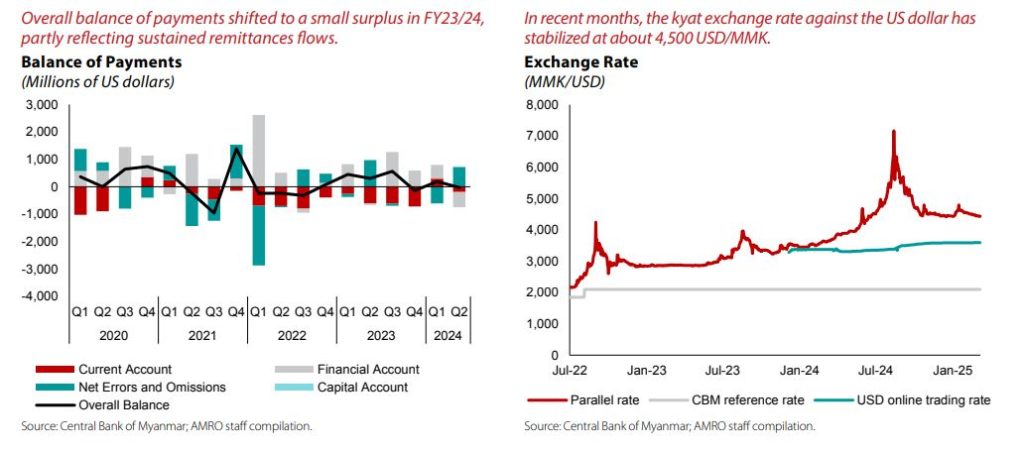

The kyat depreciated significantly over the past year, with the informal market rate reaching nearly 4,500 MMK per USD by early 2024, diverging markedly from the CBM reference rate. This has undermined investor and consumer confidence, constrained import capacity, and led to speculative behavior in foreign exchange markets.

Myanmar’s current account deficit narrowed slightly to -2.1% of GDP in FY2023/24, from -3.5% the year before. This was largely due to a compression in imports following stricter controls and limited access to foreign currency. Meanwhile, outward financial flows remained subdued, and foreign direct investment—already constrained by sanctions and business sentiment—declined further, with direct investment at just 0.9% of GDP.

Sustained inward remittances, supported by an incentive program for overseas workers, played a stabilizing role, helping to offset some of the pressure on the balance of payments. However, the overall external position remains vulnerable to shifts in trade dynamics, geopolitical uncertainty, and the possibility of further shocks—such as the earthquake.

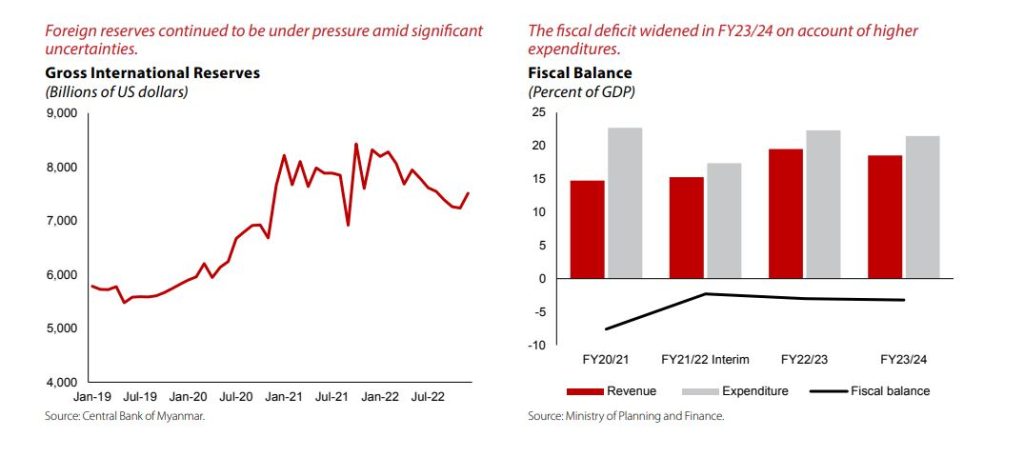

Fiscal Deficit Widens as Expenditures Climb

Government expenditure rose to 21.5% of GDP in FY2023/24, up from 20.4% in the previous year, driven by increased public sector salary outlays and social transfers. With revenue holding steady at 18.5% of GDP, the fiscal deficit widened slightly to 3.2%.

Government debt reached 62.3% of GDP, maintaining its upward trend as fiscal buffers eroded. Although domestic borrowing remains the principal source of financing, the limited availability of concessional foreign financing has added to fiscal stress.

The report notes that should inflation continue to rise, the government could face mounting difficulties in financing future spending without destabilizing financial markets or risking further devaluation of the kyat.

Banking Sector Stabilization and Credit Conditions

The banking sector, while still under strain, has seen some stabilization in recent months. Liquidity tightened during the mid-year due to deposit withdrawals at several private banks, prompting the CBM to inject liquidity through repo operations and emergency credit lines.

Domestic credit expanded by 15.4% in FY2023/24, driven by public sector borrowing and limited private sector recovery. Private credit growth was just 4.2%, reflecting weak demand, cautious lending by banks, and challenges in assessing borrower creditworthiness amid volatile macroeconomic conditions.

Labor Migration and Investor Concerns Intensify

AMRO’s report also highlights Myanmar’s worsening human capital outlook. The outflow of skilled workers—many of whom are seeking more stable economic conditions abroad—has compounded domestic labor shortages. Political uncertainty, social unrest, and economic insecurity have contributed to this trend, which could hinder recovery prospects over the medium term.

Investor confidence remains subdued. Business owners cite regulatory uncertainty, weak demand, and growing input costs as deterrents to new investments. International sanctions, opaque licensing rules, and border disruptions have added to the operational complexity for foreign and local enterprises alike.

Post-Report Developments: Earthquake Adds to Risks

Notably, the AMRO+3 report was released before the recent earthquake, which is expected to further complicate Myanmar’s economic recovery. Early reports indicate significant infrastructure damage and logistical disruptions in affected regions, particularly in transport and trade corridors.

While the full economic impact is yet to be quantified, the disaster could increase fiscal pressures, reduce productive capacity, and exacerbate inflation in the short term—particularly if supply chains are disrupted or reconstruction efforts are delayed.

Outlook: Heightened Caution Amid Structural and External Challenges

Looking ahead, Myanmar’s economy is projected to remain on a modest growth path in the near term, but downside risks abound. The inflation trajectory, currency volatility, trade restrictions, and lingering political uncertainty continue to cloud the macroeconomic outlook.

Although remittance inflows and select investment from regional partners like China may provide some support, the country’s fiscal and monetary policy space is narrowing. With rising domestic vulnerabilities and heightened external risks—including the earthquake aftermath—the path to sustained recovery remains uncertain and uneven.