Cambodia Investment Review

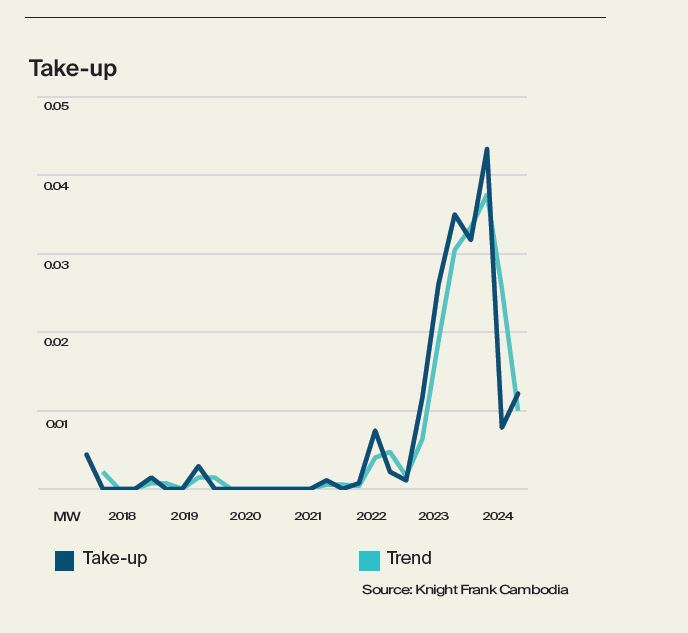

Cambodia’s data centre sector is on the cusp of significant expansion, according to the latest report from Knight Frank. The sector’s rapid growth is fueled by the country’s increasing digitalization, including advancements in e-commerce, e-banking, and government-led digital initiatives. With the rise of major operators and an expected shift in government legislation, Cambodia’s data centre market is set to grow exponentially over the next decade.

Digital Transformation Drives Demand

Cambodia has seen impressive GDP growth, averaging 7% annually from 1995 to 2019, spurred by the development of key sectors like e-commerce and e-banking. These advancements, coupled with government initiatives focused on digital platforms, have created a fertile ground for the rise of data centre operators such as ByteDC, Chaktomuk Data Centre (CDC), and Daun Penh Data Centre (DPDC).

Although the transition from traditional in-house data centres to external colocation facilities was initially met with some hesitation, the demand for secure data storage has driven the shift, particularly in Cambodia’s banking and financial sectors. These industries prioritize data security and customer protection, making the need for high-quality, reliable data centres critical.

Anticipated Legislation to Accelerate Growth

Knight Frank’s report forecasts significant expansion in Cambodia’s data centre capacity, with a new $30 million project led by the Ministry of Posts and Telecommunications (MPTC) set to come online by 2025. Furthermore, the Cambodian government is expected to introduce legislation mandating that companies store data within the country, which will likely expedite growth in the sector in the medium and long term.

Ross Wheble, the Country Head for Knight Frank Cambodia, commented: “Whilst certain challenges persist, notably the cost and stability of power supply, the anticipated change in government legislation is expected to see the sector grow exponentially over the next decade.” This shift in legislation is expected to create a favorable environment for further investment and expansion within Cambodia’s digital infrastructure.

Key Market Players Lead the Charge

The data centre market in Cambodia is being shaped by several prominent operators. Among them is ByteDC, a Tier III certified data centre inaugurated in 2023. This facility, part of the Global Tech Exchange in Daun Penh District, offers 7,529 square meters of space, with the capacity to accommodate up to 1,000 IT racks. ByteDC has been recognized for its innovative design, winning two Property Guru Asia Property Awards in 2019 for Best Data Centre Architectural Design and Best Data Centre Development.

Similarly, Chaktomuk Data Centre (CDC) in Russey Keo District boasts a seven-story facility with 3,480 square meters of dedicated rack space. The data centre offers robust infrastructure, including 2N utility power supplies, backup generators, and a comprehensive security system. These facilities provide essential services for businesses, ensuring operational continuity and data security.

Daun Penh Data Centre (DPDC), launched in 2023, is another key player. Located in the ING City development, DPDC offers cloud services like Infrastructure as a Service (IaaS), Software as a Service (SaaS), and cloud migration, positioning itself as a strong competitor in the market alongside global giants like Amazon AWS and Google Cloud.

Future Outlook for Cambodia’s Data Centre Sector

The future of Cambodia’s data centre sector looks promising, with both private and public sector investments supporting its growth. The government’s plans to mandate onshore data storage and the expansion of data centre infrastructure are expected to create a thriving ecosystem for digital services. While challenges like power supply stability remain, the combination of new infrastructure projects and legislative support positions Cambodia as an emerging hub for data centre services in Southeast Asia.

As businesses continue to prioritize digital transformation and data security, Cambodia’s data centre market is set to become a crucial component of the region’s technological landscape in the years to come.