Cambodia Investment Review

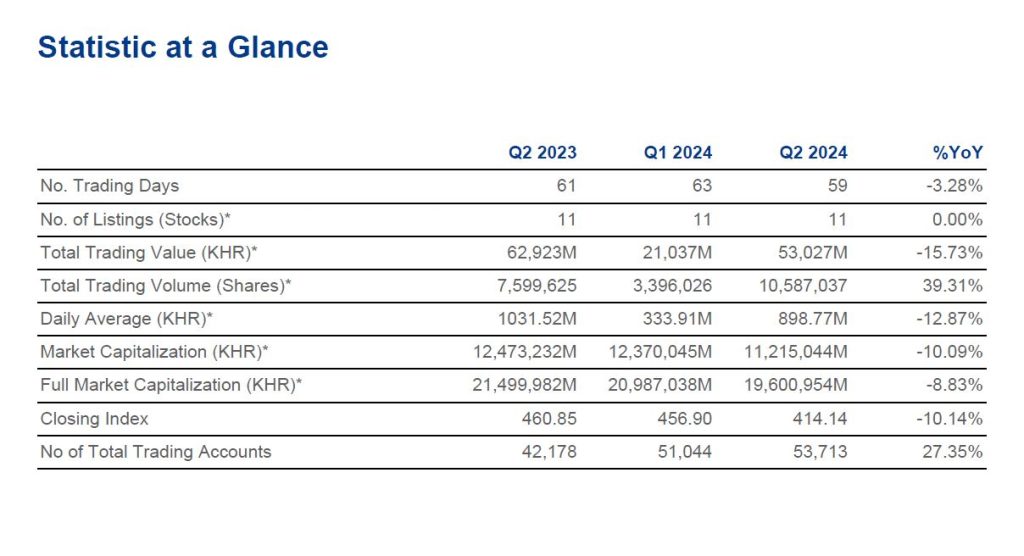

The Cambodian Securities Exchange (CSX) reported a total trading value of over $12.7 million for the second quarter of 2024, showcasing a dynamic yet uneven performance across its Main and Growth Boards. This quarter’s results underscore both the potential and the challenges facing Cambodia’s securities market as it continues to develop amidst varying investor sentiment and economic conditions.

Main Board Sees Declines Amid Increased Activity

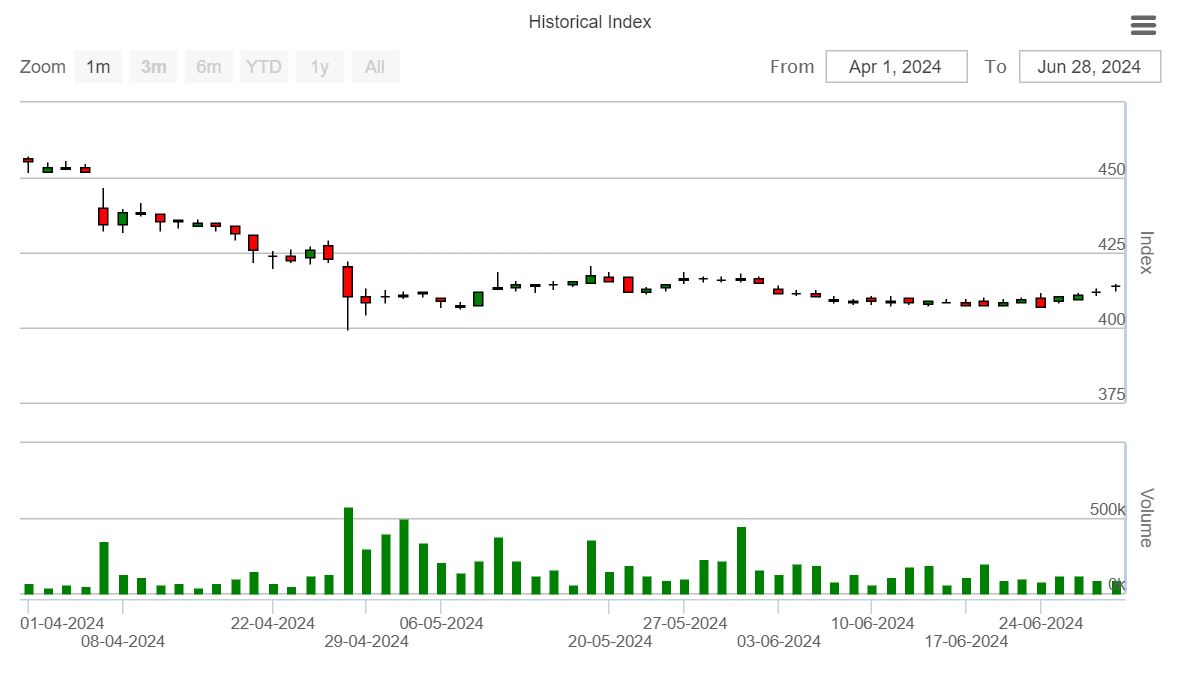

The Main Board of the CSX, which maintained its nine listings throughout Q2 2024, faced a challenging period. Market capitalization decreased by 10.14% year-over-year (YoY), falling to approximately $2.7 billion, reflecting a contraction in the value of listed companies. Additionally, the total trading value on the Main Board declined by 17.63% compared to the previous quarter, dropping to about $12.6 million, down from $15.2 million in Q1 2024. Despite this decrease in trading value, the total trading volume on the Main Board increased by 34.27% to 9.78 million shares, up from 7.28 million shares in the previous quarter. This rise in trading volume indicates that while share prices may have decreased, investor activity remained strong, with more shares being traded.

Read More: Telcotech Achieves Historic Milestone with Second $20M Bond Listing on CSX

Key contributors to the trading value on the Main Board included prominent companies such as ABC, PPSP, and PWSA. ABC, a major listing, experienced a significant decline, with its trading value dropping by 35.87% to approximately $8.6 million, down from $15.7 million in Q1 2024. Conversely, some stocks like PPSP and GTI demonstrated considerable growth, with PPSP’s trading value rising by an impressive 352.63% YoY and 429.50% compared to Q1 2024. These trends highlight the mixed performance within the Main Board, where certain stocks continue to attract investor interest despite broader market challenges.

Growth Board Emerges as a Strong Performer

In contrast to the Main Board’s mixed results, the Growth Board displayed a remarkable increase in trading activity during Q2 2024. Comprising only two listings, the Growth Board’s total trading value jumped by 120.79% YoY to over $468,000, up from $140,000 in the previous quarter. This surge in trading value was accompanied by a significant increase in trading volume, which soared by 155.66% to 806,190 shares, up from 138,972 shares in Q1 2024. The Growth Board’s strong performance was primarily driven by DBDE, which saw its trading volume increase by 196.34% compared to the same quarter last year. Despite the robust trading activity, the Growth Board’s market capitalization saw a slight decrease of 4.79% YoY, stabilizing at approximately $26 million. However, this decline in market capitalization did not diminish the positive momentum in trading activity on the board.

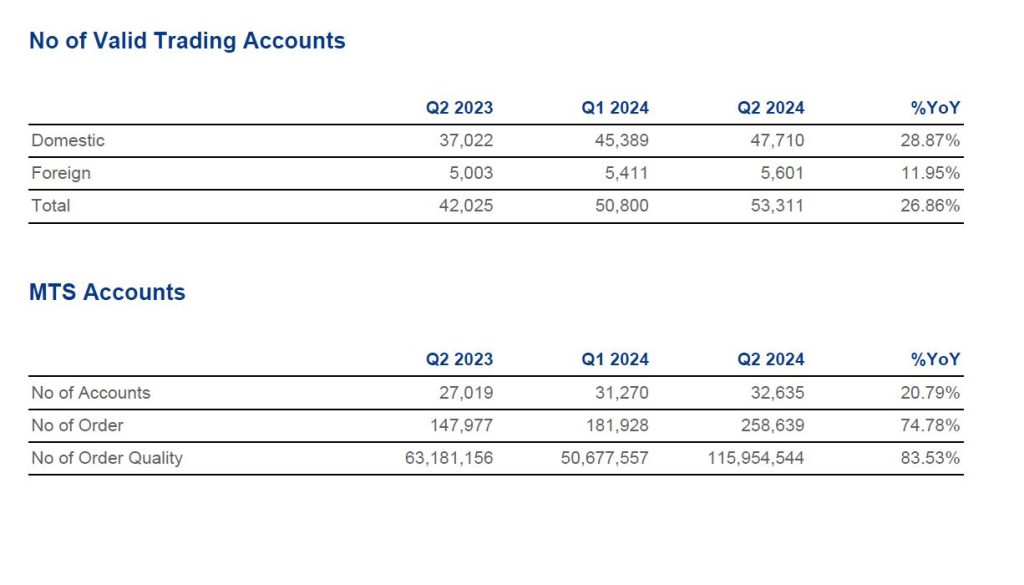

Investor dynamics in Q2 2024 indicated a shift towards greater domestic participation in the CSX. Domestic investors accounted for 96% of the total turnover during the quarter, marking an 11.63% increase YoY and up from 94% in Q1 2024. This increase in domestic investor participation suggests a growing confidence in the local market, even as foreign investor participation continued to decline, dropping to 4%, continuing a trend observed in previous quarters. Individual investors remained the primary force in the market, contributing 95% of the turnover, a slight decrease from 98% in Q1 2024, while institutional investors accounted for just 5%. This ongoing dominance by individual investors highlights the retail-driven nature of the Cambodian securities market, which may influence market volatility and trading patterns.

Shifting Investor Dynamics and Market Outlook

Commenting on the performance of the CSX in Q2 2024, Kim Sophanit, Director of the CSX, noted that the quarter reflected a dynamic market with notable fluctuations. He emphasized that while the total trading value decreased by 15.73% year-on-year, the trading volume saw a significant increase of 39.31%, indicating robust investor activity. Sophanit also highlighted the impressive gains on the Growth Board, where trading value increased by 120.79% and trading volume by 155.66% compared to the same period in 2023. These trends, according to Sophanit, underscore the increasing engagement and interest in the Cambodian market, particularly among domestic investors.

Read More: Telcotech Achieves Historic Milestone with Second $20M Bond Listing on CSX

The performance of the CSX in Q2 2024 paints a picture of a market in transition. While the Main Board faced challenges with declines in market capitalization and trading values, the Growth Board’s strong performance points to growing investor interest in smaller, emerging companies. As the CSX continues to mature, market participants can expect further fluctuations and opportunities in the coming quarters, driven by both local and international economic conditions. The resilient activity levels and increasing number of trading accounts suggest that the Cambodian market is poised for continued growth and development, albeit with the potential for volatility as the market evolves.