Cambodia Investment Review

Prince Bank Plc has announced the resignation of its Chief Executive Officer, Looi Kok Soon, on 22 October 2025, just one week after coordinated sanctions were imposed by the United States and United Kingdom on the bank, its parent company Prince Holding Group, majority shareholder Chen Zhi, and more than 140 related entities and individuals.

In a statement released on 22 October, Looi Kok Soon announced his decision to step down as Non-Independent Executive Director and CEO “to pursue personal interests,” effective immediately. His departure comes less than a year after he was appointed alongside Mr. Honn Sorachna — who became Chairman of the Board and was subsequently placed on an international watch list — on 17 December 2024. Their appointments had marked a period of leadership restructuring within the bank and its parent group.

Read More: Prince Bank Appoints New Chairman and CEO Mr. Looi Kok Soon

The sanctions were announced by the U.S. Department of the Treasury’s Office of Foreign Assets Control (OFAC) and the U.K. Foreign, Commonwealth & Development Office (FCDO), which alleged that Prince Group was linked to criminal activities involving forced-labor scam operations across Cambodia and abroad.

Central Bank Moves to Reassure Customers

The National Bank of Cambodia (NBC) issued a statement on 18 October assuring the public that all Prince Bank accounts remain accessible and secure. It stressed that all licensed financial institutions must maintain sufficient liquidity to meet withdrawal demands and confirmed it was conducting a careful review to ensure the bank’s compliance with Cambodian law.

The NBC added that it would take all necessary measures to safeguard customer funds and maintain normal operations, following reports of increased withdrawals at branches after the sanctions announcement.

However according to local media reports, customers over the past week have posted comments on the bank’s Facebook page, complaining about their USD transactions being delayed or not reaching recipients. They fear their funds being frozen due to the sanctions.

Analyst Outlines Four Key Considerations for Customers and Businesses

A local investment analyst [who requested to remain anonymous] spoke to Cambodia Investment Review outlined four areas that account holders and business owners should consider as the situation evolves.

1. Reassessing banking arrangements

“As a sanctioned entity, it’s hard to see a long-term future for Prince Bank,” the analyst said. “In that sense, it would make sense for customers to consider alternative banking arrangements.”

The analyst added that the sanctions could limit the bank’s access to international correspondent networks, affecting cross-border payments and foreign-currency transactions.

2. Liquidity position and short-term safety

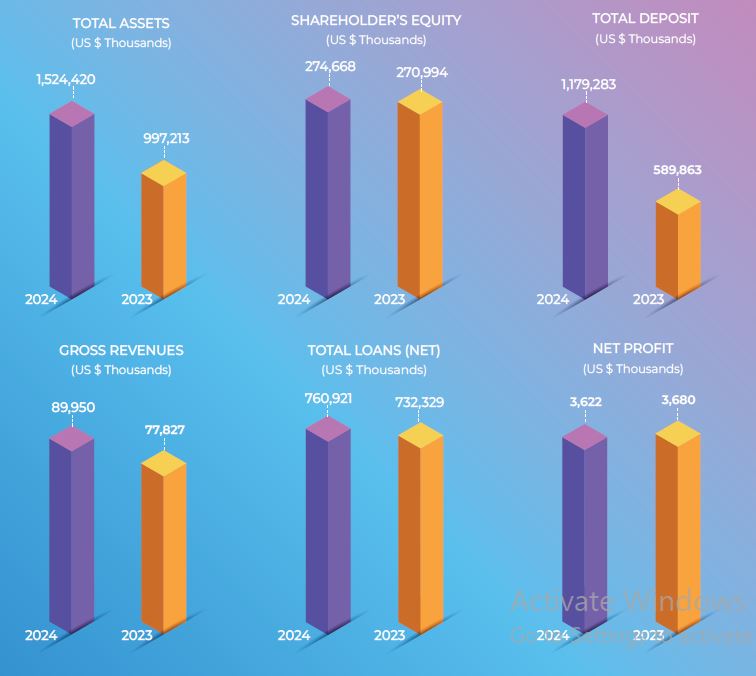

According to the bank’s 2024 financial statements, Prince Bank held around US$730 million in cash and deposits against approximately US$780 million in customer deposits from non-Prince entities, suggesting a relatively strong liquidity position. However, about US$400 million of those deposits were from related parties within the Prince Group.

“The positive for Prince customers is that the bank has strong liquidity in the short term,” the analyst said. “The key will be ensuring that related-party funds don’t flow out, so that ordinary customers remain protected.”

3. Long-term outlook

The analyst added that the resignation of Looi Kok Soon — less than a year into his tenure and following his appointment alongside Mr. Honn Sorachna — reflects mounting pressure on the institution. “You would have to say it isn’t looking positive, and the CEO’s resignation would seem to be an acknowledgment of that,” the analyst said. “It’s just a question of time before significant changes are required.”

4. Impact on the broader banking system

While public attention has been heightened, the analyst believes the broader Cambodian banking sector remains stable. “This is very much a Prince-specific issue,” the analyst said.

“The surprise isn’t that it happened — it’s why it took so long. Other institutions are well-capitalized and shouldn’t be affected.”

Regulatory Oversight and Next Steps

The NBC said it will continue to monitor Prince Bank to ensure compliance and protect depositors’ interests. It reaffirmed that Cambodia’s financial system remains liquid and operates under strict prudential regulations.

Prince Bank has yet to announce its next leadership appointment or detail how it plans to address the sanctions. Legal advisers are reportedly reviewing the sanctions’ implications and cooperating with regulatory authorities. The banking app is reported to also have been removed off both android and apple App stores however all bank branches and ATMs are reported still operating as usual.