Cambodia Investment Review

KB Kookmin Bank CEO Lee Hwan Ju completed a two-day official visit to Cambodia from October 20–21, 2025, underscoring the South Korean financial giant’s confidence in Cambodia’s growing banking sector and reaffirming its long-term investment strategy through its subsidiary, KB PRASAC Bank Plc.

Expanding Strategic Ties with Cambodia’s Central Bank

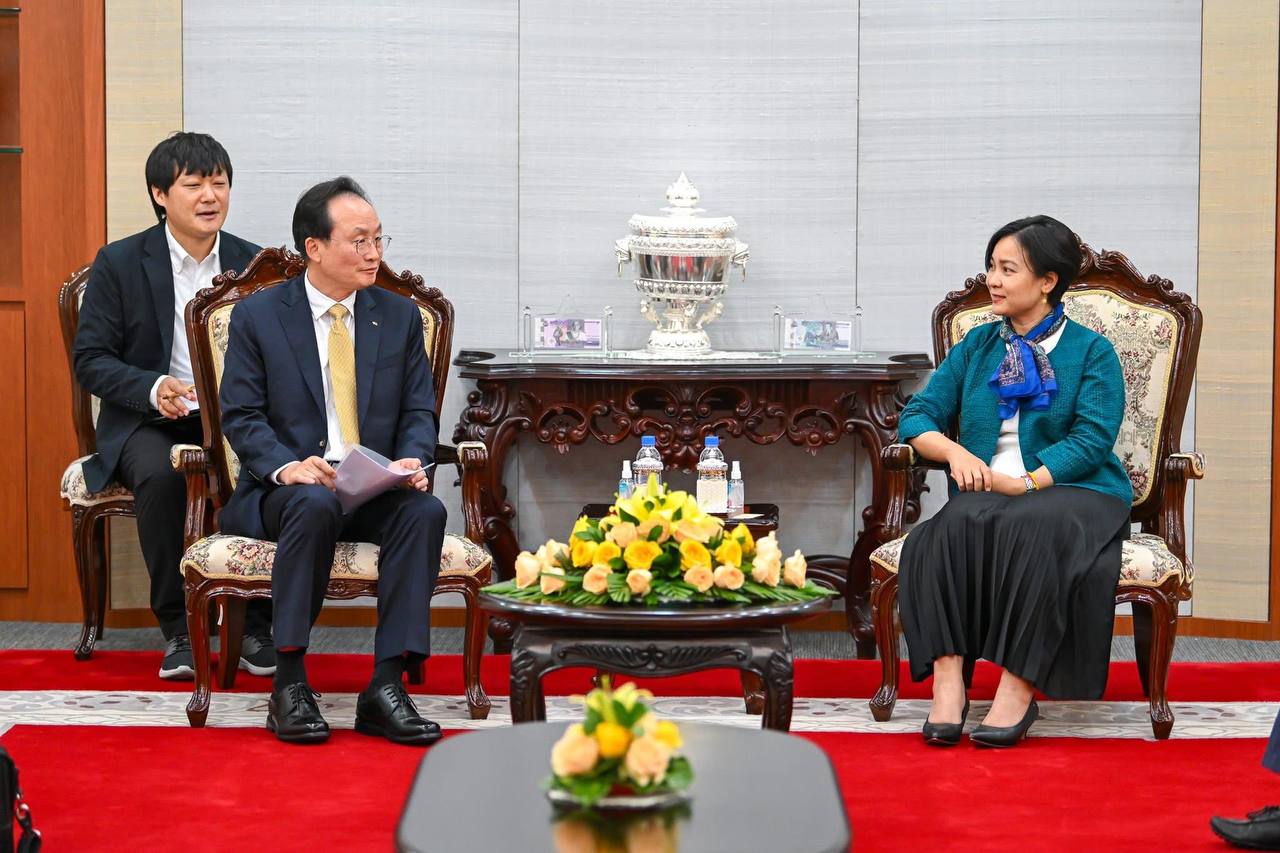

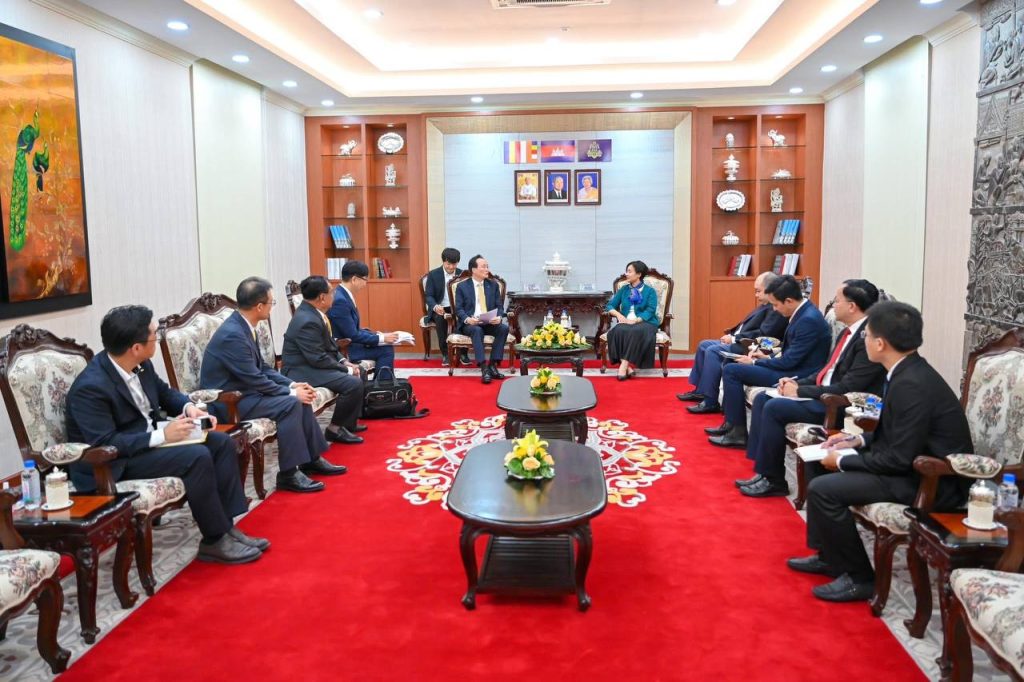

During the visit, Lee met with H.E. Dr. Chea Serey, Governor of the National Bank of Cambodia (NBC), at the Wat Phnom Building. The two leaders discussed Cambodia’s macroeconomic outlook, financial sector stability, and opportunities to enhance cooperation in areas such as cybersecurity and cross-border payment systems.

Lee praised Cambodia’s favorable investment environment, particularly in financial services, emphasizing KB Kookmin Bank’s ongoing commitment to contribute technology-driven innovation to the local market. He noted that the bank’s vision aligns with Cambodia’s economic transformation, with plans to further expand financial inclusion and customer access to modern banking services.

In response, Governor Chea Serey expressed appreciation for KB Kookmin Bank’s continued confidence in Cambodia and its active participation in developing the sector. She highlighted the central bank’s measures to ensure a stable operating environment and support foreign investors through strengthened regulatory cooperation.

Strengthening KB PRASAC Bank’s Growth Strategy

Lee also met with the management team of KB PRASAC Bank at its Phnom Penh head office to review the bank’s performance and discuss its next phase of growth. Discussions focused on maintaining loan portfolio expansion, advancing digital transformation, and promoting a stronger savings culture among customers.

Emphasizing the importance of customer-centric operations, Lee urged the management to continue improving service quality through faster and more efficient processes. He also stressed the need to retain top talent and foster innovation to sustain long-term competitiveness in Cambodia’s dynamic financial landscape.

KB PRASAC Bank, one of Cambodia’s largest commercial banks, has played a pivotal role in extending financial access across the country since KB Kookmin Bank became its sole shareholder. The subsidiary continues to be a cornerstone of KB Kookmin’s regional expansion strategy in Southeast Asia.

On-Site Visits and Broader Engagement

As part of his itinerary, Lee visited several KB PRASAC Bank branches, including Ang Ta Som and Takeo in Takeo Province and the AEON Mall Meanchey branch in Phnom Penh. These visits provided him with insights into branch-level performance, customer engagement strategies, and lending practices that consider client income and savings capacity before loan disbursement.

Lee encouraged branch teams to remain focused on customer satisfaction, reinforcing KB PRASAC Bank’s philosophy of providing timely, transparent, and responsible banking services. His observations and recommendations aimed to further align branch operations with the bank’s mission to empower Cambodians through accessible financial solutions.

Beyond corporate meetings, Lee also toured the Preah Srey Içanavarman Museum (Sosoro), commending the institution’s preservation of Cambodia’s monetary heritage and its contribution to public financial literacy.

Long-Term Outlook

KB Kookmin Bank’s latest visit signals a strengthened shareholder commitment amid Cambodia’s resilient economic momentum and expanding middle class. As the nation continues to advance its digital and regulatory infrastructure, foreign financial institutions like KB Kookmin are expected to play a key role in deepening market sophistication and integration with regional economies.

The visit reaffirms Cambodia’s growing importance in South Korea’s regional investment portfolio, highlighting a trend of deepening financial linkages between the two countries in both retail and digital banking sectors.