Cambodia Investment Review

Mergers and acquisitions (M&A) across Southeast Asia are struggling to regain momentum amid global headwinds, but Cambodia is seeing targeted deal flow in financial services, education, and healthcare, signaling investor appetite in select growth sectors. The insights were presented by Chris Robinson, Partner and Head of Regional M&A Practice at DFDL, during his recent briefing on regional deal activity.

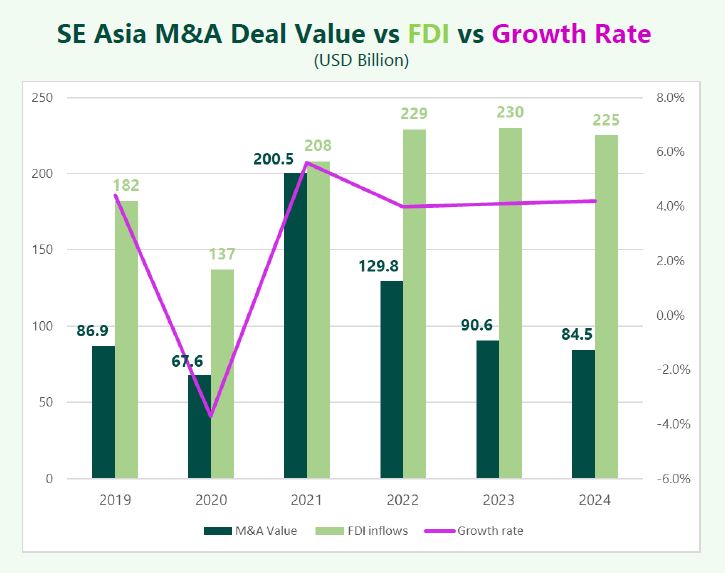

Data from Robinson’s presentation shows Southeast Asia’s deal values have fallen every year since 2021, dropping to USD 84.5 billion in 2024, down 6.7% year-on-year. Trade tensions between the United States and China, high interest rates, and political instability in countries like Vietnam, Thailand, and Bangladesh have weighed heavily on investor confidence.

Robinson cautioned that global uncertainties remain a drag on activity but stressed Cambodia’s relative resilience: “Global headwinds are clearly impacting Southeast Asia, but Cambodia remains on the radar for investors seeking well-defined growth stories.”

Cambodia Transactions Highlight Investor Confidence

Cambodia’s market, however, continues to attract strategic and financial investors. KB Kookmin Bank’s USD 925 million acquisition of PRASAC, SinoPac’s USD 550 million acquisition of a 80%v interest in Amret, and Navis Capital’s purchase of a 60% stake in CIA First highlight significant moves in the financial and education sectors.

Read More: Taiwanese Bank SinoPac Finalizes $550M Deal to Acquire 80% Stake in Cambodia’s Amret

In healthcare, Navis Capital also acquired Orienda International Hospital and Orchid Koh Pich Hospital, while First Fertility Group completed a de-SPAC merger to list on the Nasdaq. Consumer-facing deals included Grab’s acquisition of Nham 24 and Domino’s Australia’s acquisition of its Cambodian franchise. Mekong Capital’s investment in Husk Biochar also underscored growing interest in agriculture-linked innovation.

According to Robinson, these transactions underline a deeper trend: “Investors are still drawn to Cambodia’s financial inclusion story, expanding healthcare needs, and the demographic dividend driving demand for education.”

Sectors Driving Growth

Hot sectors for Cambodia remain consistent with broader ASEAN trends:

- Financial institutions, particularly banks, MFIs, and insurers.

- Education, including K-12.

- Healthcare, from hospitals to specialty clinics.

- Renewable energy, particularly solar.

- Technology, including fintech, medtech, and e-logistics.

- Consumer and retail.

- Agri-processing businesses.

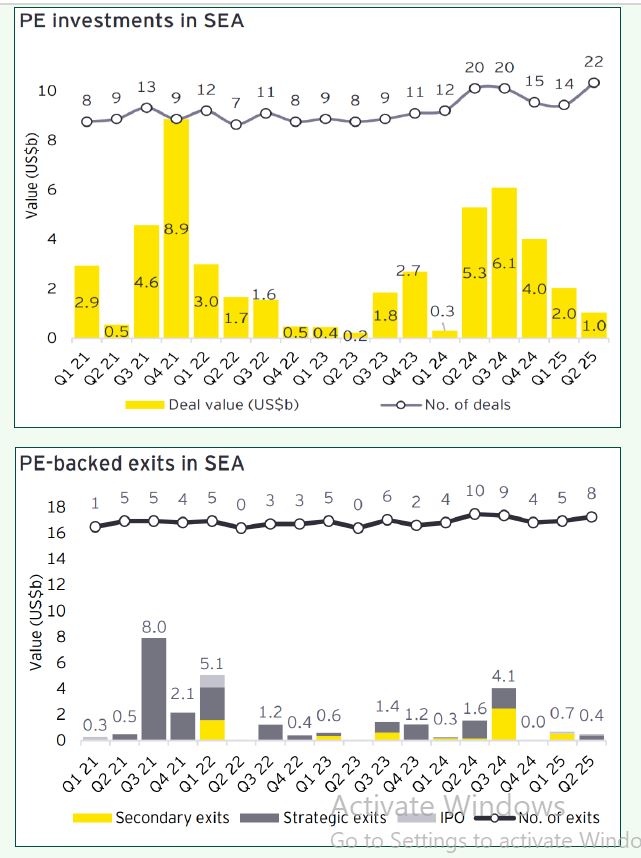

Robinson noted that even though global deal volumes are subdued, private equity and venture capital remain active in the region. “The resilience of FDI flows into Cambodia shows that long-term fundamentals remain intact, even if headline M&A volumes across ASEAN are muted,” he explained.

Singapore continues to dominate as the regional hub, accounting for nearly half of PE deal value and two-thirds of VC activity in Southeast Asia.

Complexity Rising in Cambodian Deals

Deal structuring in Cambodia is becoming more sophisticated, reflecting regulatory reforms, growing investor scrutiny and rising deal values. The Competition Law now requires merger clearance, while due diligence increasingly covers ESG compliance, anti-bribery checks, and tax liabilities.

Protracted deal timelines, more heavily negotiated transaction documents, and more complex closing arrangements are also becoming the norm. Local conglomerates are also showing stronger interest in acquisitions, often targeting co-venturer stakes in strategic projects.

As Robinson emphasized in his presentation: “Investors are approaching Cambodian transactions with more caution and more sophisticated structures. Protracted timelines and stricter compliance are now built into the process.”

Despite global uncertainties—including U.S. tariff policies, persistently high interest rates, and geopolitical instability—Cambodia’s fundamentals continue to attract investors. Robinson concluded: “For investors with patience and a sector-specific strategy, Cambodia remains a compelling play within Southeast Asia.”