Cambodia Investment Review

Cambodia’s small business lending market showed signs of strain in the second quarter of 2025, with loan applications and overall balances softening while repayment risks rose sharply, according to the latest Small Business Credit Index from Credit Bureau Cambodia (CBC).

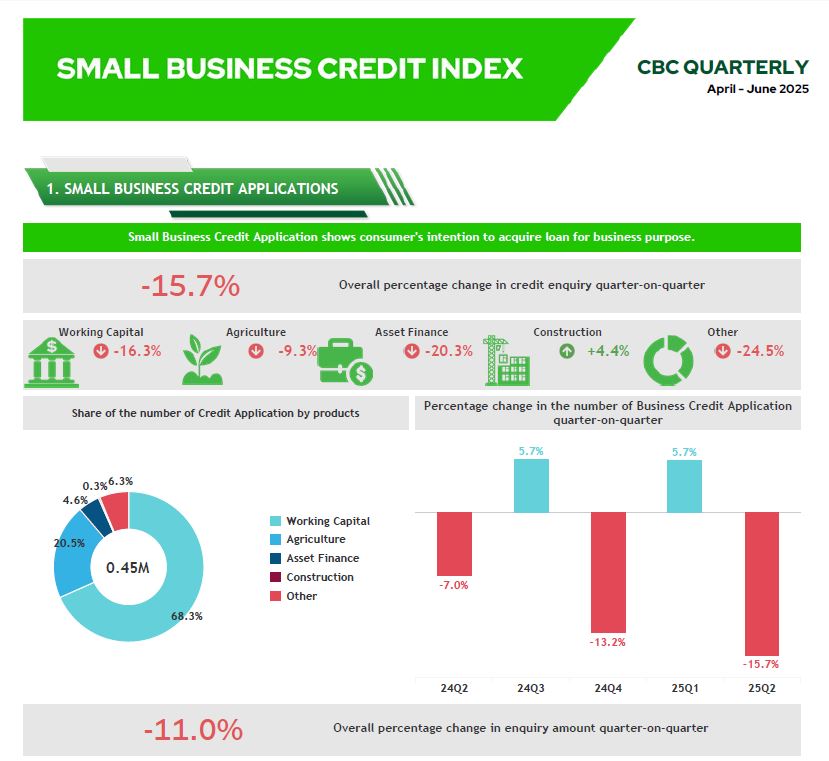

Loan Applications and Approvals Trend Down

The number of small business credit applications fell 5.7% quarter-on-quarter, marking a second straight quarter of subdued demand after a brief rebound earlier this year. The value of applications also dropped 4.4%, suggesting both fewer and smaller requests for financing.

Read More: Boosting Tourism SME Growth Through Enhanced Credit Reporting Knowledge in Siem Reap

Working capital loans continued to dominate the landscape, representing more than two-thirds of applications, while agriculture accounted for about one-fifth. Agriculture was one of the few categories to see an increase in loan requests by value, rising 4.4% despite declines in most other sectors.

Regionally, the Tonle Sap area posted the steepest decline in applications, down 15.6%, while the Plateau region experienced a modest 5.4% drop. The Coastal Plain fared worst, with a 20.7% decline.

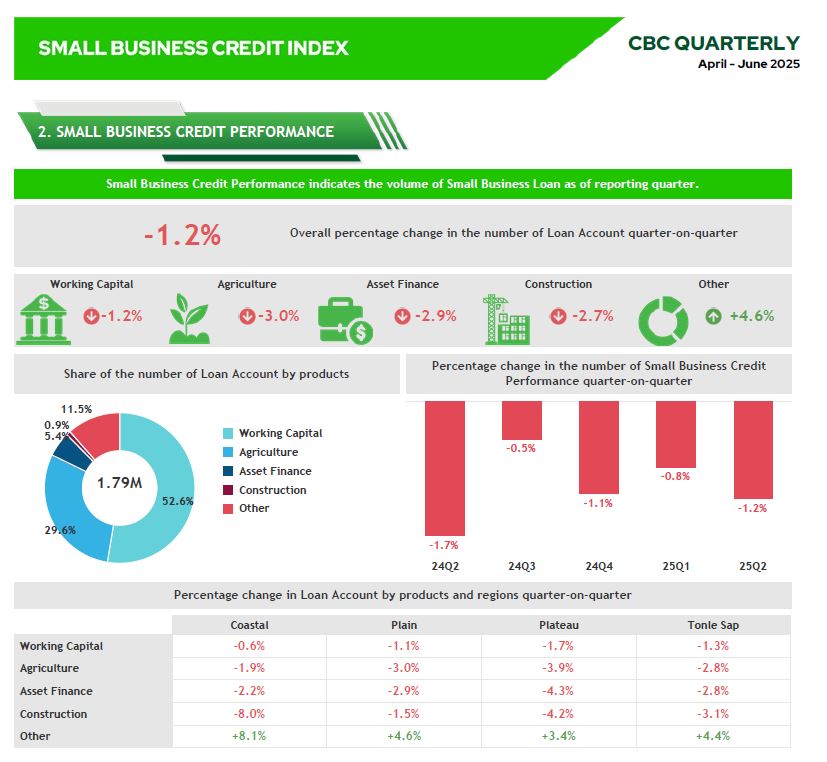

Loan Performance Mixed Across Sectors

The number of active small business loan accounts edged down 1.2% overall, as weaker appetite in asset finance and construction offset gains in working capital lending, which grew 4.6%. Loan balances across all products rose slightly by 0.8% to $35.54 billion, suggesting businesses are holding larger outstanding debts despite fewer new accounts being opened.

Agriculture again stood out, with balances up 1.8% quarter-on-quarter, while construction and asset finance contracted. Among regions, the Plateau saw the strongest growth in balances at 3.6%, while the Coastal Plain slipped 0.7%.

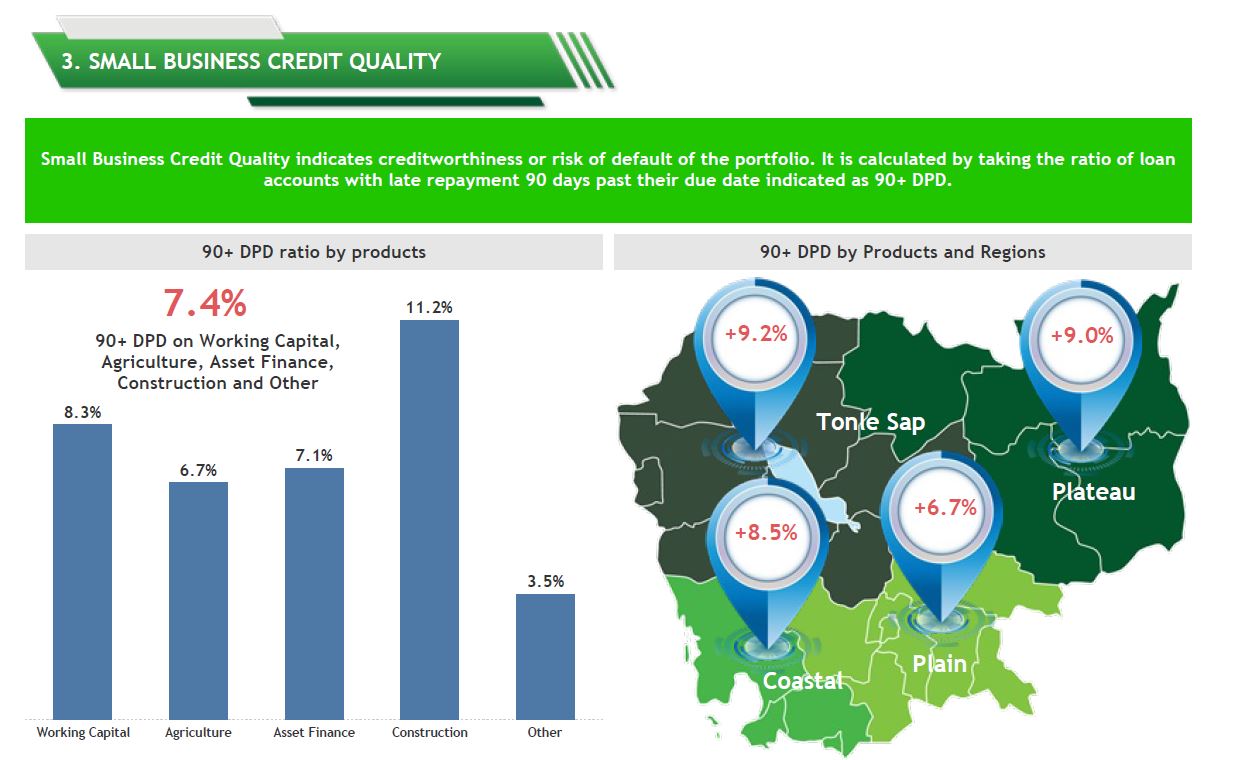

Repayment Risks on the Rise

The proportion of loans overdue by more than 90 days increased to 7.4% of all small business lending, with working capital loans showing the highest risk at 11.2%. Regional trends were uneven: delinquency ratios in the Plateau surged more than 21% from the previous quarter, while the Tonle Sap and Coastal Plain regions also saw double-digit increases.

The report also flagged a growing share of borrowers holding multiple loan accounts—about 30%—raising concerns over debt sustainability in the small business sector.

Broader Implications

The findings suggest Cambodia’s small business sector faces a more challenging credit environment in mid-2025. While working capital remains the backbone of borrowing, repayment capacity is weakening, and regional disparities are widening.

Credit Bureau Cambodia noted that the data is intended to provide insight into lending dynamics and financial stability but does not reflect its own financial position.