Cambodia Investment Review

Cambodia’s trust sector is entering a new phase of transparency and formalization following the issuance of Prakas 192 on Tax Rules and Procedures for Trusts, dated March 12, 2025. Developed with the involvement of the Trust Regulator and legal and tax advisory firm DFDL, the regulation clarifies the taxation responsibilities for trustors, trustees, and beneficiaries for both resident and non-resident taxpayers that are involved in the trust established in the Kingdom of Cambodia except the trust structures with the legal form of a company or an enterprise.

This milestone initiative aims to boost legal compliance, protect stakeholder interests, and encourage greater confidence in Cambodia’s trust structures.

Clarifying Cambodia’s Trust Taxation Landscape

During an expert session, Mrs. Vajiravann Chamnan, Tax Partner at DFDL, emphasized that the new framework “marks a significant move toward formalizing the legal and tax framework for trusts in Cambodia, offering clear guidance on taxation and enhancing transparency.”

Read More: Cambodia Leadership Review Top 50: Clint O’Connell – Partner at DFDL Cambodia

She explained that the Prakas “provides detail and certainty on the tax obligations and responsibilities for all parties involved in a trust arrangement. This clarity safeguards stakeholders’ interests and supports greater investor confidence in Cambodia’s growing trust sector.”

Mr. Diberjohn Balinas, also a Tax Partner at DFDL, added that “trust structures are increasingly important for investment, wealth management, and succession planning. Prakas 192 ensures that Cambodia remains competitive with a modernized and clear tax regime for trusts.”

Trustee Responsibilities: Managing Tax and Compliance

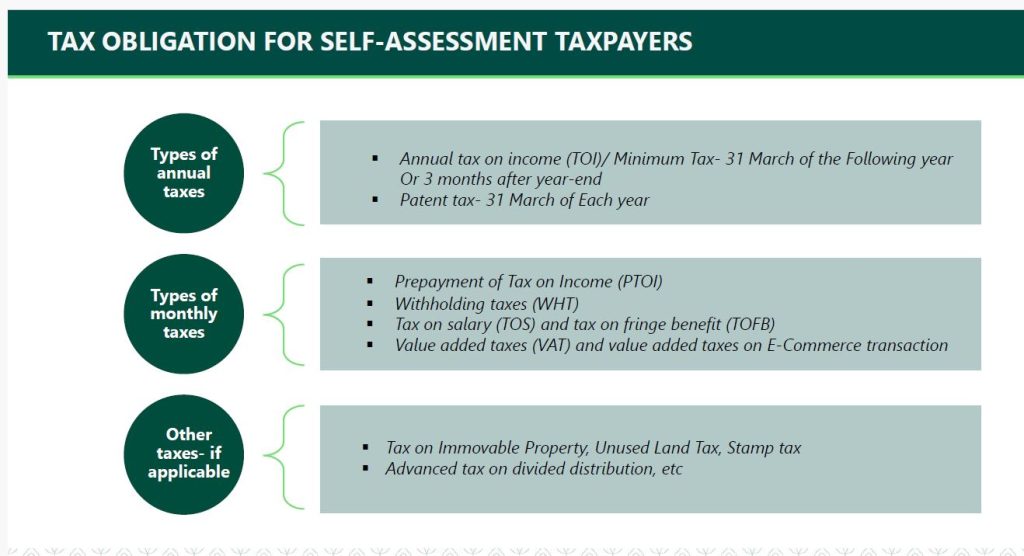

Trustees in Cambodia must now adhere to structured tax obligations under Prakas 192. Key requirements include:

- Tax Registration: Trust companies must register as medium or large taxpayers. Independent individual trustees must register as small, medium, or large taxpayers depending on their turnover and assets in accordance with Prakas on classification of Taxpayers under the Self-Assessment Taxpayer Regime The tax registration must be made within 15 working days after beginning economic activity or obtaining license/approval from the Trust Regulator.

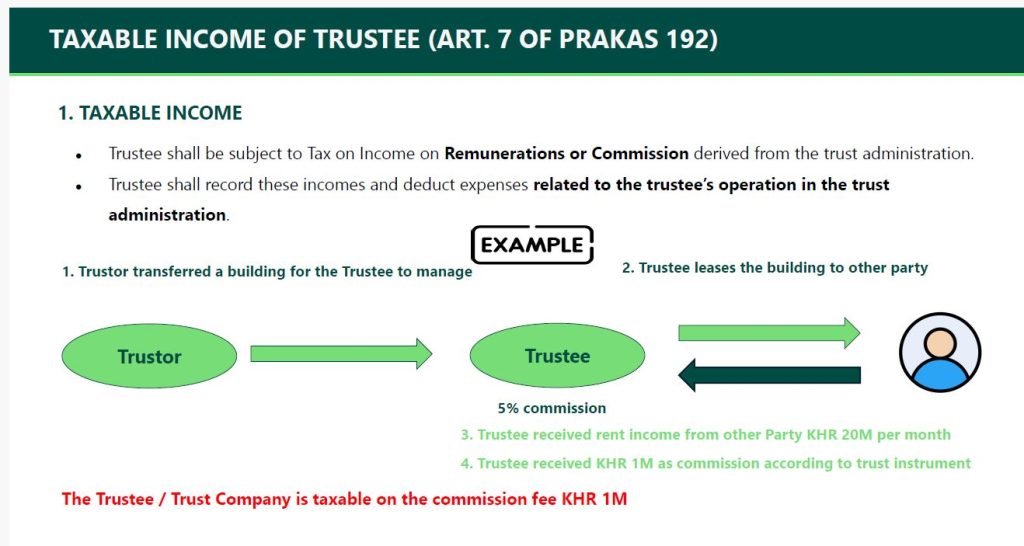

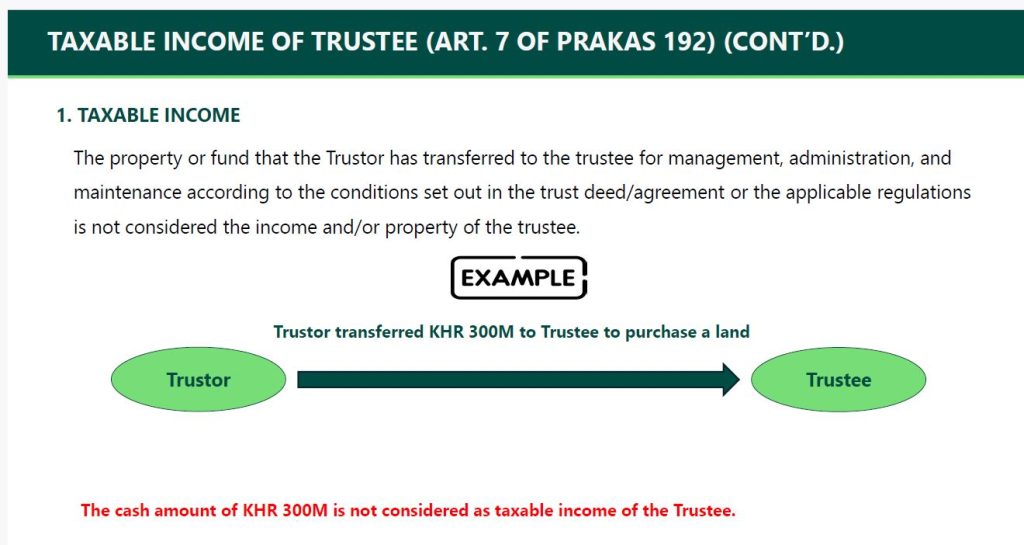

- Taxable Income Recognition: Trustees are taxed on remuneration or commissions earned from administering the trust. Assets/Fund transferred by trustors into the trust are not considered taxable income for trustees.

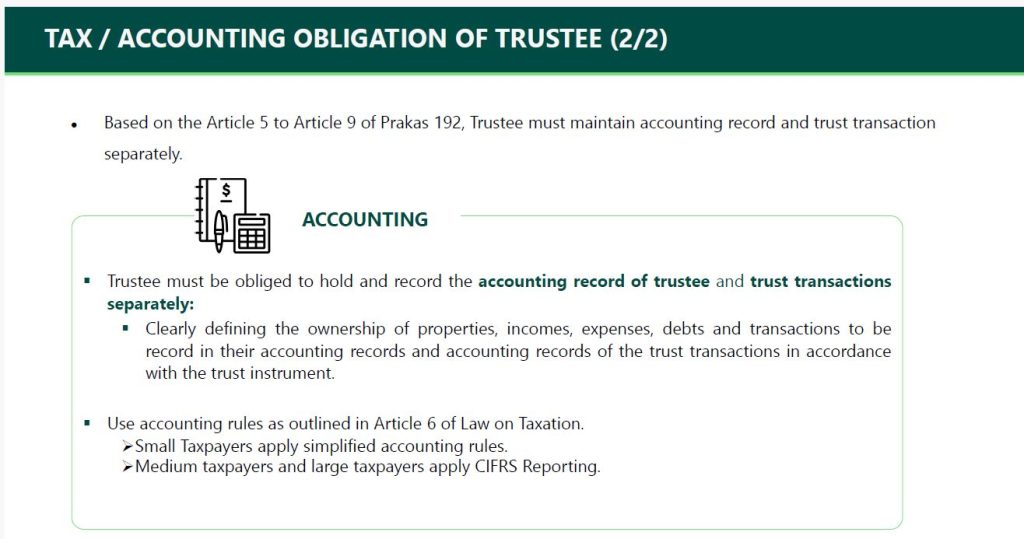

- Separate Accounting: Trustees must maintain clear, separate accounting for trust activities and their own operations, defining ownership of properties, income, expenses, and liabilities.

Applicable tax rates under the Prakas are:

- 20% corporate income tax for legal entity trustees.

- Progressive rates (0% to 20%) for individual trustees depending on the annual income thresholds.

In addition to income tax, trustees must comply with taxes arising from the trust property, including:

- 10% tax on rental income from immovable trust property.

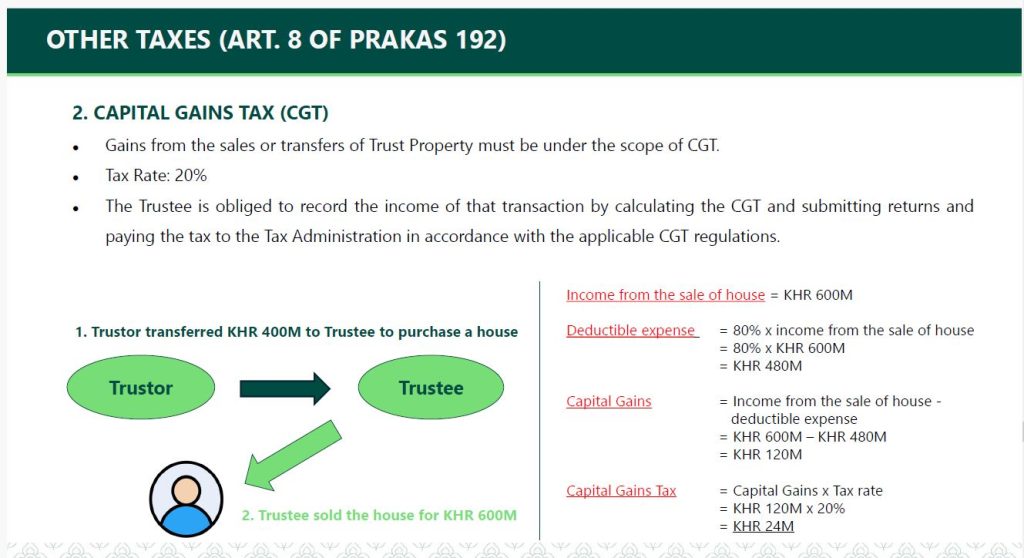

- 20% capital gains tax on the sale or transfer of trust assets.

- 4% stamp tax on property transactions.

- 14% Withholding tax on cross-border profit transfers where applicable. However, if that income is subject to Capital gain tax, the repatriation of such income is not subject to 14% Withholding tax.

Navigating the Challenges Ahead

While Prakas 192 provides necessary clarity, trustees must manage several compliance challenges:

- Maintaining Separate Reporting: Full separation between trustee and trust accounting for tax and audit purposes.

- Correct Application of Exemptions: Trustees must accurately apply exemptions on taxes such as capital gains and stamp duty where eligible.

- Handling VAT and DTA Issues: Further clarification may be needed around VAT obligations and how Double Tax Agreements (DTAs) apply to cross-border trusts.

- Asset Reporting by Trustors: Trustors may also face obligations regarding the declaration of property and funds placed into trusts.

The tax obligations now embedded within the trust framework significantly professionalize Cambodia’s sector, supporting its development into a credible financial and investment vehicle.

Conclusion

Prakas 192 on Tax Rules and Procedures for Trusts is a pivotal regulatory step for Cambodia’s financial sector. It embeds trust structures firmly within the national tax framework and promotes a more reliable and investor-friendly environment for those seeking to use trusts for commercial, charitable, or personal purposes.

As Cambodia’s trust landscape continues to expand into areas like family trusts, carbon credit trusts, and fintech-driven trust structures, professional advisory will be more essential than ever.