Cambodia Investment Review

The condominium market in Phnom Penh has witnessed significant growth and transformation over the past decade, with various phases marked by changing dynamics and market players. Despite recent challenges, the sector shows signs of resilience and adaptability, according to insights by Tom O’Sullivan, CEO of Realestate.com.kh shared at the recent AmCham Mid-Year 2024 Market Update.

A Decade of Development

The legal landscape for foreign property ownership in Cambodia saw a significant shift in 2009 when it became permissible for foreigners to own property in co-owned buildings above the ground floor. This regulatory change set the stage for the condominium market’s emergence. The first condominiums were completed between 2013 and 2014, including notable projects like Rose Condo, Decastle Royal, and Olympia City.

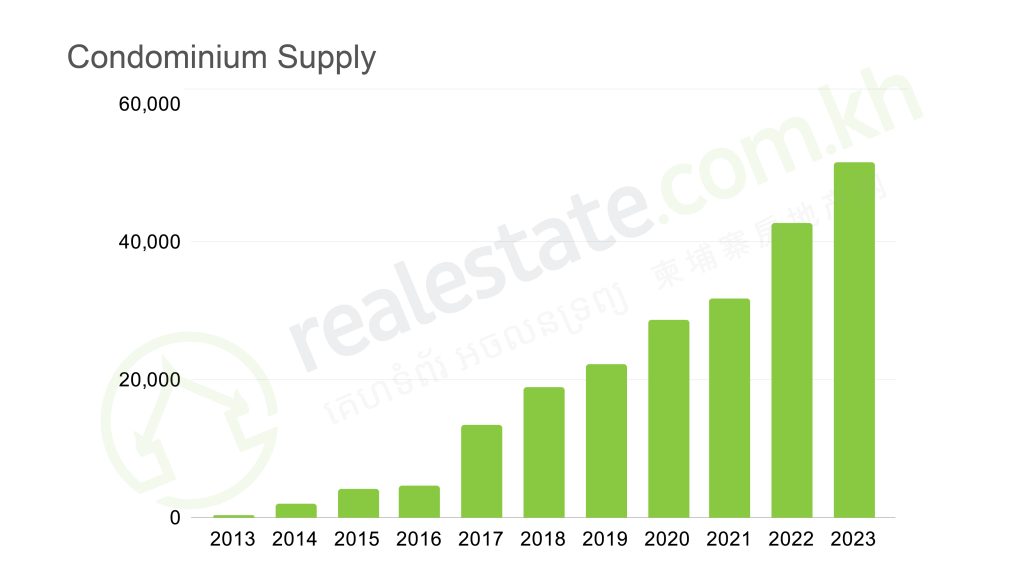

During the initial phase from 2013 to 2015, the market experienced a surge in construction activity, with 55 condominiums commencing development. By 2016, the number of completed units was under 5,000. However, a rapid increase in supply followed, with over 8,000 units completed between 2016 and 2017, primarily driven by developers from Singapore, South Korea, Japan, Taiwan, and Cambodia. The next phase saw Chinese developers dominate the market, contributing to an inventory of nearly 30,000 units by 2020.

Market Trends and Price Dynamics

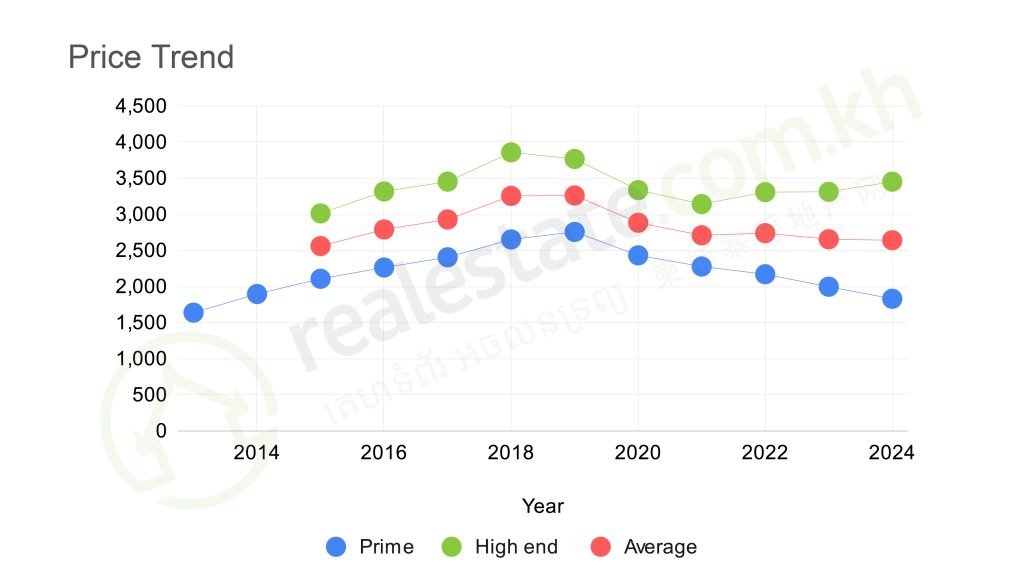

Between 2013 and 2019, condominium prices in Phnom Penh steadily increased. High-end projects began entering the market in 2015, with luxury launches averaging $4,000 per square meter, while the general average stood at $3,200. The Chinese market’s influence grew from 2016 onwards, significantly impacting the sector’s trajectory.

However, the advent of the COVID-19 pandemic brought about stagnation, particularly affecting the Chinese-dominated buyer segment. This period saw fewer new condominium launches, and the absence of Chinese buyers was felt acutely. Despite these challenges, some industry insiders view this as a positive development, promoting a “flight to quality” among both developers and agents.

Tom O’Sullivan, CEO of Realestate.com.kh, emphasized the need for market correction during the pandemic. “We needed to reset,” he noted, highlighting that rents in centrally located areas did not decrease as significantly as expected. O’Sullivan also stressed that market fluctuations are not unique to Cambodia, drawing comparisons with other global markets like Singapore and the UK, which cycle through recession, recovery, and expansion phases.

Resilience and Recovery

The high-end luxury segment remained relatively insulated from the pandemic’s adverse effects due to limited supply. Conversely, many pre-COVID condominium projects struggled to adjust pricing to the new market realities. Trusted developers capitalized on the situation by offering competitive pricing, appealing to a more discerning buyer base.

In recent times, the completion of condominiums in Phnom Penh has exceeded 50,000 units. However, new project launches have slowed since 2021, prompting supply and demand corrections. Notably, prices for prime projects have adjusted from a high of $2,510 per square meter to around $1,900, reflecting the best pricing in a decade.

O’Sullivan also mentioned that the successful developers today are those with a proven track record. He noted, “New project launches are capitalizing through competitive pricing, essentially bringing prices back to 2013 levels.”

Future Outlook

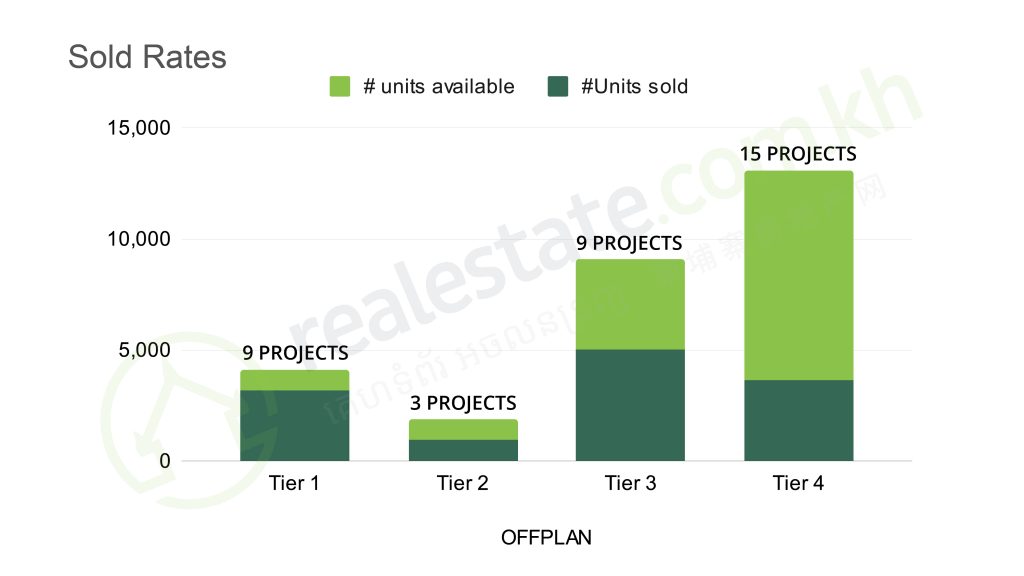

The property market seminar highlighted significant buyer trends and the strategies of successful developers. Realestate.com.kh sales data revealed that tier 1 projects achieved notable sales over the past two years, with a total value of $145.3 million from 1,164 units sold. Approximately 15% of buyers were drawn by guaranteed rental returns, emphasizing Cambodia’s strong appeal for high rental yields.

Tom O’Sullivan observed that “a large percent of buyers are Cambodian diaspora” and noted that “most sales are in the inner city ring.” Over 75% of Realestate.com.kh buyers are international investors, predominantly from the US, UK, and China, with a growing trend of Eastern European buyers.

Ty Chea, Sales Manager at Urban Living Solutions, also speaking at the update, highlighted the importance of developer credibility and the appeal of branded residences. “Developers must have a track record,” he asserted, adding that branded residences and guaranteed buybacks are key differentiators in the current market.

As the market navigates its second property cycle, stakeholders are cautiously optimistic. The focus on quality, competitive pricing, and strategic differentiation positions Phnom Penh’s condominium market for a balanced recovery and sustained growth in the coming years.