Cambodia Investment Review

DFDL Cambodia, in collaboration with the Asian Development Bank (ADB) and the Ministry of Commerce, hosted a workshop with the primary aim to raise awareness of Secured Transaction Law among private sector stakeholders. This event, attended by various stakeholders from the financial and other private sectors, focused on enhancing the country’s legal infrastructure related to security interests in movable property.

Nearirath Sreng, Co-Head of Cambodia Banking, Finance, and Technology Practice at DFDL Cambodia, was a key speaker at the workshop. With her extensive experience in legal practice and involvement in drafting regulations on e-commerce, consumer protection, and secured transactions, she provided a comprehensive overview of the current state and future directions for Cambodia’s secured transactions framework.

Nearirath emphasized the importance of the Law on Secured Transactions (LST) enacted in 2007, which established a public registration system for movable properties, known as the Secured Transactions Filing Office (STFO). This law was heavily influenced by Article 9 of the Uniform Commercial Code (UCC) from the United States and later integrated principles from the UNCITRAL Model Law on Secured Transactions. Despite these advancements, Nearirath highlighted several challenges that still impede the effective use of the LST by creditors in Cambodia.

Significant Need For Improved Awareness & Streamlined Procedures

“One of the primary issues is the lack of widespread dissemination and understanding of the LST among stakeholders,” said Nearirath. “The enforcement process and related procedures also lack clarity and certainty, which discourages creditors from utilizing the secured transactions framework to its full potential.”

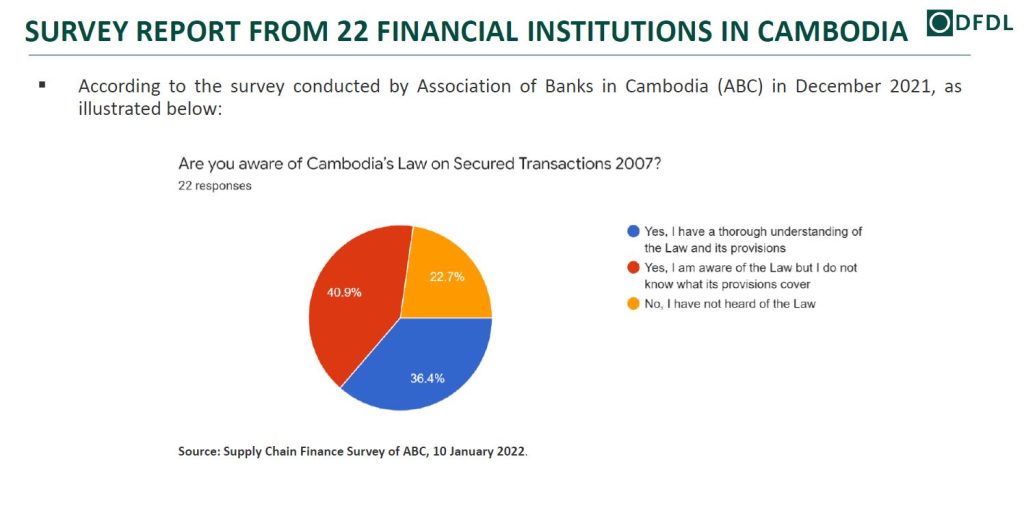

According to a survey conducted by the Association of Banks in Cambodia (ABC) in December 2021, there is a significant need for improved awareness and streamlined procedures to make the LST more effective. Nearirath proposed several recommendations to address these challenges, including the preparation and passing of a Sub-Decree to clarify uncertainties and address additional types of collateral.

“We need to solicit feedback and design relevant seminars for private stakeholders, such as banks, financial institutions, and corporates, to enhance their understanding and application of secured transactions,” Nearirath suggested. “Furthermore, it is crucial to engage with government officials from the Ministry of Commerce and relevant ministries to establish the enforcement mechanism of security interests in movable property more efficient.”

The workshop also explored the global economic landscape and its implications for secured transactions in Cambodia. The global economic slowdown, driven by the aftermath of the COVID-19 pandemic and ongoing geopolitical conflicts, has led to tighter monetary policies and weaker global trade and investment. This economic environment presents unique opportunities for lenders who can navigate these conditions effectively.

Reducing Risk & Enabling Businesses To Access Credit

“Increased demand for credit during economic downturns provides an opportunity for lenders to offer tailored financial products,” Nearirath explained. “Lenders can also explore asset-based lending, where loans are secured with movable collateral, reducing risk and enabling businesses to access credit.”

Nearirath stressed the importance of accurate valuation and maintenance of collateral to ensure it adequately secures loans. “Borrowers can unlock financing using movable collateral, which is particularly valuable during economic downturns when traditional lending becomes more restrictive. This approach can expand access to credit for SMEs and help businesses maintain operations during challenging times.”

The workshop concluded with a call to action for stakeholders to collaborate in strengthening Cambodia’s secured transactions framework. “By improving the regulatory environment and providing targeted training and technical assistance, we can create a more robust system that supports economic growth and financial stability,” Nearirath remarked.

The event underscored the commitment of DFDL, ADB, and the Ministry of Commerce to enhance the legal and regulatory infrastructure in Cambodia, fostering a more secure and efficient financial landscape for businesses and lenders alike.