Cambodia Investment Review

Cambodia’s tourism sector has avoided a complete collapse thanks to resilient air travel and continued demand from select regional markets, but the aftershocks of the 2025 Cambodia–Thailand border conflict continue to weigh heavily on arrivals, revenues, and employment, according to a new market update report from Oudom Consulting.

The Market Update Report 2026, prepared by Oudom Consulting Chairman Arnaud Darc, concludes that the disruption represented a structural shock rather than a cyclical downturn. While airports remained open and some source markets continued to expand, the collapse of land-based tourism and prolonged confidence constraints have created a slower, more uneven recovery trajectory for the sector.

Key takeaways from the report:

• Land arrivals fell more than 34% year-on-year in H2 2025, with November down over 90%

• Tourism receipt losses in H2 2025 are estimated at between USD 650 million and USD 1.25 billion

• Air arrivals remained relatively resilient but could not offset land-based losses

• Employment impacts were concentrated in Siem Reap and other land-dependent regions

Air travel resilience offsets, but does not replace, land arrivals

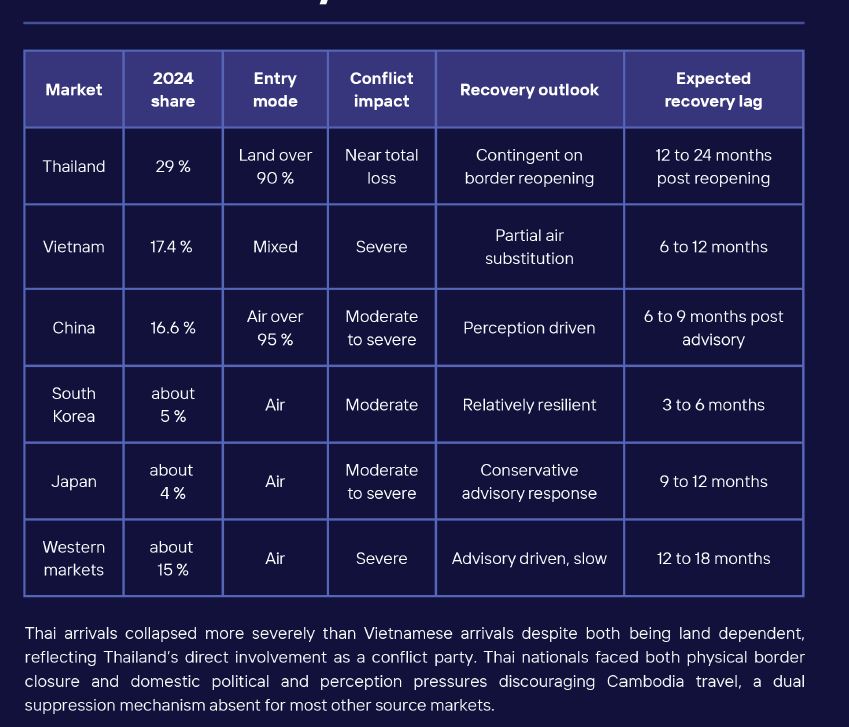

According to Ministry of Tourism data cited in the report, land arrivals declined sharply following border closures and tightened travel advisories, with Thailand—Cambodia’s largest source market in 2024 at roughly 29% of total arrivals—most affected.

The report notes that even where physical access remained available, demand was suppressed by “confidence gating,” including insurance exclusions, tour operator product withdrawals, and advisory language. As a result, air travel growth from markets such as China, South Korea, and Japan was insufficient to compensate for the scale and economic value of lost land-based tourism.

Tourism receipts hit as confidence shock spreads

Using 2024 tourism receipts of approximately USD 3.64 billion as a baseline, the report estimates Cambodia lost between USD 650 million and USD 1.25 billion in tourism revenue in the second half of 2025.

Under its central scenario, losses are estimated at around USD 950 million, implying a reduction of roughly 55% in affected travel segments. In a pessimistic scenario, where confidence restoration is delayed and land access remains constrained, losses could exceed USD 1.2 billion.

The report also highlights a longer-term structural issue: declining tourism yield. Average receipts per visitor fell from USD 74 in 2019 to USD 54 in 2024, reflecting shorter stays and lower daily spending. Preliminary indicators suggest that while arrival volumes may stabilise in 2026, per-visitor spending is likely to recover more slowly.

Angkor Wat emerges as economic transmission point

A central focus of the report is Angkor Wat’s role as both a flagship attraction and a transmission channel for tourism shocks. Data from the APSARA Authority show Angkor ticket sales declining by approximately 27% year-on-year in September 2025, resulting in an estimated USD 7 million to USD 10 million in direct ticket revenue losses in the second half of the year.

When spillover effects across hotels, transport, guides, restaurants, and informal retail are included, Angkor-linked economic losses are estimated at between USD 200 million and USD 350 million. With tourism accounting for up to 60% of Siem Reap’s local economy, the province experienced disproportionately severe impacts.

Employment pressure and uneven recovery outlook

Tourism employment in Cambodia was estimated at around 630,000 jobs in 2024. The report suggests that between 150,000 and 250,000 workers were displaced or furloughed in 2025, with informal workers and small enterprises most exposed.

Looking ahead, Oudom Consulting outlines three recovery scenarios for 2026. The most likely scenario assumes gradual confidence restoration and selective land border reopening, with tourism receipts recovering to between USD 2.0 billion and USD 2.5 billion—well below pre-shock levels.

The report concludes that Cambodia’s tourism recovery will depend less on reopening attractions and more on restoring confidence, diversifying access routes, and reducing reliance on land corridors vulnerable to geopolitical disruption.