Cambodia Investment Review

KPMG Cambodia, in partnership with the British Embassy in Cambodia and BritCham Cambodia, hosted a crucial seminar today as part of the UK-Cambodia Joint Trade & Investment Forum’s Deep Dive Series. The event, titled “Tax Developments for Economic Growth,” provided business leaders and policymakers with an in-depth understanding of how evolving tax regulations and trade policies are set to impact Cambodia’s growth, particularly in the context of the Kingdom’s ambitious Vision 2050.

Understanding the Global Tax Landscape

The seminar brought together a distinguished panel of speakers, including H.E. Dominic Williams, the British Ambassador to Cambodia, H.E. Dr. Seng Cheaseth, Director of the Department of Law, Tax Policy, and International Tax Cooperation at the General Department of Taxation (GDT), and KPMG experts, including Casey Barnett. The session was designed to help attendees grasp how global tax and tariff changes will influence Cambodia’s economy and business operations in the coming years.

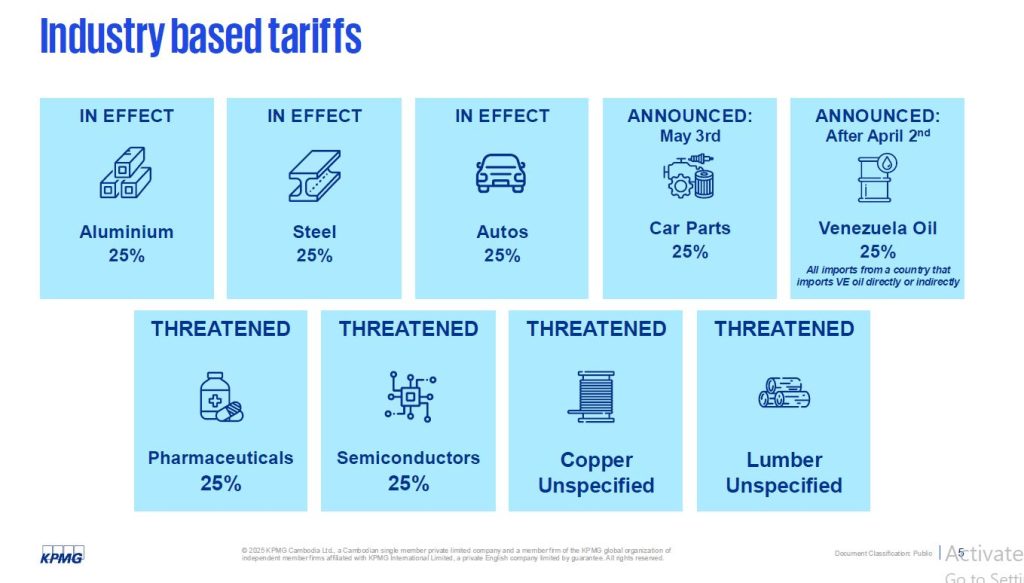

One of the key discussions centered around the U.S. reciprocal tariffs, which came into effect on April 5, 2025. As part of this policy, Cambodia faces a 49% tariff rate—one of the highest in the region. KPMG highlighted how businesses operating in Cambodia will need to adapt to these shifts to maintain their competitive edge in international trade.

Tariff stacking, a scenario where multiple tariffs apply to a single product as it crosses borders, was also discussed. KPMG experts illustrated how tariff stacking could lead to significantly higher costs for businesses, especially in sectors such as electronics and steel. They emphasized the growing importance of strategic supply chain planning to mitigate these additional costs.

The Global Minimum Tax and Cambodia’s Position

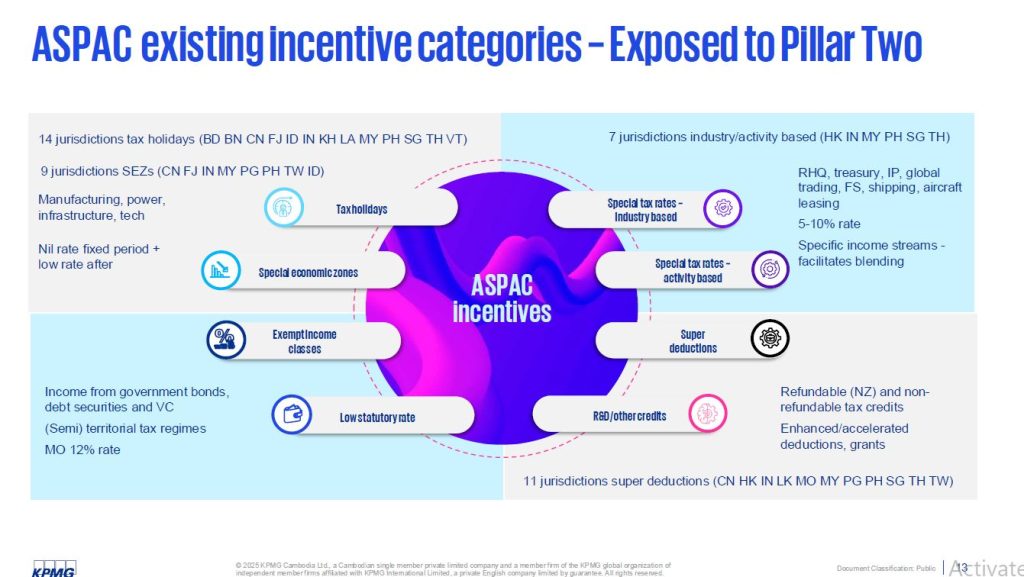

Another crucial element covered in the seminar was the Global Minimum Tax (GMT), which aims to ensure multinational corporations pay a minimum tax rate. This regulation could have significant implications for Cambodia’s existing tax incentives, particularly for businesses benefiting from tax holidays or operating within special economic zones (SEZs). KPMG experts walked attendees through the specifics of the Income Inclusion Rule (IIR) and the Undertaxed Profit Rule (UTPR), both key components of GMT.

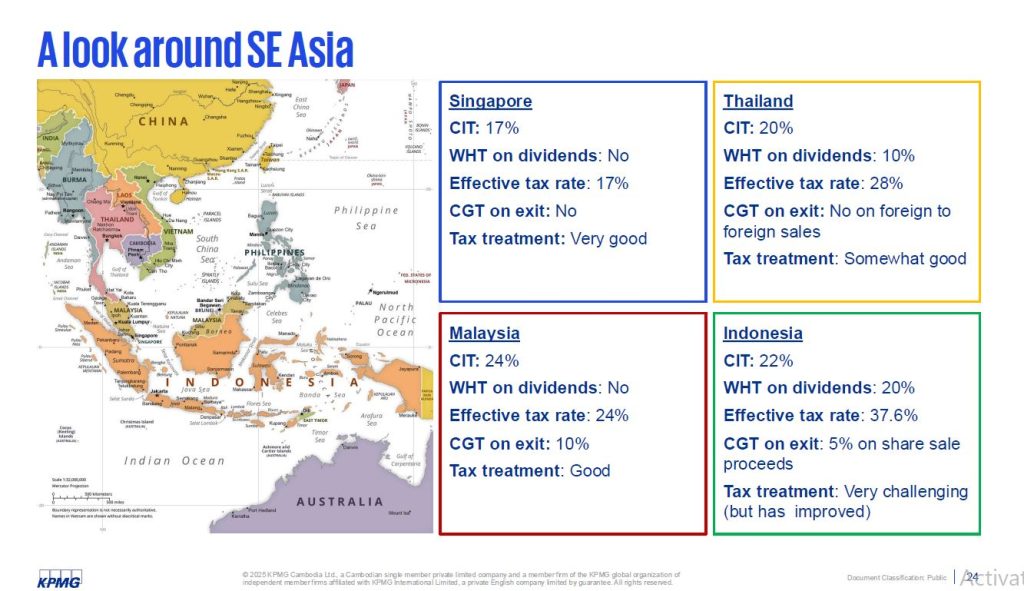

The seminar also explored the evolving role of tax incentives in the Asia-Pacific (ASPAC) region. Countries like Singapore, Vietnam, and Malaysia are already realigning their tax frameworks to meet GMT standards, leaving Cambodia’s incentives exposed to future scrutiny. Businesses in Cambodia must assess how these global changes could affect their tax strategies moving forward.

Cambodia’s Economic Strategy: Preparing for Future Challenges

As Cambodia pursues its Vision 2050, the evolving tax and trade landscape presents both challenges and opportunities. The seminar provided a platform for business leaders to discuss the impact of capital gains taxes, which may soon be implemented in Cambodia, alongside changes in other forms of taxation. KPMG stressed the importance of being proactive in understanding how such changes could affect Cambodia’s business environment and suggested that businesses adapt their tax planning strategies to remain competitive.

The Pillar Two tax regulations, a significant global tax initiative that aims to set a minimum tax rate, was another focal point of the seminar. As Cambodia’s regional neighbors prepare to implement Pillar Two, Cambodian companies must evaluate how these changes will impact their operations and tax obligations.

As Cambodia faces the evolving challenges of global trade and tax reforms, it is essential for businesses to stay informed and proactive. KPMG Cambodia is here to help you navigate these changes and ensure your business is well-prepared for the future.

To learn more about how these tax developments may impact your business and to receive tailored advice, contact KPMG Cambodia today.

Contact KPMG Cambodia

Email: info@kpmg.com.kh

Website: kpmg.com.kh