Cambodia Investment Review

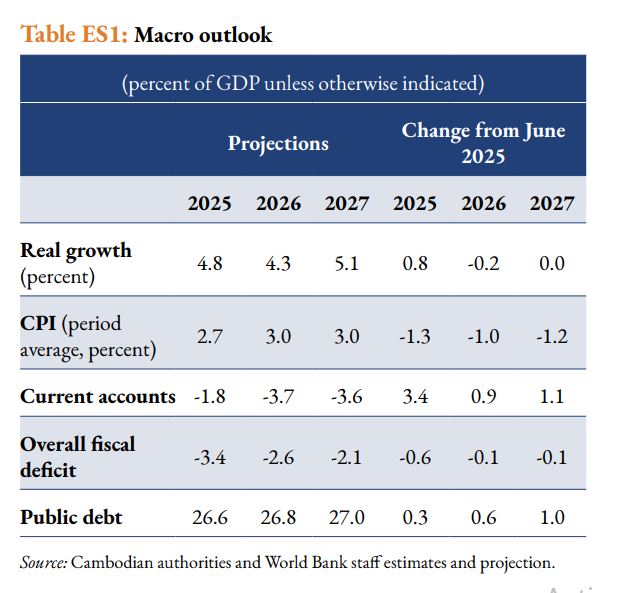

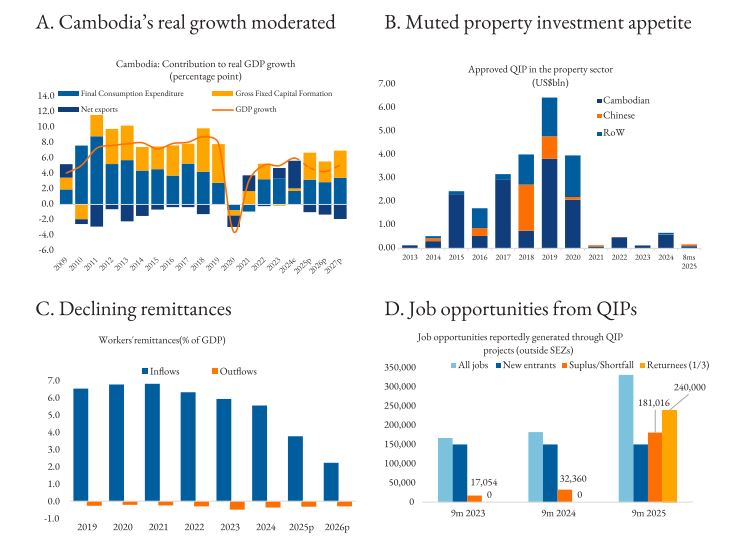

Cambodia’s economic outlook is set to moderate in 2025, with the World Bank projecting growth of 4.8 percent, down from an estimated 6 percent in 2024. The latest Cambodia Economic Update, released on December 11 under the theme Coping with Shocks, highlights the pressures from a softening property sector, ongoing border disruptions, and new international trade restrictions that are weighing on domestic activity.

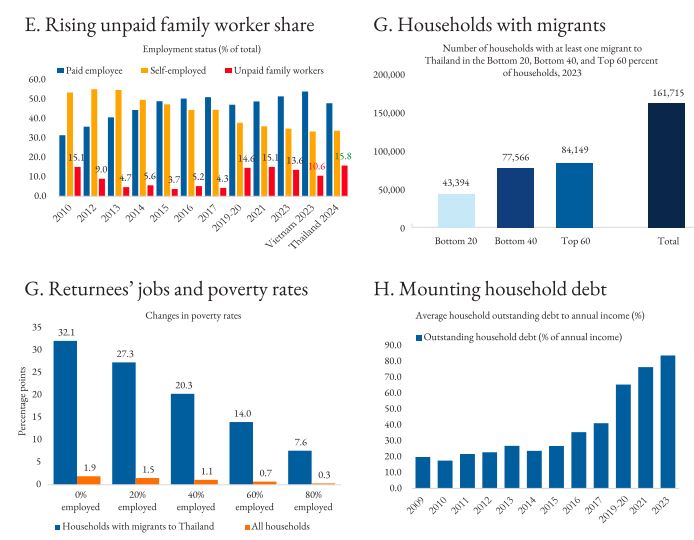

According to the World Bank, Cambodia continues to face a mix of domestic and external headwinds that are reshaping growth prospects. The report notes that the property market downturn is dampening investment and slowing construction, while border tensions are affecting labor markets, tourism, and the broader flow of goods and people.

World Bank Country Manager for Cambodia, Tania Meyer, said the Kingdom is navigating “a challenging period amid combined domestic and external shocks,” adding that policy discipline and structural reforms will be essential in reinforcing economic resilience. She also underscored the need to protect vulnerable households, including returnees, and to improve the business operating environment for small and informal enterprises.

Shocks Pressure Growth Despite Strong Buffers

The report highlights that Cambodia enters this period with relatively strong macroeconomic buffers. International reserves remain adequate at the equivalent of 7.5 months of imports, inflation is contained at an average of 2.7 percent, and public debt stands at around 26 percent of GDP.

Read More: World Bank Warns of Slowing Growth and ‘Trade Trap’ Risks for Cambodia and Region in 2025

Capital inflows continue to provide support, with foreign direct investment reaching US$2.3 billion in the first half of 2025—an increase of 28.4 percent year-on-year—helping offset pressures on the external position. However, weakened consumption is expected to weigh on government revenue performance, while the current account deficit is projected to widen.

To cushion the immediate impact of the slowdown, the World Bank recommends measures such as emergency cash transfers and targeted employment programs, particularly for return migrants affected by border tensions. Over the medium term, the Bank points to the importance of reducing the cost of doing business, improving access to finance for small firms, and accelerating digitization in trade and logistics processes.

Informal Economy Takes Center Stage

A special focus section of the report examines Cambodia’s informal economy, which accounts for roughly 90 percent of enterprises and 88 percent of total employment. The World Bank notes that while informal firms tend to be 2.6 times less productive than formal businesses, the sector is highly diverse, ranging from subsistence-level family operations to more competitive enterprises with the capacity to grow.

The assessment categorizes these into segments such as Survival Enterprises, which provide basic livelihoods for vulnerable households, and High Performers, which in some cases rival formal firms on productivity. The report emphasizes that this diversity reinforces the sector’s role in supporting income stability and absorbing economic shocks.

To strengthen the sector’s contribution to long-term growth, the World Bank recommends expanding social protection programs for low-income enterprise owners, offering targeted productivity support for viable firms, and making it easier for high-performing informal businesses to formalize. Suggested measures include lowering registration costs, increasing access to digital services, and providing clearer incentives for formal participation in the economy.

Policy Priorities Ahead

The Cambodia Economic Update, issued twice yearly, provides a detailed assessment of economic performance and policy challenges. This edition reiterates that while the Kingdom retains significant strengths, a coordinated policy response will be needed to support households, maintain investor confidence, and position the economy for recovery once current shocks subside.