Cambodia Investment Review

Cambodia’s industrial sector is showing renewed momentum heading into 2026, with rising investor confidence, expanding infrastructure, and strong trade activity despite ongoing external pressures. According to CBRE’s latest Industrial Outlook: Emerging Trends and Opportunities in the APAC Context, the country’s manufacturing and logistics landscape is evolving rapidly, supported by policy reforms, competitive land costs, and growing regional connectivity.

Construction and Industrial Activity Rebound

After a subdued period marked by external shocks and border tensions, construction activity in Cambodia has begun to rebound—particularly in residential and industrial projects. Developers are responding to stronger demand for logistics, warehousing, and manufacturing facilities as production relocations from China and Vietnam continue to reshape regional supply chains.

Read More: CBRE Cambodia’s Phnom Penh Mid-Year Review 2025 Report

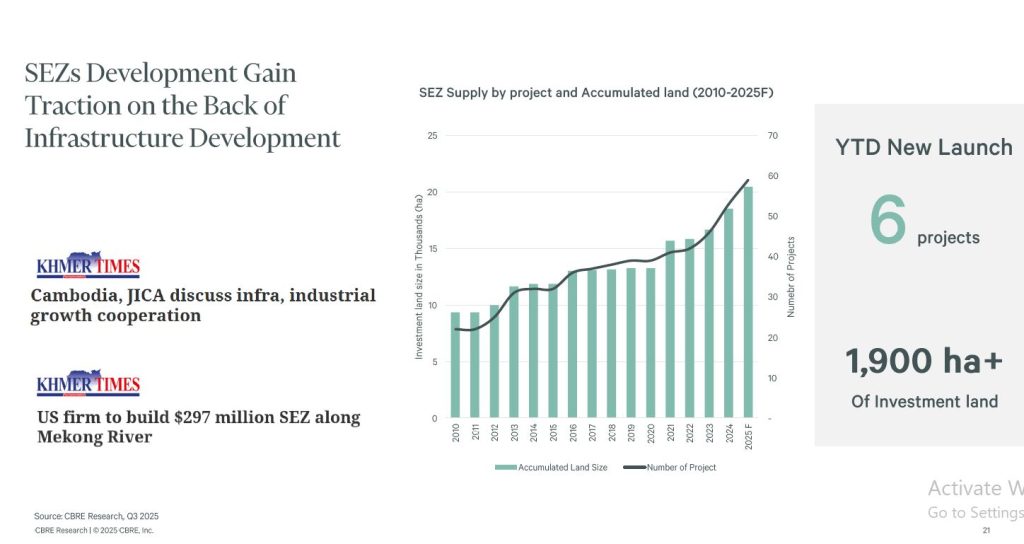

CBRE notes that special economic zones (SEZs) are playing a pivotal role in this expansion, with several large-scale developments gaining traction across provinces such as Sihanoukville and Kandal. The recently announced $297 million U.S.-funded SEZ along the Mekong River underscores growing international interest in Cambodia’s strategic manufacturing base.

Industrial property prices remain among the most competitive in the region, attracting both new entrants and expansions from established players. The government’s continued investment in infrastructure—including road, port, and air connectivity—is further enhancing accessibility and cost-efficiency for manufacturers.

Expanding Trade Connectivity and FTAs

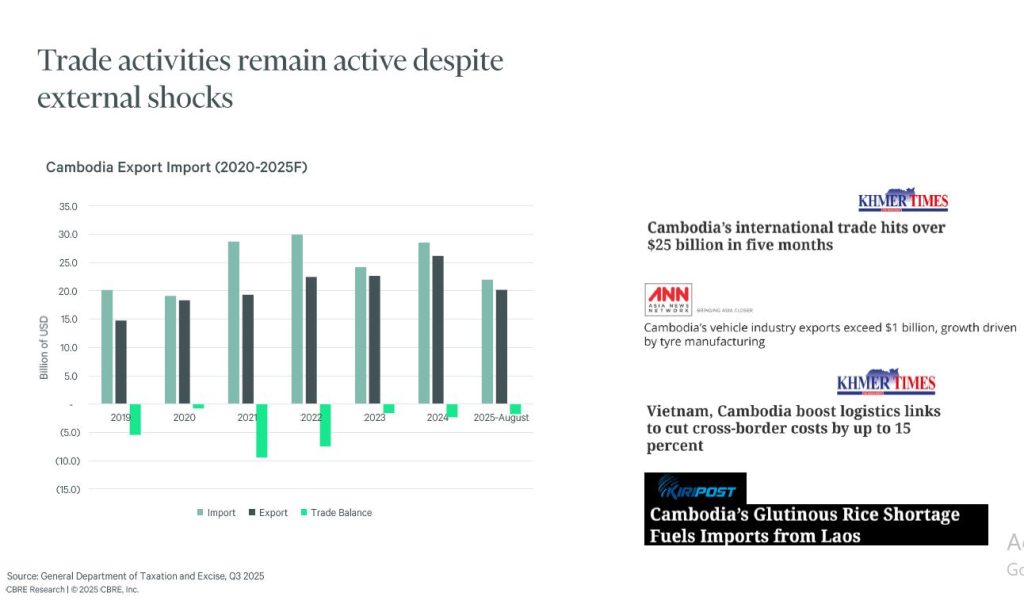

Cambodia’s trade sector remains resilient despite the lingering effects of global supply chain disruptions. The country has sustained positive export activity, leveraging its network of free trade agreements (FTAs) with China, South Korea, and the Regional Comprehensive Economic Partnership (RCEP).

Sea transport continues to dominate trade flows, with deep-sea port expansion projects in Sihanoukville identified as a key driver of competitiveness. Air and waterway connectivity improvements are also broadening the country’s logistics landscape, positioning it as a potential hub within mainland Southeast Asia.

Recent discussions between the Cambodian government and the Japan International Cooperation Agency (JICA) highlight renewed collaboration on infrastructure and industrial growth. These developments are expected to help bridge the gap between Cambodia’s raw-material exports and its ambitions to move toward higher-value production.

Labor, Policy, and Investment Opportunities

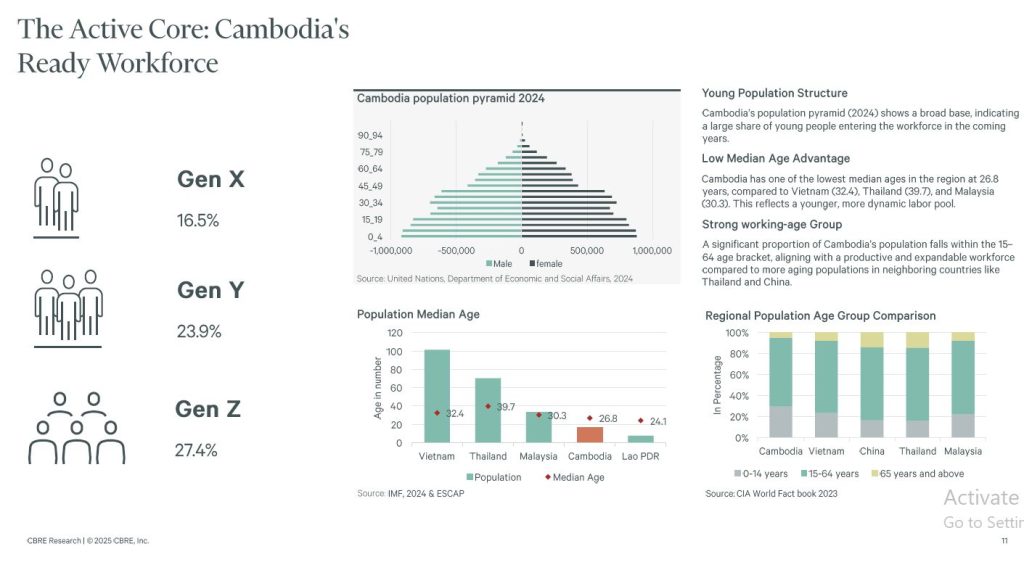

CBRE highlights the country’s “ready workforce” as a core enabler of industrial growth. However, aligning workforce skills with the demands of modern manufacturing remains a challenge. The report underscores the need for vocational training and digital upskilling to sustain competitiveness in sectors such as electronics assembly, automotive components, and agro-processing.

The Sub-Decree on the Implementation of the Law on Investment (LOI) has clarified investment incentives and streamlined procedures for foreign investors—an important step in improving regulatory transparency and attracting more sophisticated manufacturing operations.

Emerging opportunities have been identified in upstream industries, agro-processing, automotive and electronics assembly, furniture manufacturing, and logistics and warehousing. Cambodia’s strategic location between major Asian markets, combined with competitive labor costs and improved governance, provides a compelling case for long-term industrial investment.

Outlook: Balancing Growth and Global Uncertainty

While CBRE expects Cambodia’s industrial sector to continue expanding, the outlook remains sensitive to global trade dynamics—particularly evolving tariff policies from major markets such as the United States. Still, the country’s steady integration into regional production networks and continued infrastructure development are likely to sustain growth over the medium term.

With GDP per capita projected to exceed $2,700 in 2025, and robust FDI inflows into manufacturing and logistics, Cambodia’s industrial base is entering a new phase of diversification and resilience. As CBRE concludes, bridging the skills gap, strengthening infrastructure, and maintaining competitive investment conditions will be key to realizing the nation’s industrial ambitions in the decade ahead.