Cambodia Investment Review

Siem Reap’s real estate market remains in a fragile recovery phase as buyer sentiment softens, liquidity tightens, and the city continues to rely heavily on tourism inflows, according to a market review presented by CBRE Cambodia at the “Real Estate Landscape & Investment Opportunities” forum.

The event, held at Rose Apple Square Auditorium in Siem Reap and moderated by CBRE Cambodia Managing Director Kinkesa Kim, featured panelists Ty Chea of ULS Cambodia, Mario Tan of Hunter Group, and Kimsea Chea of CBRE Cambodia. Discussions highlighted the risks facing Siem Reap’s economy but also pointed to emerging opportunities linked to infrastructure and diversification.

Read More: CBRE Cambodia’s Phnom Penh Mid-Year Review 2025 Report

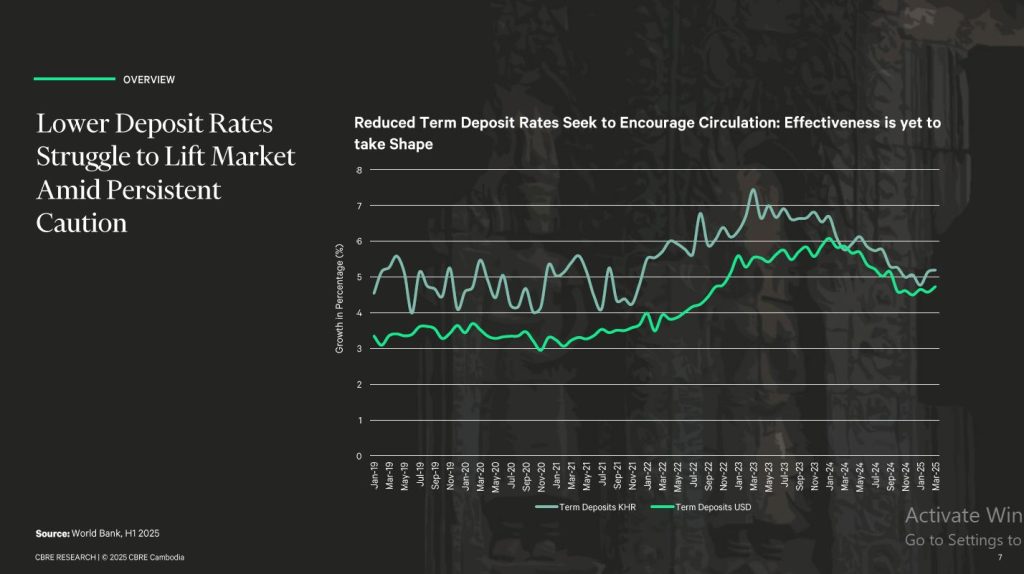

Cautious Buyer Sentiment and Rising Deposits

CBRE’s research noted that market liquidity in Siem Reap is being squeezed as deposit growth at Cambodian banks outpaces new property investments. Many buyers remain cautious, preferring to keep funds in savings rather than commit to long-term real estate projects.

“Buyer sentiment is very different to Phnom Penh. Here, people are waiting for a stronger recovery in tourism and infrastructure before they commit,” said CBRE’s Kimsea Chea, Manager of Research and Consulting Services.

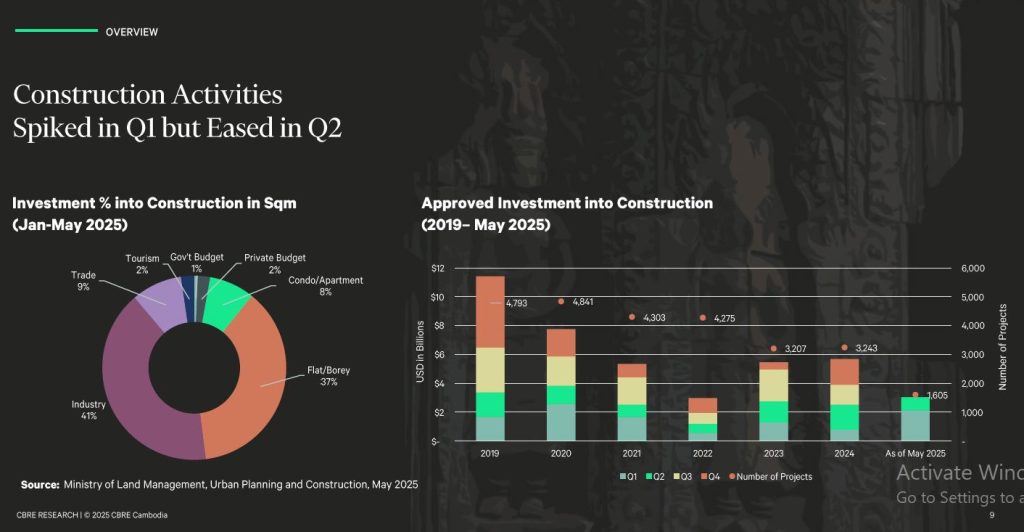

Construction Activity Slows After Q1 Surge

The review showed that while construction activity spiked in the first quarter of 2025, momentum weakened in the second quarter. Developers are increasingly selective, delaying projects until demand stabilizes. This uneven trend reflects investor hesitancy amid broader economic uncertainty and slower-than-expected tourism growth.

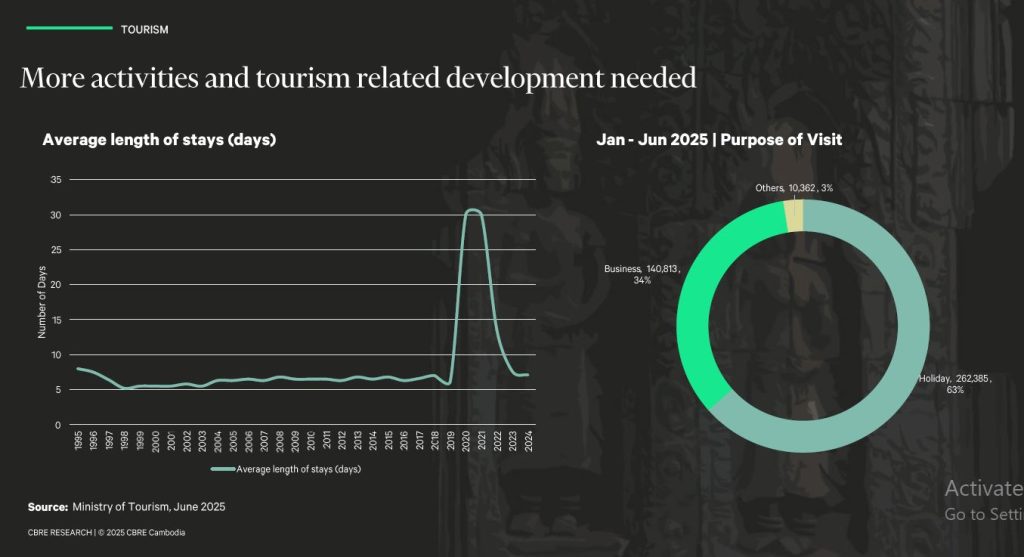

Tourism as the Backbone

Tourism remains central to Siem Reap’s economic prospects. International arrivals have returned but growth remains uneven, with the recent Cambodia-Thailand border conflict expected to dampen Angkor Wat ticket sales. This underscores the vulnerability of Siem Reap’s economy to external shocks.

Panelists agreed that while hospitality and retail remain key sectors, overreliance on international arrivals poses risks. “We need to see more diverse tourism-related developments that can capture both domestic and regional demand,” said ULS Cambodia’s Ty Chea.

Need for Diversification Beyond Tourism

CBRE’s analysis stressed that Siem Reap’s growth is too narrowly tied to tourism revenues. Beyond hotels and retail, the city has potential to develop education, healthcare, and small-scale industrial assets. These could help build resilience and broaden the local economic base.

Hunter Group’s CEO Mario Tan emphasized the long-term importance of mixed-use and lifestyle projects that can appeal to both locals and domestic visitors. “There’s a need to create reasons for people to stay longer and spend more, not just rely on heritage sites,” he noted.

International Flights Still Below Pre-Pandemic Levels

International connectivity remains a challenge. Flight volumes to Siem Reap are below pre-pandemic benchmarks, slowing recovery in international visitor numbers. This has limited hotel occupancy rates and delayed new pipeline projects.

Industry stakeholders are closely monitoring the return of carriers and routes, but panelists acknowledged that rebuilding capacity will take time, particularly given regional competition for tourists.

Phnom Penh–Siem Reap Expressway

A central theme of the forum was the potential impact of the new Phnom Penh–Siem Reap expressway, which is expected to cut travel time significantly. The expressway is seen as a key driver for domestic tourism, making weekend travel more accessible and increasing demand for hospitality, retail, and entertainment venues.

Panelists agreed that the infrastructure project could reshape demand patterns, but its full impact will depend on supporting developments such as rest areas, entertainment clusters, and tourism promotion campaigns.

Angkor Ticket Sales Under Pressure

CBRE reported that Angkor ticket revenues are expected to soften following the border conflict, adding to concerns about Siem Reap’s dependency on heritage tourism. Declining revenues could limit reinvestment into cultural preservation and related infrastructure, with knock-on effects for the real estate market.

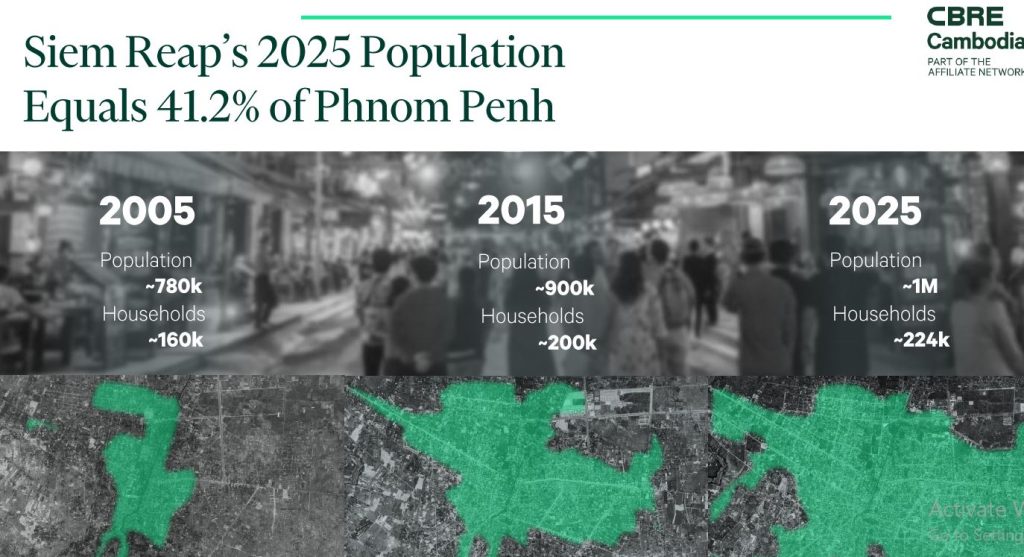

Population and Regional Hub Status

Siem Reap’s population now equals 41.2% of Phnom Penh’s, reinforcing its position as Cambodia’s second economic hub. This demographic weight creates long-term demand for residential, retail, and community developments, but panelists stressed that the city must be positioned as more than just a tourist destination.

Key Opportunities Identified

CBRE outlined several areas of opportunity for investors and developers:

- Tourism-related development: Targeting both international and domestic segments with diversified hospitality offerings.

- Infrastructure-linked projects: Leveraging the expressway to develop roadside retail, logistics hubs, and entertainment clusters.

- Education and healthcare: Addressing gaps in private schooling and medical facilities for a growing middle class.

- Small-scale industrial: Exploring light manufacturing and supply chain facilities that could serve both Siem Reap and surrounding provinces.

Outlook

The near-term outlook for Siem Reap remains subdued as investor caution and uneven tourism recovery weigh on sentiment. However, infrastructure projects and demographic fundamentals suggest longer-term opportunities for those willing to look beyond traditional tourism assets.

As CBRE Cambodia’s forum concluded, the message was clear: Siem Reap’s future depends on diversification, stronger infrastructure, and the ability to reimagine its real estate landscape as more than just the gateway to Angkor Wat.