Harrison White

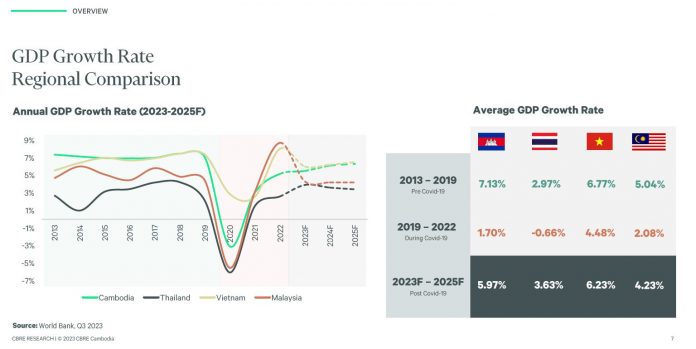

CBRE Cambodia’s recently released third-quarter review for 2023 paints a complex picture of Phnom Penh’s property market, revealing both opportunities and challenges. Lawrence Lennon, Country Director of CBRE Cambodia, kicked off the review with positive economic forecasts. “Cambodia is on track for a healthy growth rate in 2023, expected to be around 5.3% to over 6% in 2024, a robust performance in comparison to other economies, Lennon stated.

Lennon highlighted not just the increased office occupancy rates, particularly in grade A spaces, but also the stabilization of office rental rates in the sector. He emphasized the importance of customer knowledge and targeted marketing for landlords, saying, “It’s crucial for landlords to Know Their Customer and market effectively to fill up spaces.”

Lennon also touched upon the broader economic landscape, noting that ongoing issues in China’s real estate market are creating ripple effects, especially concerning Foreign Direct Investments (FDI) into Cambodia. “China’s real estate challenges are flowing down and affecting FDI into Cambodia. This coupled with the U.S. and Europe’s declining purchases of Cambodian exports is impacting disposable income here, and in turn affecting our tourism and manufacturing sectors,” he elaborated.

The Country Director spoke positively about the political transition in Cambodia, stating that the smooth transition to Prime Minister Hun Manet has been encouraging for the investment climate. “Many investors are excited about the new policies expected to come with this transition, as they could drive growth over the short and mid-term,” he said. According to Lennon, these policies could offset some of the economic headwinds Cambodia is currently facing.

Finally, Lennon addressed some of the current uncertainties surrounding the delayed implementation of the Capital Gains Tax. “The situation sends mixed signals to the market,” he cautioned. But he pointed to ongoing infrastructure projects as a bright spot for Cambodia’s economic outlook. “We’re looking at $30 billion in infrastructure investments in the coming years. The completion of significant projects like new airports and major highways will boost the economy. Particularly, the Koh Pich to Koh Norea bridge is expected to open up many new locations,” he concluded.

Phnom Penh Office Sector Sees Stabilization and Emerging Trends

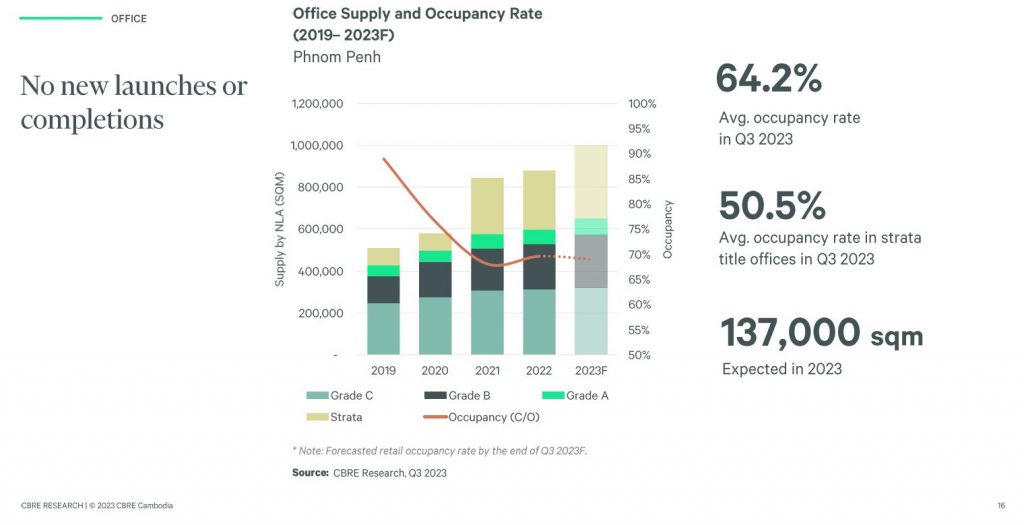

Daluch China, CBRE Senior Manager of Valuation & Advisory Services, offered an insightful view into the office segment in Phnom Penh. “For the first time in the last seven years, we have not seen any new launches or completions this quarter,” she said. According to Daluch, this is actually a positive development. “The pause has allowed the market’s occupancy rates to catch up. We are currently at an average occupancy rate of 64.2%,” she explained. This market recalibration has also prompted landlords to reduce prices to increase occupancy, she noted.`

Looking ahead, CBRE provided projections on office supply. “By the end of the year, we are forecasting that office supply in Phnom Penh will reach around one million square meters,” she said. The Senior Manager also observed a stabilization in rental rates, stating, “We’re seeing rates stabilize at around $26 per square meter for grade A offices, $22 for grade B, and under $15 for grade C offices.”

Daluch outlined three key market trends affecting the office landscape. “Firstly, the flight to quality continues,” she said. “As rents continue to contract, tenants are taking the opportunity to upgrade to better office spaces.” Secondly, she noticed a move towards more formal office spaces. “Affordable rates and professional property management services are motivating businesses to move into formal office settings,” she elaborated.

Lastly, she touched upon the growing significance of health, safety, and environmental, social, and governance (ESG) requirements. “Compliance with ESG requirements is no longer optional but is fast becoming the norm. This is especially crucial for attracting big international clients who require these standards to be met,” she concluded.

A Period of Reevaluation for Phnom Penh’s Retail Sector

In a detailed assessment of the retail landscape, Daluch pointed out another unique development. “We haven’t seen any new launches or completions in the retail sector for Q3 2023. This is a first in around five years,” she revealed. Daluch interpreted this pause as a positive development for the retail market, as it “allows for market supply to catch up.”

Despite the halt in new projects, the sector is not without challenges. “Occupancy rates in the retail sector continue to slide, now hovering at around 68%,” said Daluch. The trend could be attributed to a number of factors, including reduced disposable income among consumers. “Given these conditions, we anticipate further delays in project completions,” she added. Meanwhile, average quoting rents have slowed, with rates around $26 for prime shopping areas and under $20 for community malls.

CBRE also noted significant movements among retail brands. “In this quarter, there have been 29 new brand expansions, predominantly led by the F&B sector, and 24 branch closures,” she highlighted. According to her, these changes align with three key trends affecting the retail sector. “Firstly, landlords are investing more in frequent marketing activities to increase footfall,” she pointed out. Secondly, the trend shows a “slowdown in brand expansion as retailers, facing lower sales revenues, are becoming increasingly cautious.”

She then touched upon the continued delays in new retail projects. “Construction for half of the retail supply planned for 2023 has been delayed, due to increased market competition and slow leasing,” China concluded. The overview paints a picture of a sector in transition, cautiously navigating market complexities while seeking sustainable growth paths.

Phnom Penh’s Condominium Sector Navigates Market Changes

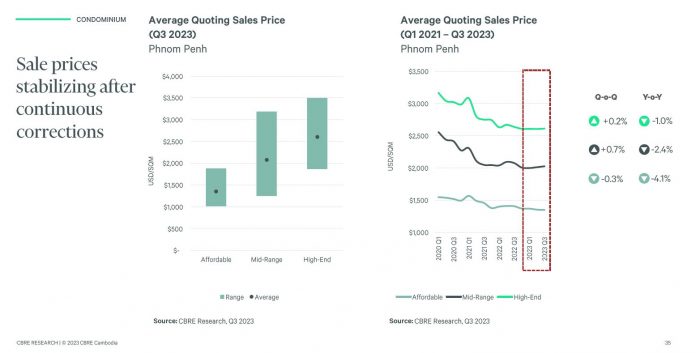

Kinkesa Kim, an expert on the condominium sector at CBRE, kicked off her segment by pointing out the apparent slowdown in new projects this year. “We’ve seen only one new launch, Times Square 6, and the completion of Prince Huan Yu Center in Q3 2023,” she said. Kim was quick to add that this isn’t necessarily an indicator of trouble. “Contrary to what you might think, the slowdown in launches, especially compared to the 2018-2021 period, is not a bad sign. It allows the market to absorb the existing supply.”

The industry appears to be on track with regard to completions. “With 120+ projects and a total of 60,000 units, we are maintaining a robust portfolio in Phnom Penh,” Kim mentioned. This stabilization seems to have had an impact on pricing as well. “We’re observing stabilized prices across the board: high-end condominiums at $2,700 per sqm, mid-range at $2,200, and affordable categories just under $1,500,” she elaborated. However, Kim admitted that this stabilization has been challenging for developers, who have faced reduced year-on-year prices since 2021.

Identifying market trends, Kim noted two particular shifts. “Developers are increasingly focusing on affordability, targeting more local buyers,” she said. “We’re also seeing opportunistic investors eyeing bulk purchases, carefully considering stock and secondary sales.” According to Kim, these trends could significantly shape the condo market in the upcoming quarters.

Kim’s insights reveal a Phnom Penh condominium market that is adjusting to new economic realities while maintaining a cautious optimism. The industry is pivoting toward more sustainable growth by adapting to shifts in demand, thereby creating a more balanced market in the long term.

Landed Property Market Faces Continues Slowdown and Price Corrections

Discussing the state of the landed property sector, an expert at CBRE noted several significant shifts this quarter. “In Q3 2023, we’ve had 3 new launches and 7 completions. Notably, these are predominantly in the high-end segment, with little activity in the affordable segment,” she said. According to her, this skew towards high-end properties could be linked to the ongoing financial pressures affecting the lower-income brackets.

A slow pace in project completions was another point of interest. “There has been a 50% slowdown in expected completions this quarter,” she pointed out. “This can mostly be attributed to the horizontal nature of the design style, which typically requires more time than the vertical styles found in condominiums, and the recent slowdown in sales.”

The market is also experiencing pricing corrections due to mismatched demand and supply. “We’re seeing average quoting sales between $800 and $1,200, a significant drop of around 15% compared to 2021,” she stated. “This is likely due to a combination of strong supply growth in the past few years and a current large slowdown in demand.”

Emerging trends in the landed property market indicate shifts in marketing and risk factors. “We’re noticing more community events at boreys to drive public exposure and keep residents engaged, which is critical for word-of-mouth referrals,” she commented. “On the flip side, liquidity risks are becoming a major concern as market demand weakens and cash flows begin to dry up.” These trends suggest that the landed property market is in a period of adjustment, reacting to broader economic pressures while looking for ways to sustain interest and investment.