Kosal Nith

Only 15 percent of Cambodia’s total workforce, or 1.2 million workers, are employed in the formal sector and thus required to pay monthly salary tax through their employers.

Meanwhile, 85 percent or roughly 7.2 million workers in the informal sector do not pay any direct taxes. It is unfair that those who work and pay taxes receive the same benefits from public goods as those who do not pay taxes.

This system ultimately undermines and weakens Cambodia’s ability to invest in public goods.

The salary tax in Cambodia has been in place since at least the mid-1990s. It iscommon practice worldwide due to its simplicity and feasibility for the tax authority to enforce by collecting revenue from the secondary agency that acts as the employer, with a well-established internal system to record the payroll of each employee’s income.

By 2004, the salary tax was extended to cover both Cambodian and foreign-source salaries, with progressive tax brackets ranging from 0 to 20 percent and defined exemptions and deductions.

But collecting tax from informal sector workers is difficult because their income is often irregular, undocumented or cash-based.

If we continue with the current system, informal employers must register so they can handle payroll tax for their workers. Yet this approach is ineffective because the informal sector is vulnerable. Registration creates additional barriers, forcing entrepreneurs to comply with various tax obligations.

Personal income tax is a tool for fair revenue collection

With a personal income tax (PIT) system, the government can better collect taxes from individuals who are not employed in the formal sector. Instead of disproportionately burdening Cambodians who do pay tax, this system ensures fair tax collection from all eligible individuals.

And through legal enforcement, the system ensures everyone contributes fairly to national development according to their income.

PIT provides a useful model of tax collection in this era of economic complexity and e-commerce. Within the current system, the salary tax is applied only to income earned from employment, such as wages, salaries, and bonuses.

However, PIT is a tax applied to all types of an individual’s income, including salary, business earning, rental income, and investment income. Everyone residing in the country, both nationals and foreigners, has an equal obligation to pay tax, with exemptions for children, dependents, and retired persons who are unable to generate income.

Key considerations in personal income tax

Cambodia must transform the salary tax into a comprehensive PIT that ensures fair contributions from everyone. First, the General Department of Taxation (GDT) should establish a tax registration system.

This registration does not require creating a new working group because existing data from the Ministry of Interior can be shared, using the national identification card number as the taxpayer identification number (TIN).

For newborns, parents should register their child’s birth certificate at the commune level. Upon registration, the child would receive a TIN, also serving as a social security number. This number would remain the same as the national ID issued when the child turns 15 to 18 and obtains an official ID card.

All eligible individuals must pay tax if their income exceeds the exemption threshold, for example, below $300 per month. Tax can be collected monthly, quarterly, or annually based on income patterns. Formal sector employees with stable monthly income pay tax monthly through their employer and file an annual income statement to report additional earnings or transfers.

Self-employed and informal workers may pay tax quarterly or annually. For instance, a single man with no spouse and no dependents who earned $10,000 would pay tax at 10 percent without any deductions.

Taxpayers must accurately report their income using forms developed by the GDT and submit them online or on paper. The GDT team is responsible for guiding taxpayers on the correct forms and required documents, providing instructions through social media or training — especially for those unfamiliar with digital or paper submissions.

To implement this system, the government can start with selecting urban economic actors, focusing on the top 20 percent of earners, influencers, online sellers, and freelancers. For example, e-businesses — roughly about 10–15 percent ofurban informal workers — earn an average of $640 monthly. Taxing this income could generate approximately $3.2 million per month for the government.

For vulnerable sectors, like street vendors and small farmers, tax collection is not necessary now due to high administrative costs and many falling below the tax threshold. The government may consider applying PIT nationwide within the next five years, once the system is firmly established.

Implementation cost of the personal income tax

In order to implement this new tax system, the government will need to expand its administrative and IT investment. Upfront costs include technical staff, IT infrastructure, training, taxpayer registration, online filing, audits, and taxpayer services.International benchmarks show that mature PIT administration costs range from 0.5 percent to 1.5 percent of PIT revenue annually, but can reach 3 percent to 5 percent during early start-up years due to the investment in the system and operation.

Source: The author’s calculations are based on Cambodia’s nominal GDP in 2024 (US$46.35 billion) and international benchmarks for personal income tax administration costs in developing countries, which typically range from 0.5percent to 1.5percent of PIT revenue annually.

In Cambodia, due to the high informality and need to build new capacity, early administrative costs could be $5 to $15 million per year, plus $10 to $20 million for IT and staffing over 3 to 5 years. Based on GDP in 2024 and PIT revenue scenarios between 0.4percent to 1.8 percent of GDP, scenario 1 projects average net revenue of $332.6 million with $10.4 million in costs over five years, while scenario 3 forecasts $616.6 million in revenue with $23 million in costs.

Taxpayers will also be required to investtime and money in PIT compliance. Individuals without employer withholding may spend 5 to 10 hours annually filing, while formal employers face compliance costs of $50 to $200 per employee per year, requiring 30 to 100 hours annually for complex payrolls.

Enforce personal income tax through legal means

To implement this PIT effectively, strong law enforcement is crucial. The GDT’sDepartment of Tax Crime Investigation needs a technical team to review records, analyze income patterns, and investigate discrepancies. If inconsistencies are found, authorities can summon the individuals for clarification or pursue legal action.

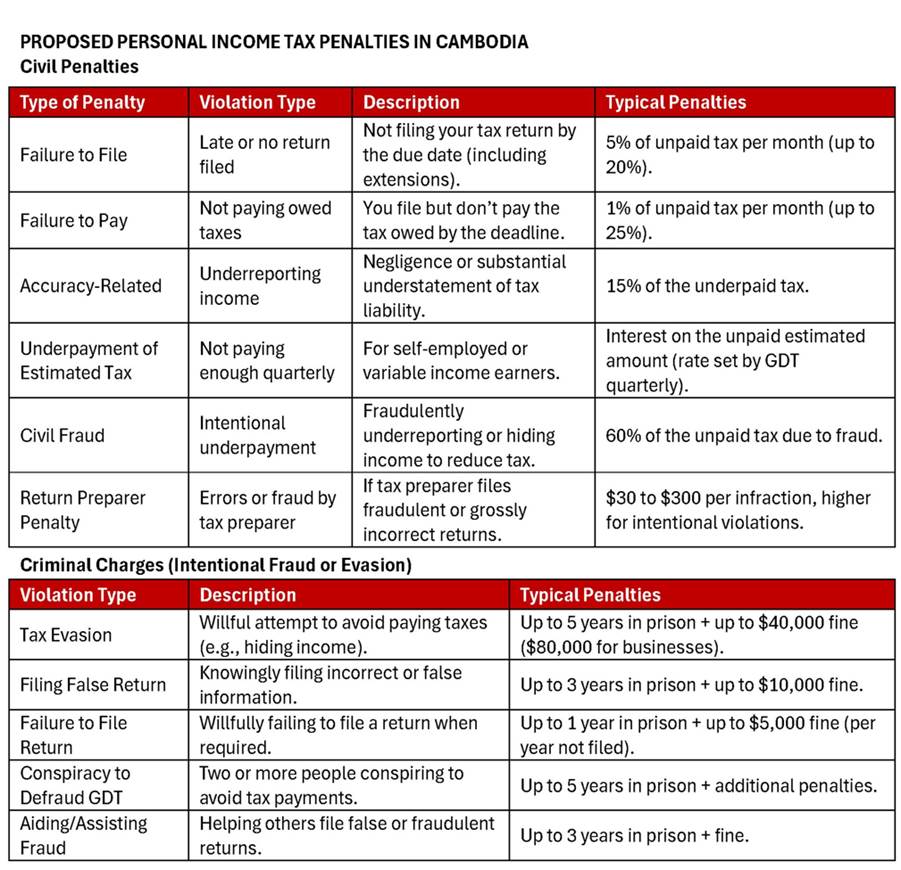

Penalties can be implemented in two forms: civil and criminal. Civil penalties apply to late or missing tax filings, unpaid taxes, substantial misstatements, income under-reporting, or errors by tax preparers. Penalties are charged at rates and interest set by the GDT. For example, Cambodia can consider the proposed rates below, calculated based on a review of global developing and developed economies.

Criminal charges apply to intentional fraud or tax evasion, with penalties higher than civil ones. Tax evasion includes wilfully avoiding taxes, submitting false information, failing to file returns, or assisting others in fraud. Offenders may face prison terms of 1 to 5 years and substantial fines, depending on the case.

There should be no exceptions for anyone who fails to comply with tax laws, whether unintentionally or intentionally. Cambodia must leverage law enforcement to build a moral society and a culture of compliance, where high penalties encourage respect for the law. For instance, if someone underpays $2,000 of a $4,000 tax bill and is caught, they will owe an additional $3,200 plus interest and fees if we follow the suggested rate in the table. In serious cases like falsifying income or documents, imprisonment is warranted. One prison case can deter thousands, so the government should widely promote enforcement efforts.

Implementing personal income tax involves costs, challenges, and requires public trust, but its benefits outweigh these concerns. Cambodia needs to transform the current salary income tax system into a comprehensive personal income tax that ensures fair tax collection for all and relies on law enforcement and public education to promote accurate compliance. And importantly, this new type of tax will generate significant revenue for public investment that promotes the well-being of all Cambodians.

Kosal Nith is a Research Fellow at Future Forum, a public policy think tank based in Phnom Penh. This article was written as part of the Future Forum’s Inclusive Policy Fellowship, an endeavour supported by the Australian Government through The Asia Foundation’s Ponlok Chomnes II: Data and Dialogue for Development in Cambodia.