Cambodia Investment Review

Myanmar’s tourism sector is showing early signs of recovery in 2025, according to new analysis from the ASEAN+3 Macroeconomic Research Office (AMRO), but structural challenges continue to weigh on the country’s ability to regain its pre-pandemic growth trajectory.

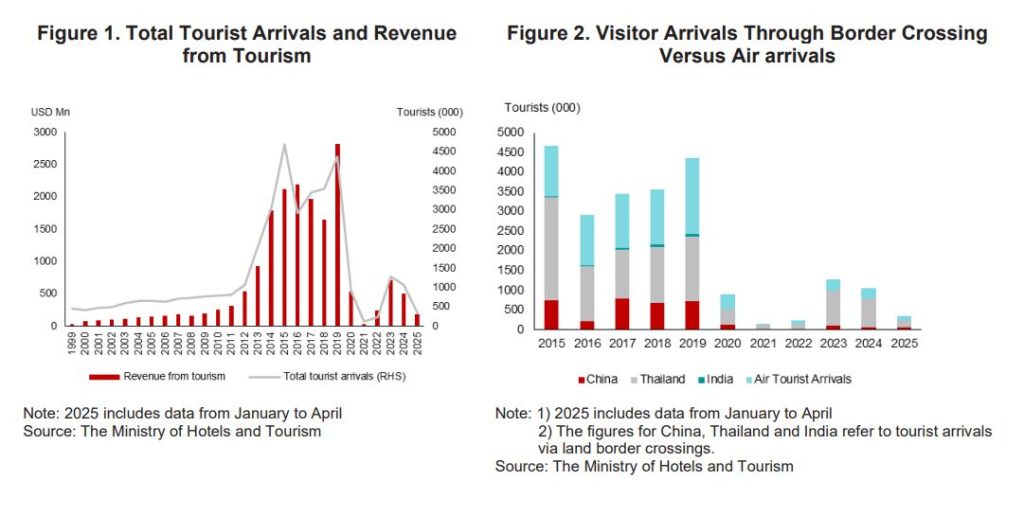

Tourist arrivals, which peaked at 4.7 million in 2015 after a wave of economic reforms and foreign investment, collapsed to just 130,000 in 2021 at the height of COVID-19 travel restrictions. Borders reopened in April 2022 and visitor numbers improved to about 1 million by the end of 2023—still well below pre-pandemic levels.

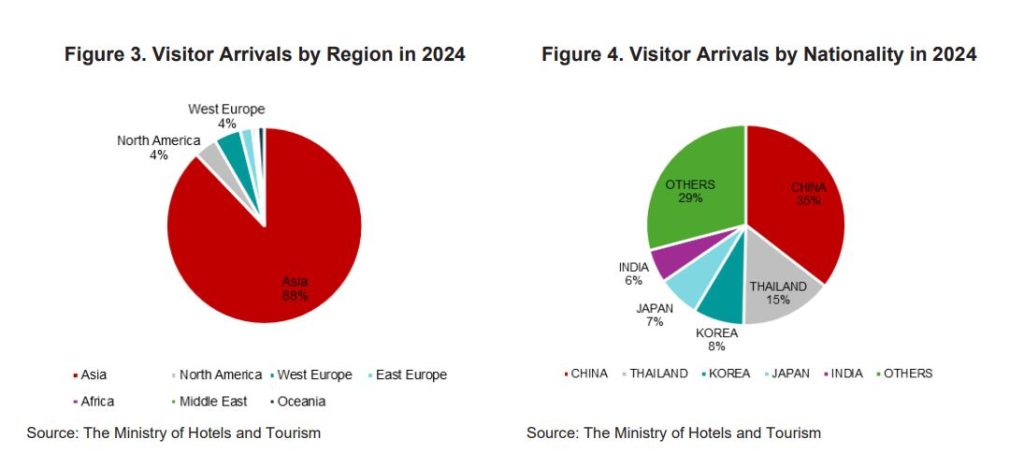

The surge in recent arrivals has been driven overwhelmingly by land border crossings, particularly from Thailand. In 2024, nearly 70 percent of visitors entered via land checkpoints, with Thai nationals accounting for almost 90 percent of those arrivals. Air travel continues to lag, constrained by limited international flight capacity.

Domestic Policy Push Aims to Rebuild Market Confidence

The government has stepped up measures to bring tourists back, including easing visa requirements and restoring digital entry systems. Myanmar now offers visa-free entry for short-stay tourists from eight Asian countries and has reactivated its e-visa program, enabling single-entry visas through designated airports and border crossings.

A broader tourism recovery strategy extends through 2025 and focuses on:

- promoting domestic tourism,

- developing new attractions,

- launching targeted marketing campaigns,

- piloting travel “bubbles” with selected neighbors.

Authorities have also rolled out “Enchanting Myanmar Health and Safety Protocols” certification for hotels and service providers to provide reassurance on hygiene standards in the post-pandemic era.

Air Connectivity and Energy Shortages Emerge as Major Bottlenecks

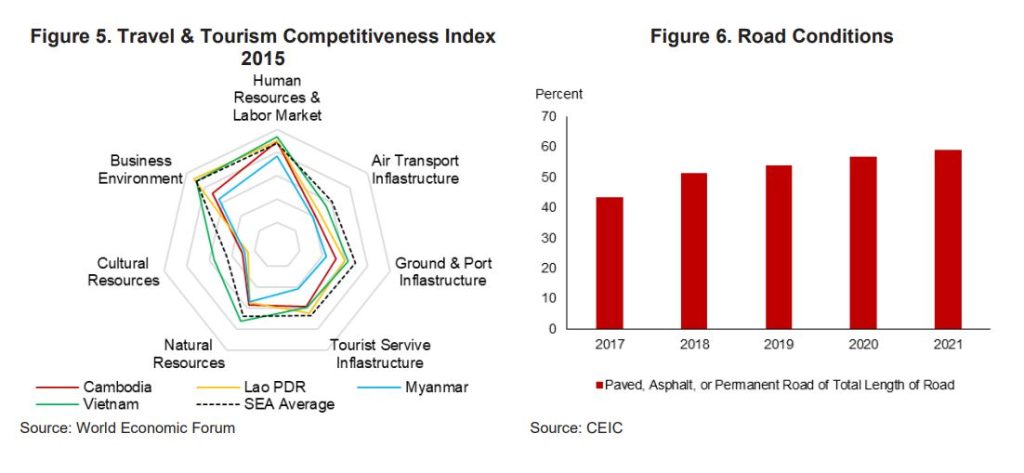

Limited flight access remains one of the biggest constraints on recovery. As of August 2025, Myanmar had just 19 direct international flight routes across 10 countries—far fewer than regional competitors like Thailand and Vietnam. Industry operators warn that without expanded routes, long-haul tourist demand may struggle to return.

Infrastructure constraints are also weighing on the sector. Power reliability has dropped sharply in recent years, with many regions experiencing scheduled blackouts lasting up to eight hours at a time. Hotels, restaurants and tourism facilities face operational disruptions, while road conditions continue to hamper travel to key attractions outside major cities. Only about 60 percent of national roads are paved or permanent.

Employment Recovery Slow as Businesses Rebuild Capacity

Tourism’s collapse during COVID-19 caused widespread shutdowns and job losses across hotels, restaurants and transport services. According to labor research, 94 percent of hotel and restaurant businesses suspended operations during the peak of the pandemic. The prolonged downturn has left service providers short on skilled labor, complicating efforts to scale back up as visitor demand increases.

Before 2020, tourism contributed nearly USD 5.1 billion to GDP—or about 8 percent—while supporting more than a million jobs across hospitality, transport and local supply chains. Restoring that level of output will likely hinge on both tourism demand and investor confidence in the broader business environment.

Industry Outlook: High Potential, High Risk

Market analysts say Myanmar’s long-term tourism fundamentals remain attractive—rich cultural heritage, unspoiled natural landscapes and growing popularity of responsible tourism. But structural barriers must be addressed before the industry can return to its pre-pandemic trajectory.

Priority areas highlighted by policymakers and industry players include:

- expanding international air routes,

- developing energy and road infrastructure,

- ensuring the safety of travelers through clear information and regulated travel zones,

- strengthening human capital to improve service quality.

A successful recovery, analysts argue, will require a coordinated approach among government, industry and international partners as Myanmar attempts to restore global confidence and redistribute tourism-driven income to local communities.