Cambodia Investment Review

At the 2025 Annual Conference of the Securities and Exchange Regulator of Cambodia (SERC) held in October, Koh Hao Jie, Chief Executive Officer of BYEX, outlined how blockchain technology could transform Cambodia’s securities market through tokenization—a model he said could make investing faster, fairer, and more inclusive.

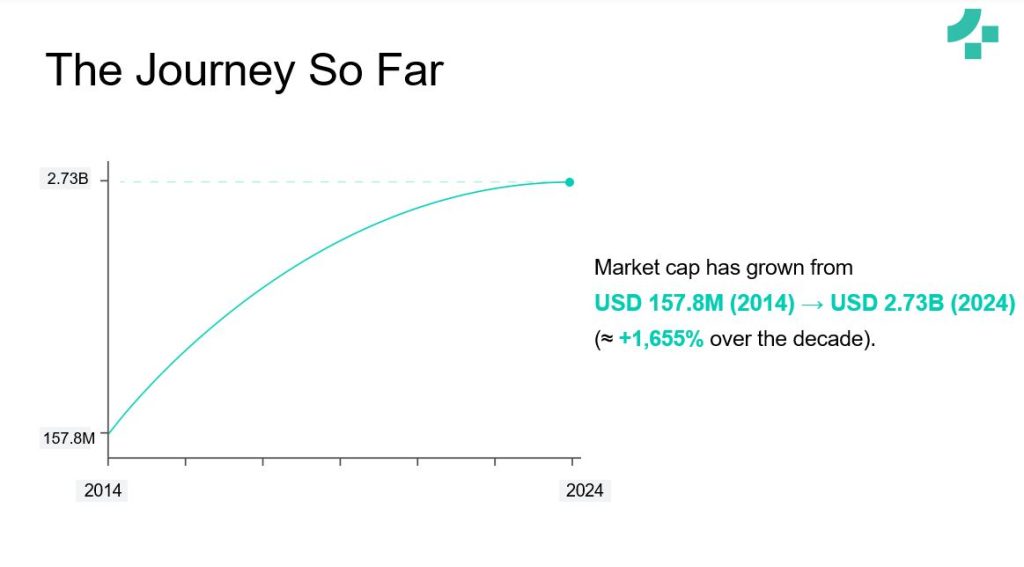

Over the past decade, Cambodia’s capital market has expanded rapidly, with market capitalization rising from USD 157.8 million in 2014 to USD 2.73 billion in 2024, marking an increase of over 1,650%. Koh attributed much of this progress to growing investor participation, new listings, and the collective efforts of regulators and market operators. However, he emphasized that further acceleration would depend on the adoption of digital innovation.

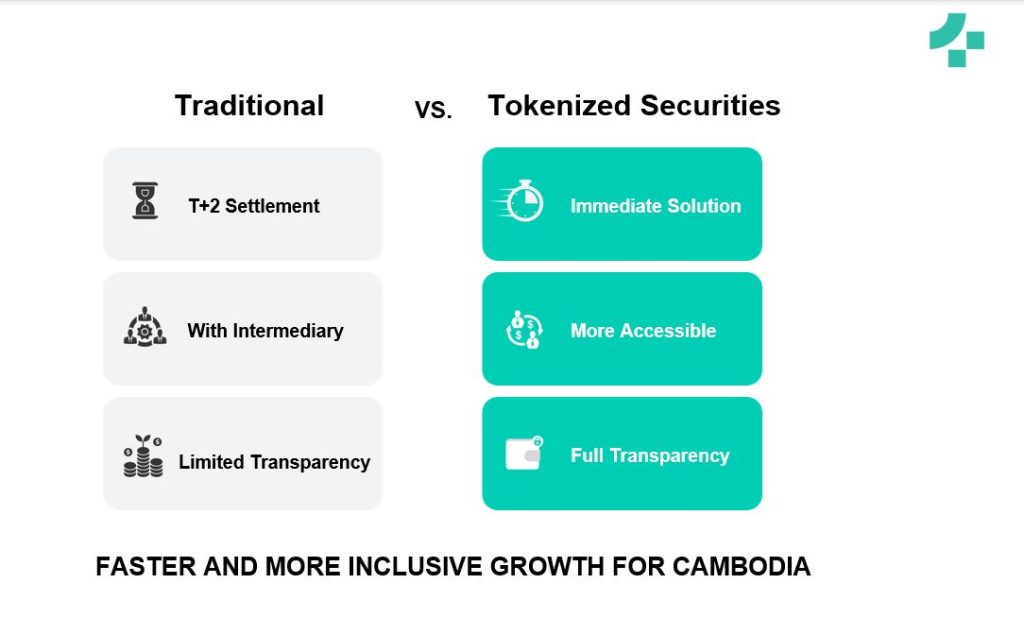

“Tokenized securities enable broader participation and accelerate market growth,” Koh said, noting that blockchain technology offers a “transparent, efficient, and secure” way to represent ownership and manage corporate actions in real time.

Tokenization: From Concept to Catalyst

Explaining the concept of tokenization, Koh described it as the representation of traditional securities as digital tokens on a blockchain ledger, where transactions, ownership transfers, and dividend payments can be tracked automatically. This digital transformation, he argued, will reduce friction in the trading process and make securities investment more accessible—particularly for Cambodia’s growing retail investor base.

Read More: BYEX Strengthens Blockchain Literacy in Cambodia with Knowledge-Sharing Events

He pointed out that tokenization not only strengthens transparency and trust, but also lowers entry barriers for both local and foreign investors. “By leveraging blockchain, Cambodia can leapfrog into a more advanced phase of financial market development,” he said.

Koh also highlighted that the broader regional momentum toward digital asset integration provides a strategic opportunity for Cambodia to align with its ASEAN peers while maintaining local financial integrity and compliance under SERC’s oversight.

A Phased Approach Toward Market Digitization

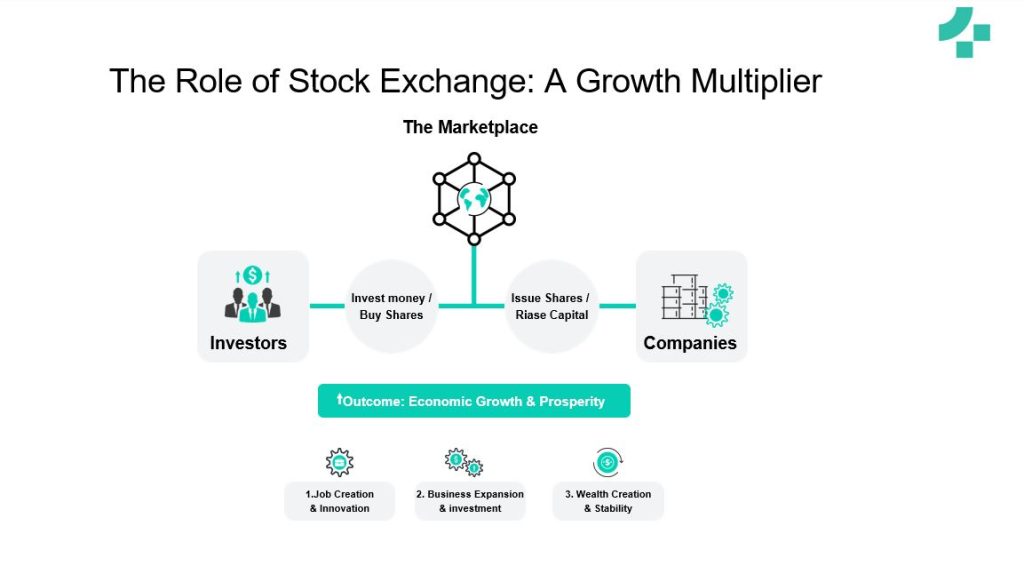

In his remarks, Koh urged regulators, financial institutions, and technology providers to take a phased and collaborative approach to introducing tokenized securities. He outlined a roadmap beginning with pilot programs under regulatory sandboxes, followed by gradual integration with existing exchange infrastructure, and ultimately, a fully digitized ecosystem where blockchain serves as the core ledger for all securities transactions.

“The role of the stock exchange is a growth multiplier,” he said. “Every riel counts, every investor matters. Together, we can build Cambodia’s capital future.”

The BYEX CEO concluded his presentation by reaffirming the company’s commitment to supporting Cambodia’s digital transformation agenda in finance, emphasizing that blockchain is not just a trend—but a tool for sustainable, inclusive growth.

As Cambodia continues its journey toward deeper financial integration and innovation, blockchain-based solutions like tokenized securities could become a cornerstone of its next growth phase—transforming how investors, companies, and regulators engage with the market.

For more information contact BYEX at info@byex.com or website at https://m.byex.com/en_US/