Cambodia Investment Review

According to the Cambodia Real Estate Highlights H1 2025, Knight Frank Cambodia’s flagship bi-annual report – Despite global economic pressures, including tariffs on Cambodian exports from the United States and ongoing trade disputes with Thailand, Cambodia’s real estate sector continued to showcase strength and opportunity.

Ongoing Tensions Weigh Down On Market Sentiment

Ly Hakim, head of research at Knight Frank Cambodia said: “The Cambodian real estate sector recorded its strongest performance during Q1 2025 since the Covid-19 pandemic. However, the optimism was short-lived as the Trump Administration announced heavy trade tariffs for the APAC region in April, including Cambodia. This was further compounded with the closure of the Cambodia-Thailand border in May. Whilst the tariffs and ongoing border tensions will continue to weigh down on market sentiment over the short-term, the medium and long-term fundamentals for Cambodia will offer abundant opportunities across all sectors and markets.”

Economic Overview

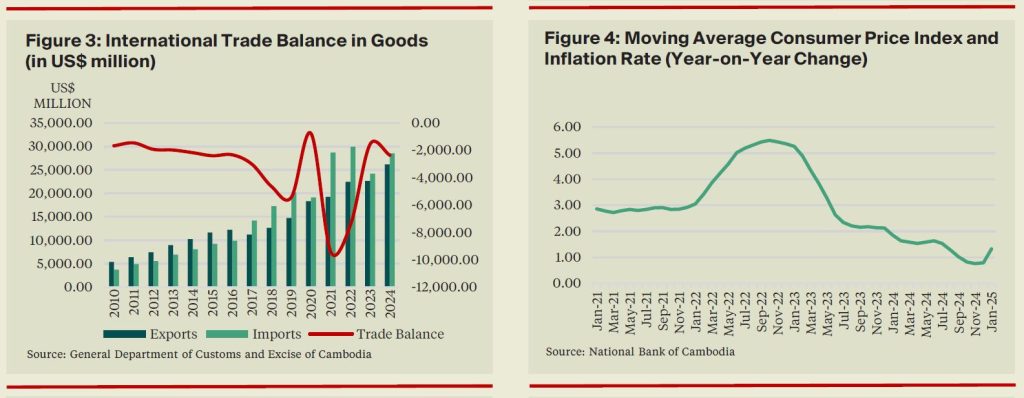

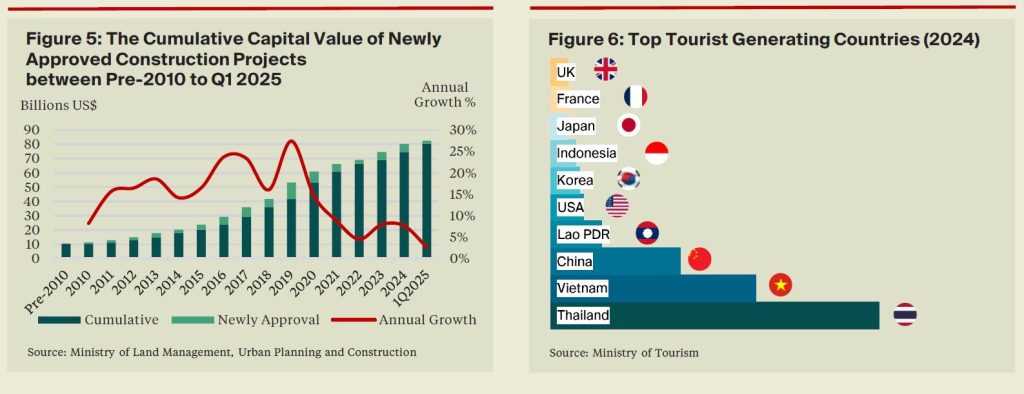

Cambodia’s economy has maintained positive momentum, supported by steady inflows of foreign direct investment, a growing tourism sector, and robust domestic demand. While tariffs and regional trade tensions present near-term challenges, diversification into new markets, infrastructure development, and continued urbanisation underpin long-term growth.

Phnom Penh: A Mixed Market

Phnom Penh remains the country’s economic hub and new construction projects continue to launch. In the first half of 2025, the city saw resilience in condominium sales following the highest first quarter sales right since Covid-19 recorded in H2 2024. Industrial activity also saw a notable uptick despite Trump’s tariffs announced in April.

On the flip side, the commercial sectors continued to face challenges, with vacancies increasing across office and retail. With the closure of the Cambodia-Thailand border, the hotel sector also recorded weak results during H1 2025 and full year performance is expected to be significantly below initial market projections. Cambodia’s Real Estate Sector Demonstrates Resilience Amid Global Headwinds but the Outlook for H2 2025 Worsens Page 2

Read More: Knight Frank Report: Cambodia’s Data Centre Market Set for Exponential Growth

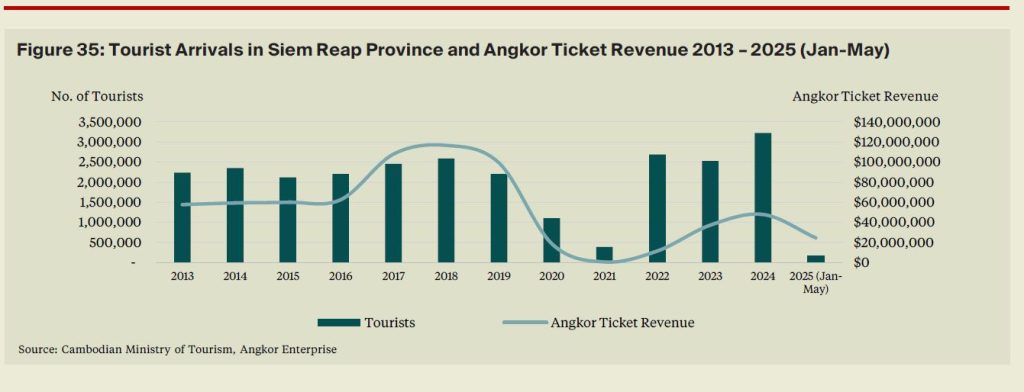

Siem Reap: Tourism-Led Recovery Diminished with Border Closure

The Siem Reap economy was showing good signs of a recovery, with a strong peak season between November to February giving hope of a long-awaited revival. However, with the closure of the Cambodia-Thailand border in May, this optimism was short-lived, and the overall market has come to a temporary standstill.

Sihanoukville: A Gateway to the Future

Sihanoukville is fast emerging as a strategic coastal hub, benefitting from infrastructure investments, port expansion, and its growing role in logistics and trade. While the global backdrop remains challenging, Sihanoukville’s transformation positions it as a future gateway city, attracting investment into industrial, residential, and hospitality developments.