Cambodia Investment Review

The Credit Guarantee Corporation of Cambodia (CGCC) has officially launched a new USD 200 million “Economic Stimulus Guarantee Scheme” (ESGS), marking a significant milestone in the country’s post-pandemic financial recovery and private sector development efforts. Effective from July 1, 2025, ESGS replaces the earlier “Business Recovery Guarantee Scheme” (BRGS), which concluded on June 30, 2025.

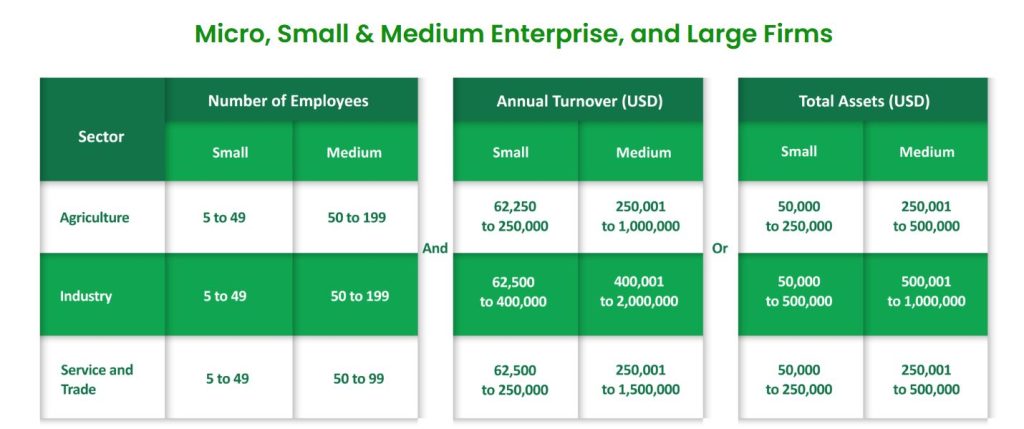

Approved by H.E. Deputy Prime Minister and Minister of Economy and Finance, the new guarantee scheme is designed to boost access to finance for Micro, Small, and Medium Enterprises (MSMEs) as well as large firms, reinforcing the Royal Government of Cambodia’s Pentagon Strategy – Phase 1, which prioritizes economic diversification, job creation, and resilience.

Stronger Terms to Drive Loan Disbursement

One of the standout features of the ESGS is its enhanced guarantee terms. CGCC has increased the maximum guarantee coverage to 90% of the total loan principal, one of the highest ratios offered in the Cambodian market to date. The minimum guarantee fee has also been lowered to just 0.75% of the outstanding guaranteed amount, creating a more favorable cost environment for borrowers and lenders alike.

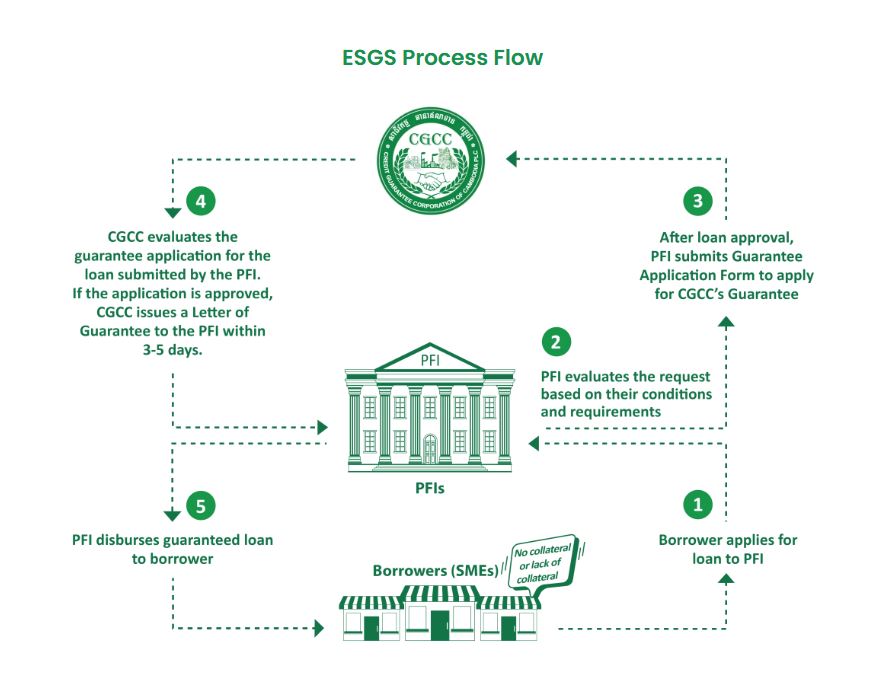

These measures are aimed at encouraging Participating Financial Institutions (PFIs) to disburse more credit, especially to businesses with limited collateral or track records, while minimizing the risk exposure for lenders. Other improved conditions under ESGS are expected to attract a broader range of enterprises and stimulate economic activity across both urban and rural areas.

Focused Support for Key Sectors

The ESGS specifically targets businesses operating in priority sectors critical to Cambodia’s development. These include:

- Agriculture: crop cultivation, livestock farming, aquaculture

- Industry: agro-processing, food manufacturing, waste recycling, pharmaceutical production, and green technology

- Services: tourism, logistics, digital services, education, utilities, and healthcare

Businesses outside these areas are still eligible, provided they do not fall under the officially designated “Negative List,” which outlines excluded sectors and loan purposes.

Eligible borrowers must be Cambodian citizens or majority Cambodian-owned legal entities (holding over 50% local ownership). Businesses that are not yet formally registered may still apply, but must complete registration within one year of receiving the guarantee. Otherwise, a business registration fee of 0.5% per annum will apply on the outstanding guaranteed amount.

Building on a Growing Track Record

The launch of ESGS comes as CGCC continues to expand its role in Cambodia’s financial system. As of the end of May 2025, CGCC had approved guarantees for 4,877 business loans, representing a total guaranteed amount of approximately USD 294.32 million.

CGCC, a state-owned enterprise under the technical and financial guidance of the Ministry of Economy and Finance, was established to enhance financial inclusion by reducing barriers to credit access. The corporation’s broader portfolio includes:

- Loan guarantees in the banking and financial services sector

- Bond guarantees in the securities market

- The Entrepreneurship Program Initiative of CGCC (EPIC), which supports startup and SME development through tailored guarantees and advisory support

By rolling out ESGS, CGCC aims to further scale up these efforts and accelerate Cambodia’s journey toward a more inclusive, diversified, and resilient economy.

For more information about ESGS and eligibility criteria, visit www.cgcc.com.kh or contact CGCC directly at 023 722 123.