Cambodia Investment Review

The latest CBRE Cambodia report highlights the importance for property owners, developers, and investors to rapidly adapt to the evolving consumer demands and changing market conditions. With data spanning multiple real estate sectors, the report showcases significant trends in office, retail, condominium, and industrial segments, underscoring the need for a flexible approach to development, marketing, and pricing.

Shifting Preferences in Design and Development

Cambodia’s real estate sector is witnessing a clear move away from traditional design models. The report points to a declining popularity for conventional flat houses, with buyers gravitating toward newer condominium styles, such as lofts and duplexes. In addition, there is growing demand for projects that emphasize green spaces and open areas, reflecting the increased awareness around wellness and quality of life.

Read More: CBRE Cambodia: Funan Techo Canal to Transform Cambodia’s Real Estate and Economy

The inclusion of modern features such as smart home technology, playgrounds, fitness centers, and sufficient parking spaces is becoming a standard expectation. However, CBRE cautions that sustainability continues to be overlooked in many developments, a factor that may become more pressing as environmental awareness continues to rise globally.

The report emphasized: “Design strategies that worked in the past are no longer sufficient to meet the expectations of today’s consumers. Developers must prioritize sustainability and more holistic living experiences in their projects.”

Office, Retail, and Condominium Market Performance

According to the CBRE research, the office and retail markets in Cambodia have experienced softening in the first half of 2024, with both sectors seeing declines in occupancy and rental rates. The office sector reported an occupancy rate of 61.8%, while prime rental rates stood at $27 per square meter. Similarly, retail spaces faced challenges, with an occupancy rate of 58.7% and prime rental rates around $22.1 per square meter.

In contrast, the condominium market demonstrated resilience. Over 2,200 new units were launched in the first half of 2024, and high-end condominium sales prices remained strong at $2,718 per square meter. This continued demand for high-end condos, despite challenges in other sectors, signals a growing niche market in Phnom Penh’s real estate landscape.

Industrial Sector Showing Positive Trends

The industrial sector emerged as a bright spot, driven by increasing foreign direct investment (FDI) and expanding manufacturing activities. The report revealed that 120 hectares of industrial space were launched in the first half of the year, with land lease prices standing at $61 per square meter for a 50-year lease.

“The industrial market is seeing sustained growth, reflecting Cambodia’s ongoing integration into regional supply chains,” the report added. “This growth, combined with strategic infrastructure improvements, is likely to attract further investment into the sector.”

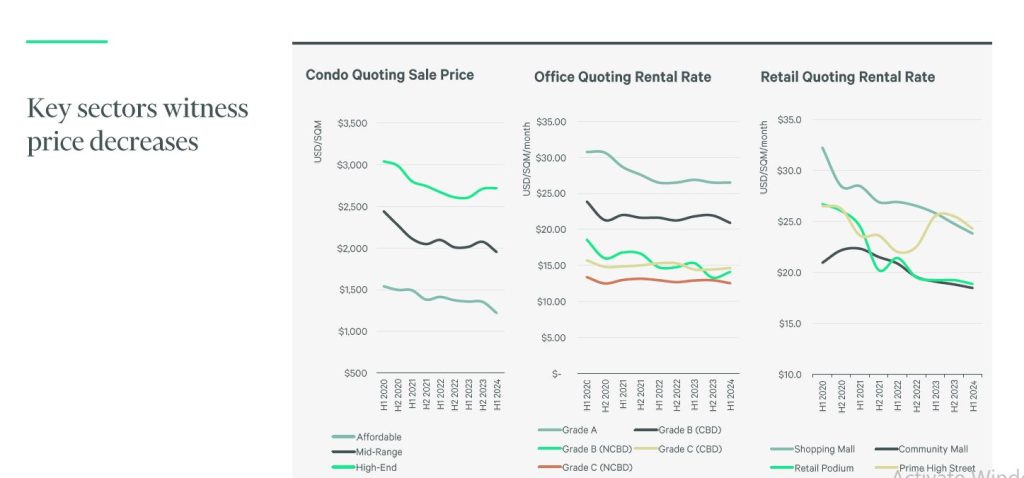

Pricing Pressures and Key Sector Challenges

One of the most notable aspects of the report is the declining rental and sales rates across key real estate sectors. Condo quoting prices for affordable, mid-range, and high-end units have experienced downward pressure, with high-end units seeing a decline to just above $2,500 per square meter by mid-2024. Similarly, office and retail quoting rental rates have continued to decrease, reflecting the competitive market conditions in Phnom Penh and surrounding regions.

According to CBRE, these price reductions are part of an ongoing market adjustment. The Cambodian real estate market is undergoing a correction, especially as post-pandemic challenges persist and regional economic trends influence buyer and tenant behavior.

Regional Market Comparisons and Cambodia’s Position

When comparing Cambodia’s real estate market with regional counterparts such as Ho Chi Minh City (HCMC), Kuala Lumpur, and Singapore, Phnom Penh’s pricing and yields appear to be more favorable. Prime office and high-end condominium construction costs remain competitive in Phnom Penh, and rental yields for high-end condos stand at around 6%, higher than in some neighboring markets.

“The yield for high-end condominiums in Phnom Penh remains attractive for investors,” the report outlined. “Despite challenges in occupancy and rental rates, the Cambodian market offers opportunities, especially when compared to regional markets like HCMC and Kuala Lumpur, where yields tend to be lower.”

Adapting to Consumer Expectations and Market Trends

The CBRE report emphasizes the need for developers to stay attuned to market shifts and evolving consumer preferences. One trend identified is the repurposing of older buildings, which has proven to be more sustainable and often comes at a lower development cost. Repurposing also allows developers to maintain strategic locations in prime urban areas.

Moreover, branding has become increasingly crucial in the real estate market. Projects backed by branded operators and strong property management teams are viewed more favorably, helping enhance a development’s reputation. This emphasis on branding extends beyond aesthetics and contributes to the overall perception of quality and reliability in the eyes of consumers.

Marketing Strategies: Enhancing Engagement

Developers are also leveraging innovative marketing strategies to appeal to new buyers and tenants. The report outlines successful community engagement activities such as outdoor movie festivals, cultural shows, art exhibitions, and tenant-focused events that create vibrant living spaces and enhance the overall appeal of developments.

“As developers move toward creating more integrated communities, the focus is not only on the physical property but also on the lifestyle experience,” it stated. “Tenant engagement through events and partnerships has proven effective in driving interest and long-term retention.”

Market Is Navigating A Period Of Transition

The Cambodian real estate market is navigating a period of transition, marked by changing consumer demands, market corrections, and new opportunities. The CBRE report suggests that while some sectors are facing pricing pressures, others, such as industrial continue to thrive. Property developers are urged to embrace sustainability, flexible pricing models, and dynamic marketing strategies to stay competitive in the face of evolving market conditions.

With ongoing shifts in the regional and global economy, Cambodia’s real estate market offers both challenges and opportunities. Those developers who are able to adapt quickly and meet the new expectations of buyers and tenants will likely emerge as leaders in the sector.