CIR Media

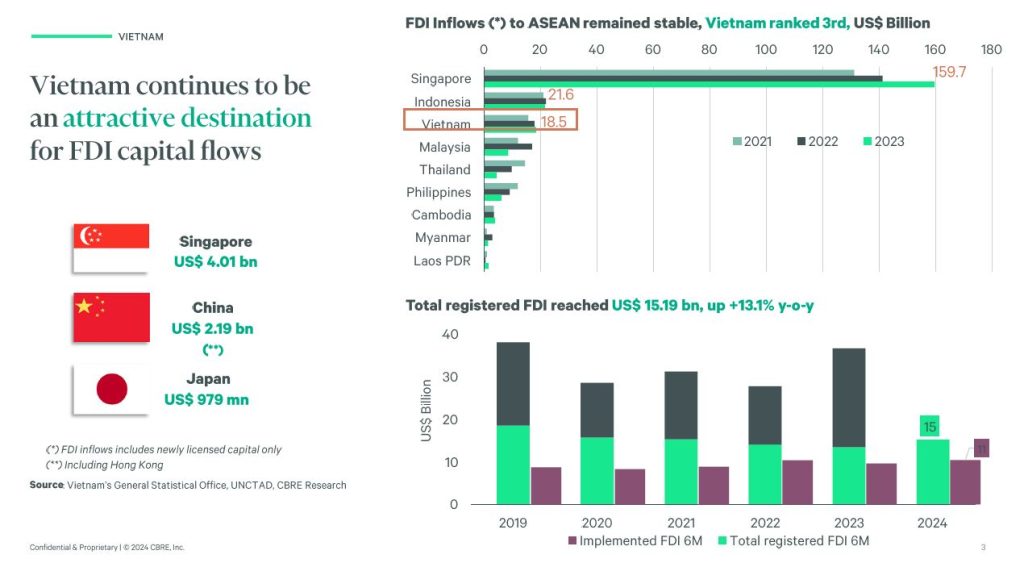

Vietnam’s hospitality sector experienced significant growth in the first half of 2024, driven by robust GDP growth, a resurgence in international arrivals, booming industrial growth and ongoing infrastructure developments, according to a recent report by CBRE Vietnam. The report indicates that Vietnam’s GDP expanded by 6.42% year-on-year (y-o-y) in H1 2024, putting the country on track to meet its annual growth target of around 6%.

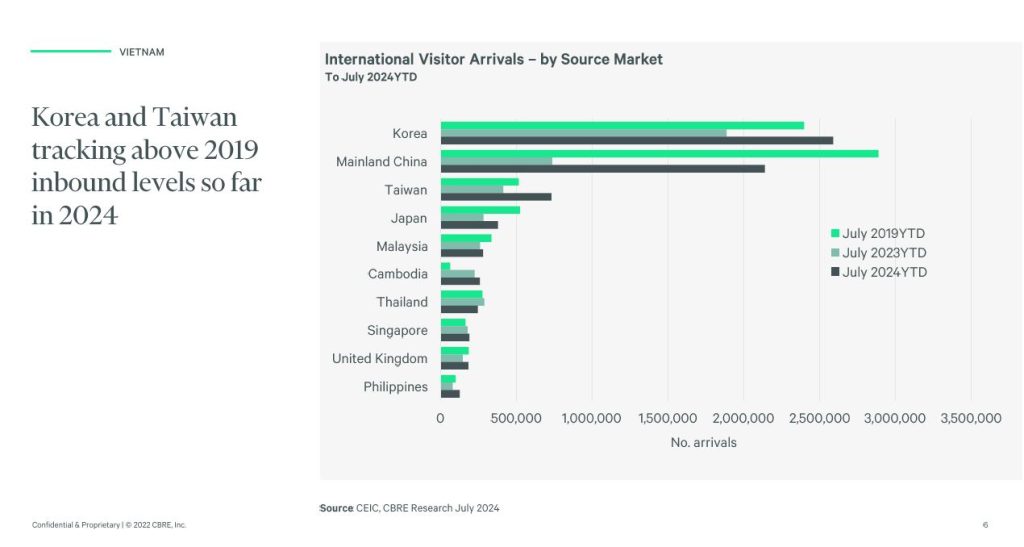

A critical factor contributing to the sector’s recovery has been the increase in international arrivals. In early 2024, arrivals accelerated and have since returned to seasonal trends. By July 2024, the country recorded 8.8 million international arrivals, a 58.4% increase y-o-y, and an 11.4% increase compared to pre-COVID levels in H1 2019. South Korea and China remain the largest source markets for visitors to Vietnam, with arrival numbers from these countries surpassing those of 2019 illustrating high regional pent-up demand for leisure and business activity within the country.

Growing Demand From Both International And Domestic Travelers

Domestic tourism also played a significant role, with 66.5 million domestic visits recorded in H1 2024. The total number of both international and domestic visitors in Vietnam during this period reached 75.3 million, solidifying the country’s position as a leading tourist destination in the region.

The report highlights varying levels of recovery across major urban centers, with Ho Chi Minh City (HCMC) showing stronger occupancy recovery compared to Hanoi. By June 2024, HCMC’s occupancy rates reached 70%, while Hanoi’s were slightly lower at 67%.

Lawrence Lennon, Director of CBRE Vietnam’s Capital Markets team, highlighted, “Average Daily Rates (ADRs) in both cities have exceeded historical levels, reflecting the growing demand from both international and domestic travelers. That high reflects high demand. Importantly for the tourism industry, as of July 2024 Available Aircraft Seats were just -2% of July 2019 levels. Another factor is where demand is coming from – there’s clearly strong appetite from high-spending East Asian tourists with South Koreans make up 40% of inbound visitors to Vietnam in 2023, really indicating the rebuilding of momentum.”

Infrastructure developments have also been pivotal in supporting the sector’s recovery. The expected completion of the Ho Chi Minh City metro in 2024 and the expansion of Tan Son Nhat International Airport and Noi Bai International Airport in 2025 are expected to enhance connectivity and accessibility, attracting more tourists and investors to the country.

Recent Transactions Reflect Investor Confidence

Lennon adding, “the thirty-three million domestic middle class has continued desire to travel in-country – as infrastructure completes, such as the recently completed US$535 million Phan Thiet Expressway connecting Ho Chi Minh City with coastal destinations, we expect further opening up of new hot spots to match a range of consumer preferences as infrastructure gets built – the government is targeting 1,200 km of new expressway between 2023 – 2025.”

The report also notes that hotel supply in Vietnam, while gradually cooling, remains higher than in other Asia Pacific markets. The compound annual growth rate (CAGR) for hotel supply from 2014 to 2023 was 7.8%, with future supply projected to grow at a CAGR of 6.1% between 2024 and 2028. The upscale and upper upscale segments are expected to dominate the market, accounting for 35.1% and 24.6% of the supply, respectively.

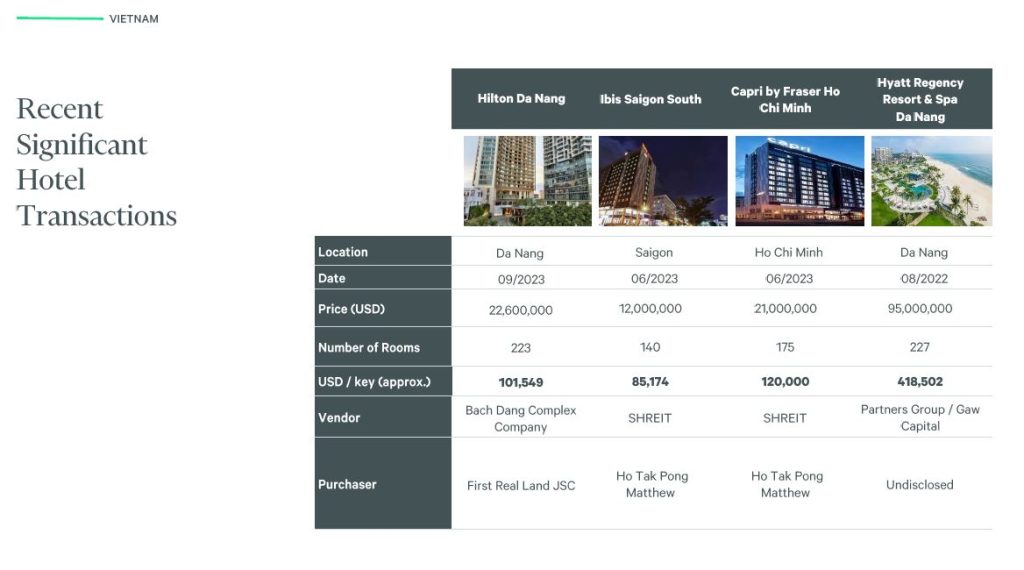

Recent significant hotel transactions, including the sale of Hilton Da Nang, Capri by Fraser Ho Chi Minh, and Hyatt Regency Resort & Spa Da Nang, further underscore the positive outlook for Vietnam’s hospitality market. These transactions reflect investor confidence in the sector and its potential for continued growth.

As Vietnam continues its post-pandemic recovery, the hospitality sector is poised for sustained growth, supported by a combination of strong economic fundamentals, rising tourist arrivals, and strategic infrastructure investments. The developments highlighted in the CBRE report suggest that Vietnam is well-positioned to reinforce its status as a premier destination for both leisure and business travelers in Southeast Asia.