David Van

The Cambodian rice industry is a vital part of the country’s economy, with the European Union (EU) serving as a key export market. As global trade increasingly prioritizes sustainability, Environmental, Social, and Governance (ESG) compliance has become essential for maintaining and expanding market access. This paper explores the importance of ESG compliance for Cambodian rice exporters, particularly in relation to the EU market, and examines the benefits of integrating ESG practices with sustainable financing.

Why Cambodian Rice Exporters Should Comply with ESG Standards

1. Alignment with EU Market Requirements

The EU market is known for its stringent regulations on sustainability and social responsibility. Compliance with ESG standards is crucial for Cambodian rice exporters seeking to maintain their market share in the EU. The EU’s demand for sustainably sourced products means that non-compliance with ESG criteria could result in trade barriers, such as increased scrutiny or even bans on imports.

Read More: Opinion – Current Cambodian Economy and Challenges Moving Forward in 2024

2. Achieving Competitive Advantage

By adhering to ESG standards, Cambodian rice exporters can differentiate themselves in the global market. Compliance with certifications such as the British Retail Consortium (BRC), International Featured Standards (IFS), and ISO certifications relevant to ESG can enhance the appeal of Cambodian rice to European buyers. These certifications ensure that environmental, social, and governance factors are rigorously managed, which is increasingly becoming a requirement for entry into premium markets.

3. Mitigating Operational and Reputational Risks

ESG compliance helps mitigate various risks associated with environmental damage, social unrest, and governance failures. For instance, ISO 14001 focuses on environmental management, reducing the risk of environmental penalties, while ISO 45001 ensures workplace safety, minimizing the risk of labor disputes. This comprehensive risk management through ESG practices can safeguard Cambodian exporters against potential disruptions.

The Benefits and Linkages Between ESG and Sustainable Financing for Cambodian Rice Exporters

1. Access to Favorable Financing Options

Sustainable financing refers to financial products that integrate ESG criteria into lending and investment decisions. Cambodian rice exporters who adhere to ESG standards can access green financing products such as loans with favorable terms for investments in sustainable farming practices. These include organic farming, water conservation technologies, and energy-efficient milling processes, all of which are crucial for enhancing sustainability in the rice sector.

2. Lowering the Cost of Capital

Investors and financial institutions are increasingly considering ESG factors in their risk assessments. Rice exporters with strong ESG credentials are often perceived as lower risk, which can lead to reduced interest rates on loans and better terms on financial products. This can significantly lower the cost of capital, making it easier for exporters to invest in further sustainable practices.

3. Attracting Long-Term, Stable Investment

By demonstrating a commitment to ESG principles, Cambodian rice exporters can attract long-term investors who prioritize sustainable and responsible growth. These investors are often more stable and willing to invest in the long-term success of a company, providing a reliable source of capital for ongoing development.

4. Enhancing Brand Value and Market Positioning

Adherence to ESG standards can significantly enhance the reputation and brand value of Cambodian rice exporters. A strong ESG profile not only meets regulatory demands but also aligns with consumer expectations in the EU, where there is a growing demand for sustainably produced goods. This can improve market positioning and open up new opportunities in premium segments of the market.

Conclusion

For Cambodian rice exporters, integrating ESG standards into their operations is not just about regulatory compliance—it is a strategic necessity for maintaining access to key markets like the EU. Furthermore, the linkages between ESG and sustainable financing offer significant financial benefits, including access to favorable loan conditions, reduced capital costs, and the attraction of long-term investment. By embracing ESG practices, Cambodian rice exporters can enhance their competitive edge, ensure long-term sustainability, and contribute to broader national and global sustainability goals.

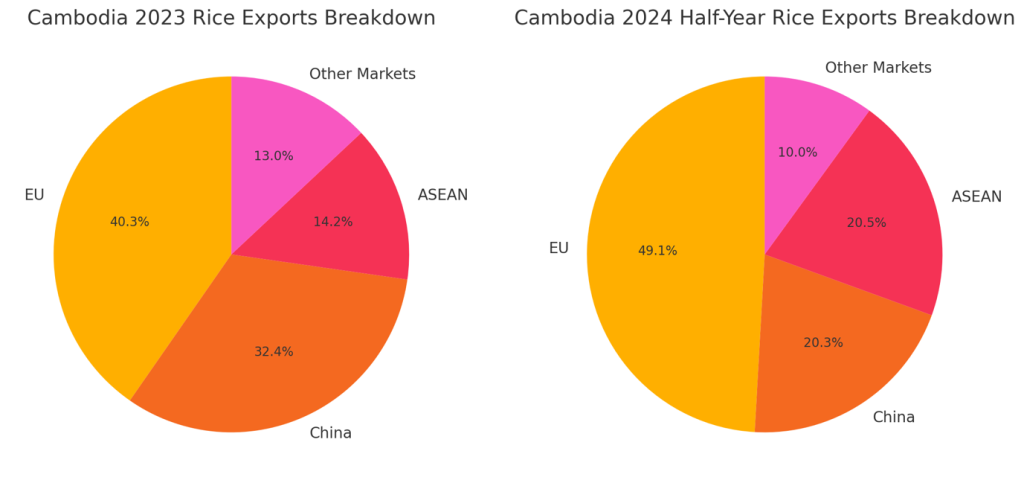

1. Cambodia 2023 Rice Exports Breakdown

Let’s break down the 2023 exports by destination:

- EU: 264,683 metric tons

- China: 212,756 metric tons

- ASEAN: 93,376 metric tons

- Other Markets: 85,508 metric tons

2. Cambodia 2024 Half-Year Rice Exports Breakdown

For the first half of 2024 (up to July), the breakdown is:

- EU: 186,377 metric tons

- China: 77,204 metric tons

- ASEAN: 77,933 metric tons

- Other Markets: 38,032 metric tons

David Van is a savvy business and policy advisor, with a long experience in regional senior management roles and development sector in Asia, as well as government relations advisory support, blended finance and private-public partnership conceptualization.