Cambodia Investment Review

A new condominium project in Phnom Penh’s BKK1 district has recorded a strong pre-sale performance, with around 50% of units reserved during its initial launch phase, underscoring continued buyer demand for well-located residential developments with competitive pricing and flexible payment structures.

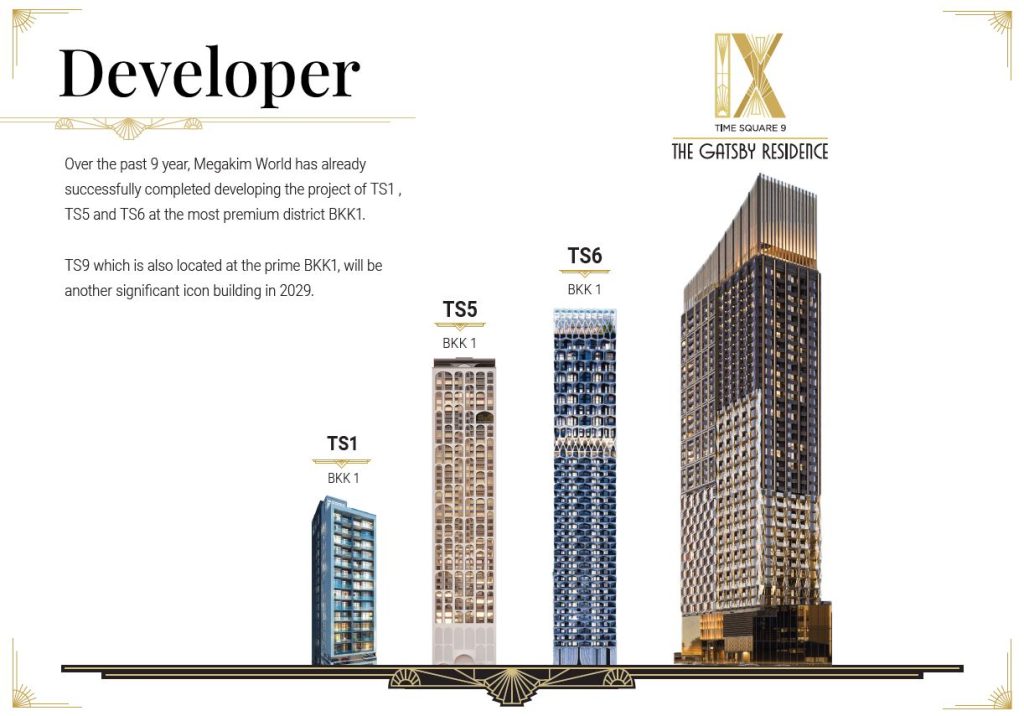

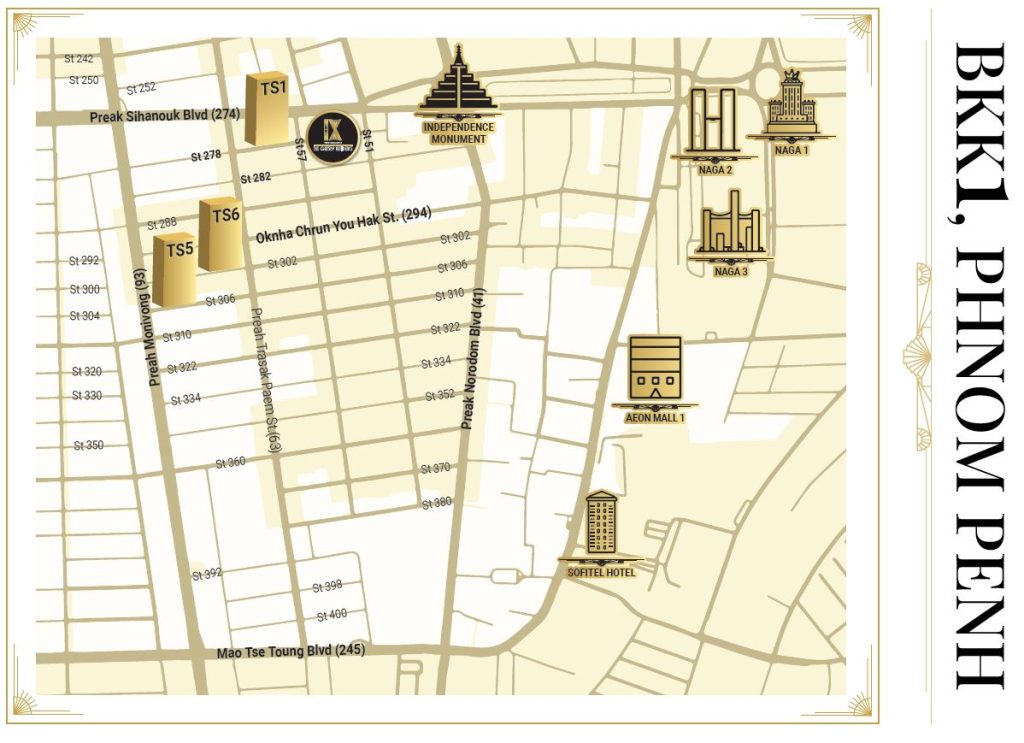

Time Square 9, also branded as The Gatsby Residence, is located on Street 278, one of BKK1’s most established residential corridors. According to Charlotte Cambodia, the early sales momentum reflects a combination of location appeal, manageable unit supply, and financing terms aligned with current market conditions.

Strong early demand in a selective market

Phnom Penh’s condominium market has become increasingly selective over the past two years, with buyers placing greater emphasis on location, pricing realism, and project fundamentals. Against this backdrop, the reported 50% pre-sale uptake at Time Square 9 stands out as a notable indicator of buyer confidence.

Charlotte Cambodia noted that interest has come from a mix of owner-occupiers and longer-term investors, with particular demand for smaller and mid-sized units suited to urban living and rental potential. The project comprises approximately 600 units in total, positioning it as a moderately sized development within one of the capital’s most mature residential districts.

Market participants say that projects in central areas such as BKK1 have continued to outperform peripheral locations, where increased supply has placed pressure on pricing and absorption rates. As a result, developments that combine centrality with disciplined pricing strategies have been better positioned to attract early-stage buyers.

Pricing and payment structures support uptake

One of the key drivers behind the project’s early traction has been its pricing and payment structure. Units are reported to start from the high US$80,000 range, placing them within reach of mid- to upper-middle income buyers seeking central Phnom Penh locations.

Buyers are offered down payments in the range of 10% to 20%, alongside instalment plans extending up to 45 months with zero interest. Such structures have become increasingly common across Phnom Penh’s primary residential market, helping to lower upfront barriers while supporting sales velocity in a cautious environment.

Unit configurations range from one- to four-bedroom layouts, with sizes spanning approximately 60 square metres to 190 square metres. This breadth allows the project to cater to a wide demographic, from single professionals and young couples to families seeking larger living spaces in the city centre.

BKK1 fundamentals remain resilient

BKK1 continues to be one of Phnom Penh’s most resilient residential sub-markets, supported by proximity to embassies, international schools, offices, dining, and lifestyle amenities. Properties in the area have historically demonstrated stronger price stability and more consistent rental demand compared to emerging districts.

Industry observers note that while overall rental yields in Phnom Penh have moderated, well-located units in established neighbourhoods continue to attract tenant interest, particularly from expatriates and higher-income local residents. For many buyers, this has reinforced a longer-term holding approach rather than short-term speculative strategies.

The early performance of Time Square 9 highlights how projects aligned with these fundamentals can still achieve solid absorption rates. As further sales phases are rolled out, the market will closely watch whether demand remains consistent, offering broader insights into buyer sentiment within Phnom Penh’s evolving condominium sector.

Find out more with Charlotte Cambodia!

- LinkedIn: https://www.linkedin.com/in/charlotte-cambodia-286212253/

- YouTube: https://www.youtube.com/@Charlottecambodia

- whatApp : https://wa.link/g6r9p6

- Telegram : https://t.me/CharlotteCambodia

- Telephone: +855 81916829