Cambodia Investment Review

Stablecoins — digital tokens designed to mirror the value of traditional currencies — are rapidly reshaping global finance, with the ASEAN+3 region emerging as one of the most impacted markets. Cambodia sits at the center of this shift as regulators and financial institutions weigh the promise of instant cross-border payments against risks to currency sovereignty and monetary stability.

The new wave of regulation in the United States has accelerated the global uptake of USD-backed stablecoins, cementing their legitimacy within the mainstream financial system and driving the total market capitalization sharply higher in recent months. This trend is now spilling into Southeast Asia, where the US dollar is already widely used for both retail and business transactions — giving Cambodia more upside opportunity than most markets, but also exposing the country to greater macro-financial vulnerabilities.

Read the full AMRO report here.

USD-Backed Tokens Gain Traction Across ASEAN— and Cambodia Is A Prime Test Case

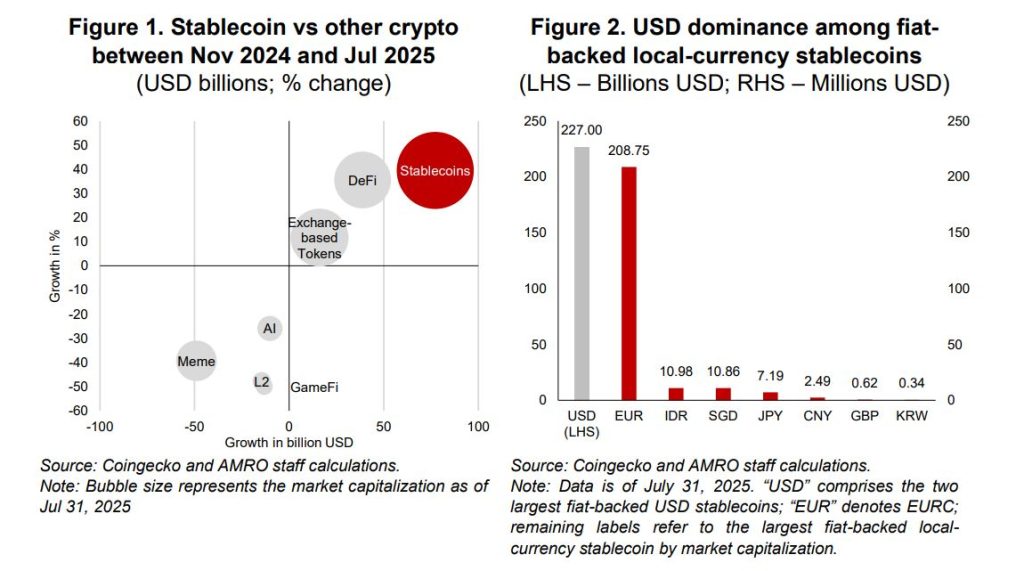

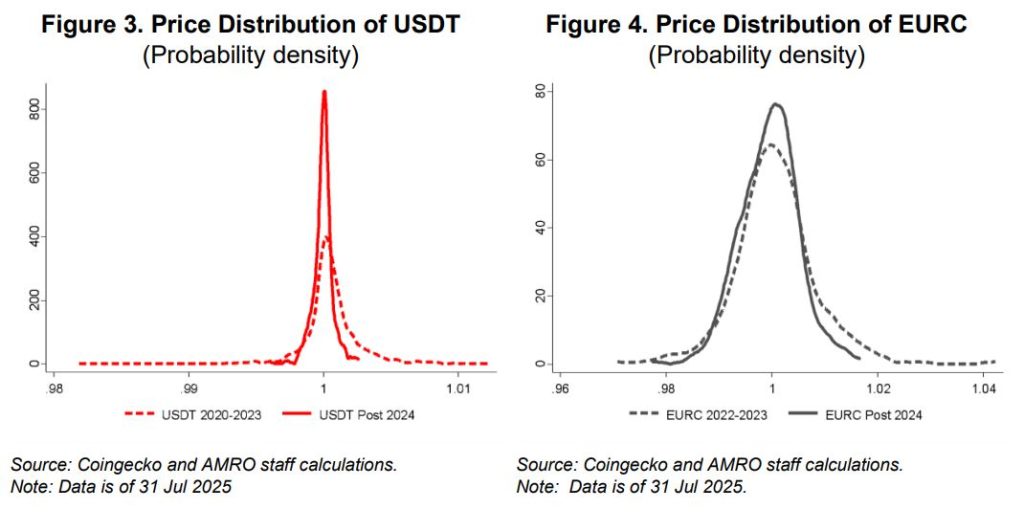

Stablecoins have emerged as the dominant bridge between cryptocurrency markets and traditional finance, functioning as tokenized versions of non-bank money backed by reserves such as cash or government securities. Since late 2024, USD-denominated tokens have surged by around USD 77 billion, accounting for more than 97% of all fiat-backed stablecoins globally.

Their appeal in Southeast Asia is straightforward: they enable near-instant 24/7 payments that bypass correspondent banking networks. That makes them ideally suited for markets with large remittance flows, extensive regional trade linkages and digitally driven consumer spending — all of which describe Cambodia’s current economic landscape.

However, the country’s long-standing partial dollarization means greater reliance on digital dollars could weaken central bank effectiveness. Large-scale use of USD stablecoins for everyday transactions risks reinforcing an already deep currency substitution trend, limiting the ability of local monetary policy to influence domestic conditions.

The Governance Gap: Regulation Will Define Winners — and Losers

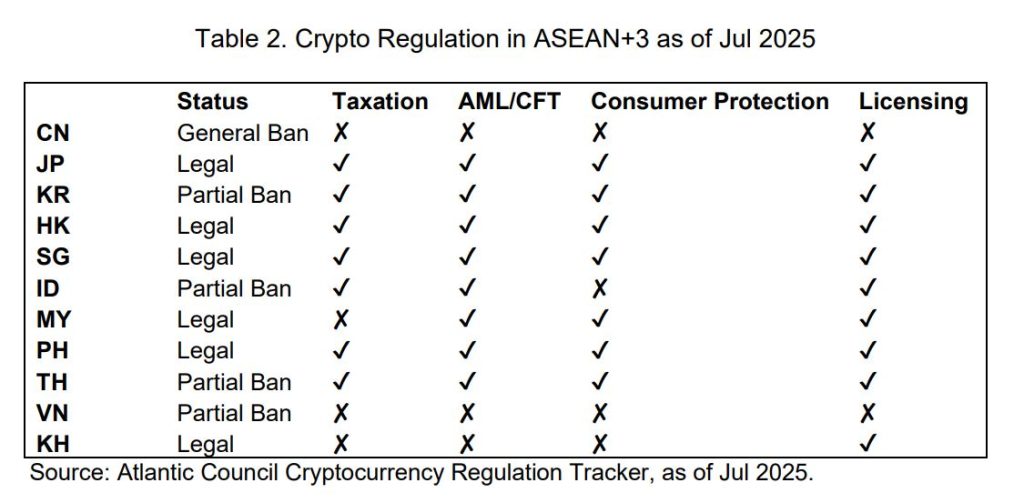

A major challenge for Cambodia and its neighbors is the speed at which stablecoin usage has grown relative to regulation.

Across ASEAN+3, digital asset rules vary widely — from comprehensive frameworks in Singapore and Hong Kong to legal gray zones in markets like Cambodia and Vietnam. The report notes that even jurisdictions permitting crypto activities have not necessarily defined clear policies for stablecoins specifically, especially when tokens are issued overseas rather than domestically.

If regulatory uncertainty persists, Cambodia may face three major external risks:

• Monetary Sovereignty: Digital dollar adoption could further displace the riel in commerce and savings, increasing sensitivity to U.S. monetary policy.

• Capital Flows: Stablecoin transactions can bypass conventional capital controls, accelerating capital movement during market shocks.

• Financial Integrity: Pseudonymous transfers complicate enforcement of anti-money-laundering frameworks.

To mitigate these risks, the report recommends that ASEAN+3 economies — including Cambodia — clarify their legal stance on foreign-currency stablecoins, formally regulate domestic wallet providers, and establish redemption and reserve standards for any issuer serving local residents.

Read More: EuroCham Forum Highlights Cambodia’s Push for Clarity in Digital Asset Regulation

A Cambodian Path Forward: Local-Currency Tokens May Offer A Strategic Counterbalance

Despite the dominance of digital dollars, the research suggests that local-currency stablecoins could play a complementary role in the region, preserving financial sovereignty while expanding payment efficiency.

For Cambodia, that could mean:

• enabling tokenized riel payments within mobile-wallet ecosystems

• integrating these tokens with remittances and retail payments

• connecting to regional clearing networks as ASEAN moves toward interoperable fast-payment architecture

The report highlights that e-money and digital payment platforms are already deeply embedded in daily life across ASEAN, creating a strong foundation for tokenized payments to scale — provided they offer real economic value rather than simply replicating existing domestic mobile payments.

However, progress in the region also shows the technical hurdle ahead. The Indonesian RupiahToken, currently the most prominent local-currency stablecoin in ASEAN, remains largely confined to crypto-trading activity, illustrating the difficulty of transitioning from speculative to real-economy usage without strong regulatory support and clear cross-border settlement frameworks.

Why Cambodia Will Be A Key Country To Watch

The digital-finance landscape in ASEAN is headed toward a multilayered monetary architecture where bank deposits, central-bank digital currencies (CBDCs), and well-regulated stablecoins coexist — all operating through shared settlement standards.

Cambodia’s unique position gives it an outsized role in this transition:

| Factor | Strategic Implication |

| High digital adoption | Fast potential uptake of tokenized payments |

| Heavy USD usage | Highest risk of digital dollarization |

| Cross-border trade and remittances | Strong use cases for programmable settlements |

| Growing fintech sector | Competitive advantage if regulatory clarity arrives early |

The opportunity is considerable: stablecoins could connect trade, remittances, and investments across ASEAN with lower costs and faster settlement. But the report stresses that guardrails must be in place before adoption accelerates.

That means Cambodia’s policymakers face a narrow window — not to resist stablecoins, but to define how they operate locally.

The strategic priority identified for the region is clear: interoperability must be treated as a core policy objective, linking traditional and digital money while coordinating cross-border oversight to prevent regulatory arbitrage.