Cambodia Investment Review

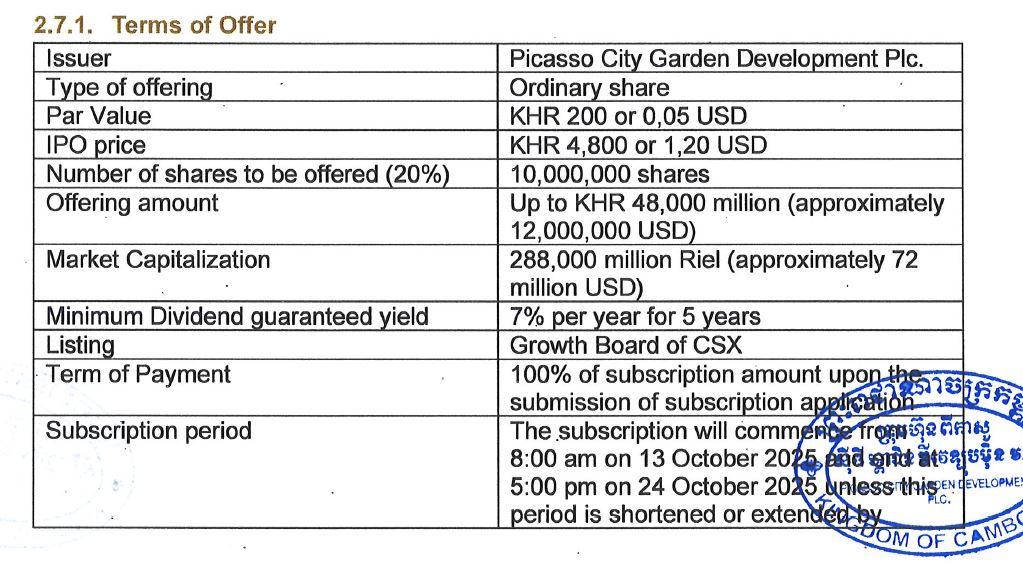

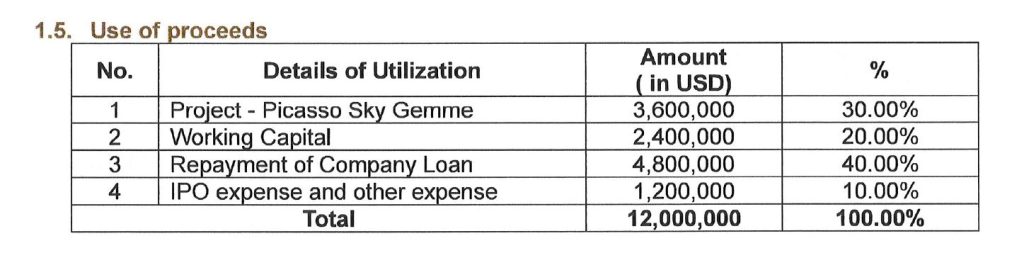

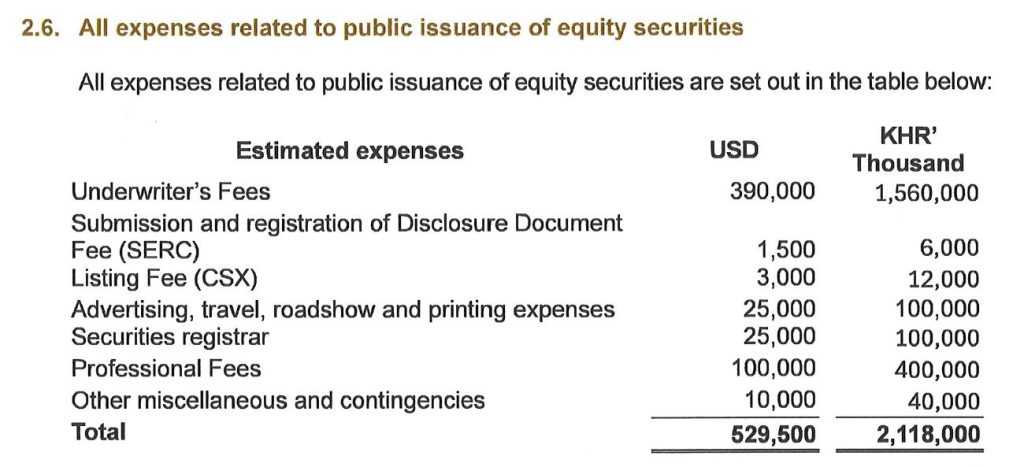

Picasso City Garden Development Plc, has officially launched its initial public offering (IPO) on the Cambodia Securities Exchange (CSX) Growth Board, seeking to raise USD 12 million through the sale of 10 million shares at USD 1.20 per share.

The listing marks a new entrant to Cambodia’s nasecent capital market, with the company valued at approximately USD 72 million upon listing. The Growth Board, launched by CSX in 2015, is designed for small and medium-sized enterprises with strong potential but lower minimum capital requirements than main-board listings—encouraging greater access to equity financing for domestic firms.

Founded in 2016, Picasso City Garden Development Plc. is engaged in real estate development, marketing, construction, commercial operations, land planning, and branded property management. The company’s upcoming projects span Phnom Penh and provincial centers, with an emphasis on modern design and premium residential offerings.

Key Offer Highlights for Investors

- IPO size: 10 million shares at USD 1.20 per share (USD 12 million total)

- Post-IPO valuation: ~USD 72 million

- Projected book value after IPO: USD 17 million (up from USD 5 million)

- Dividend policy: Fixed 7% annual cash dividend for five years

- Listing board: CSX Growth Board

- Expected listing: Late November 2025, subject to approval

Fixed Dividend Policy and Flagship Project

Following the IPO, Picasso City Garden Development has committed to distributing a 7 percent annual cash dividend, based on the IPO price, for five consecutive years. The Board of Directors will review the policy annually and may adjust it depending on performance and market conditions. If the company cannot distribute dividends during the guaranteed period, the unpaid amount will be carried forward to subsequent years.

Read More: Titan Stone Real Estate and Realestate.com.kh Sign Exclusive Deal for Picasso Sky Gemmev

During its Phnom Penh investor presentation, the company highlighted its flagship project, Picasso Sky Gemme—a 52-storey, 180-metre residential tower in the city’s BKK1 district. The project, featuring a “liveable art gallery” concept, will become one of Phnom Penh’s tallest residential buildings and serve as the company’s brand showcase for high-end living and architectural design.

Valuation Discussion and Company Response

The IPO’s valuation has prompted debate among market participants. Stephen Higgins, Managing Partner at Mekong Strategic Capital told Cambodia Investment Review, that while it was positive to see more companies going public, “it has a book value of only USD 5 million, yet it is raising USD 12 million at a USD 72 million valuation, in a residential property market that currently has ten years’ worth of supply.”

In response, the company stated that the IPO price was calculated using a discounted cash-flow (DCF) model based on three years of projected performance, representing a 40 percent discount to its internal fair value of USD 2.00 per share. Management added that after the IPO, the book value would increase to USD 17 million, and the valuation was consistent with Cambodia’s developing real estate sector and regional comparisons.

The company emphasized that this is its first public share issuance and that the offering price represents a fair entry point for investors within a regulated framework, without a speculative premium.

Read More: ADB and SERC Launch 10-Year Securities Masterplan to Tackle Market Challenges

Regional Roadshow and Timeline

The lead underwriter, Cambodia Securities Plc., (under Titan Stone Group which also owns Picasso City Garden Development) said in a press release the Phnom Penh event marked the start of Picasso City Garden Development’s regional roadshow, which will include presentations in Shanghai, Shenzhen, Hong Kong, Chongqing, Kuala Lumpur, Singapore, Taipei, and Tokyo. The company said the goal is to introduce Cambodia’s property market to a broader investor base, particularly within the regional Chinese and ASEAN investment communities.

The subscription period runs from October 13 to 24, 2025, with notifications of successful applicants on November 3 and refunds for unsuccessful investors by November 17. The official CSX listing is expected in late November 2025, pending regulatory approval.

In a company press release, Smallove Teoh, General Manager of Picasso City Garden Development, said the IPO represents both a financial milestone for the company and a broader step forward for Cambodia’s property market. “Through this roadshow, we’re not only introducing our IPO but also sharing the brand value and future vision of Picasso City Garden,” he said. “We look forward to welcoming investors from different places to join us in building a better and more forward-looking city together.”