Cambodia Investment Review

At the 2025 AmCham Cambodia Tax Forum held at Tax Tower in Phnom Penh, Laysym Sim, Tax Partner at Andersen Cambodiav, outlined the country’s sweeping reforms to its tax audit and appeals framework—marking one of the most significant governance updates in recent years aimed at improving compliance, transparency, and investor confidence.

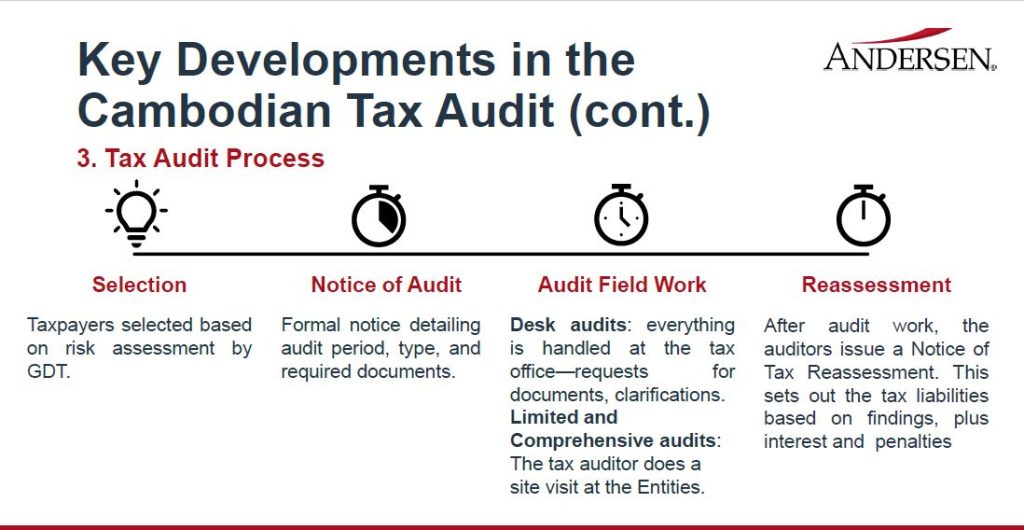

The presentation, titled “Tax Audits and Appeals,” detailed new procedures by the General Department of Taxation (GDT) that are designed to make audits more consistent, risk-based, and digitally integrated. The reforms also strengthen the appeal process and establish new oversight structures to expedite dispute resolution.

Standardized Procedures and New Oversight

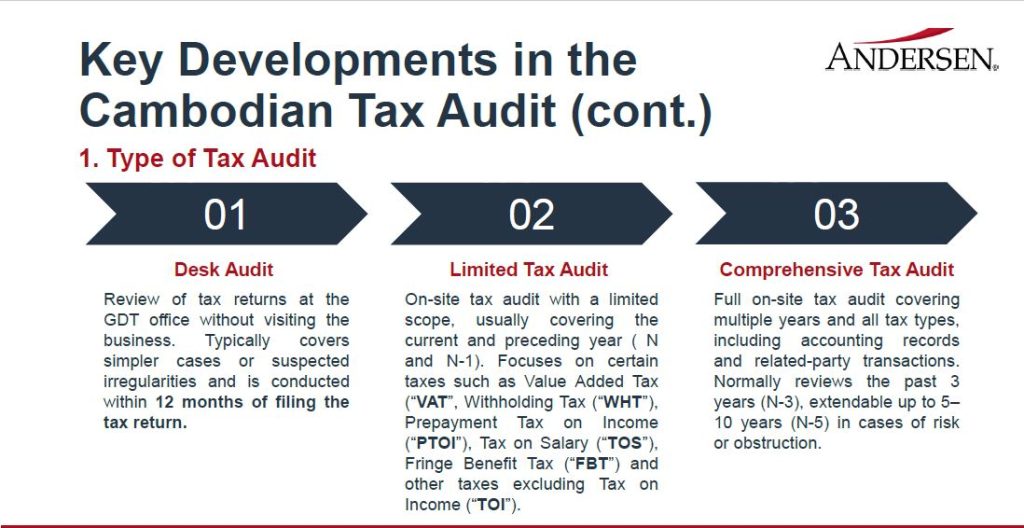

Under the new framework, the GDT has introduced standardized audit procedures, clearly defining the types and timelines for desk, limited, and comprehensive audits.

Desk audits are conducted off-site and typically cover one year of filings, while limited audits focus on specific tax categories—such as VAT, withholding tax, or salary tax—across the current and previous year. Comprehensive audits, by contrast, involve full on-site inspections covering up to three years, and in some high-risk cases, up to a decade.

One of the most notable developments is the creation of the Unit of Special Tax Audit (USTA), established under Sub-Decree No. 160 in July 2024. Equivalent in status to a department within the GDT, the USTA handles comprehensive audits for enterprises with Gold Tax Compliance Certificates and other designated taxpayers. The new unit is expected to help resolve cases faster, reduce backlogs, and enhance the investment climate.

“Cambodia’s tax audit environment has entered a new era of governance and professionalism,” said Laysym Sim, speaking at the forum. “These reforms are designed not only to strengthen compliance but also to promote fairness and transparency for all taxpayers, which is essential to sustaining investor confidence.”

Clearer Appeals and Legal Safeguards

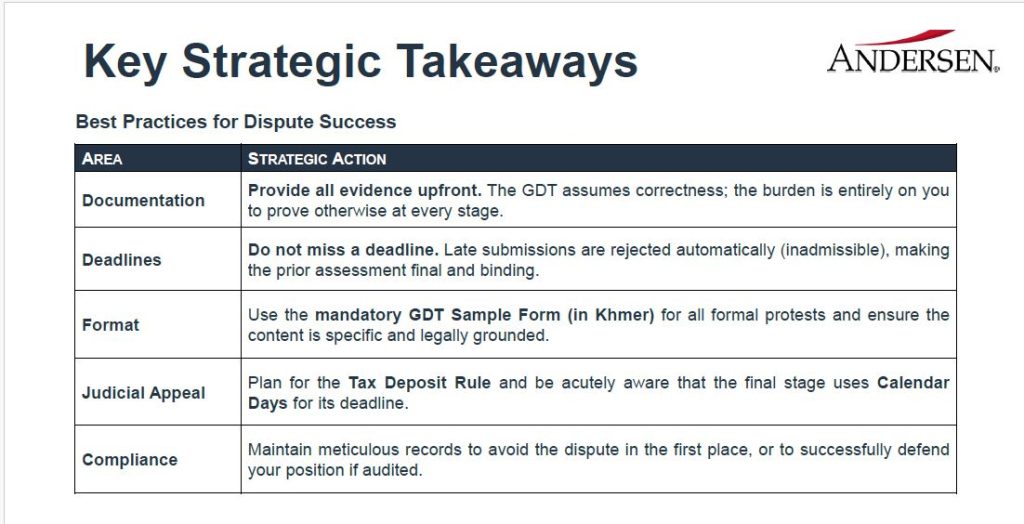

The GDT’s Tax Audit Standard Operating Procedure (SOP) now provides a formal mechanism for taxpayers to challenge audit findings. Businesses have 30 working days to file an objection following a Notice of Tax Reassessment (NOTR). Subsequent appeals can be escalated to the Ministry of Economy and Finance (MEF) and ultimately to the Administrative Court.

Read More: Private Sector Working Group D Engages GDT on Key Tax Issues at March Meeting

However, taxpayers must strictly comply with procedural requirements. All protests must be submitted on the official GDT form in Khmer, clearly identifying the disputed items, supporting legal grounds, and documentary evidence. Late or incomplete submissions are automatically invalidated.

Moreover, before appealing to the court, taxpayers must deposit the principal amount of reassessed tax (excluding penalties and interest) into the National Treasury. This “tax deposit rule” is mandatory for judicial review and serves to prevent delays in tax collection.

“These rules require businesses to be disciplined and proactive,” Laysym emphasized. “The burden of proof lies entirely on the taxpayer, so preparation and documentation are critical from day one.”

Digitization and Risk-Based Selection

Cambodia’s tax administration is also embracing digital transformation. The adoption of e-filing, online submissions, and electronic correspondence is expected to make audits faster and reduce administrative friction. At the same time, the GDT has introduced risk-based audit selection, leveraging data analytics to identify high-risk cases instead of relying on random sampling.

According to Andersen’s briefing, these initiatives signal Cambodia’s continued alignment with international standards of tax governance and transparency—an important step as the country positions itself for long-term sustainable growth under its Vision 2050 agenda.

“Tax transparency and fairness are cornerstones of investor confidence,” Laysym concluded. “By embracing digitization and modern audit governance, Cambodia is taking decisive steps to create a more predictable and business-friendly environment.”

Learn More: Businesses seeking to understand the new audit and appeal framework or prepare for potential tax reviews can contact Andersen Cambodia for advisory support and in-depth guidance at kh.andersen.com