Cambodia Investment Review

Cambodia’s fast-expanding digital banking ecosystem is emerging as a cornerstone of financial resilience in ASEAN, even as the region faces rising global uncertainty, according to the ASEAN+3 Financial Stability Report 2025 released by the ASEAN+3 Macroeconomic Research Office (AMRO).

The report highlights the Kingdom’s progress in digital financial inclusion—driven by the National Bank of Cambodia’s (NBC) Bakong payment system—as a model for regional peers navigating rapid technological change and global monetary volatility. While many ASEAN economies continue to experience spillovers from U.S. policy shifts and trade tensions, Cambodia’s proactive digital transformation has helped stabilize its domestic financial environment and expand access to formal finance.

Read More: Opinion: When Innovation Meets Inclusion – Cambodia’s Vision for Borderless Finance

Digital Payments Anchor Financial Inclusion

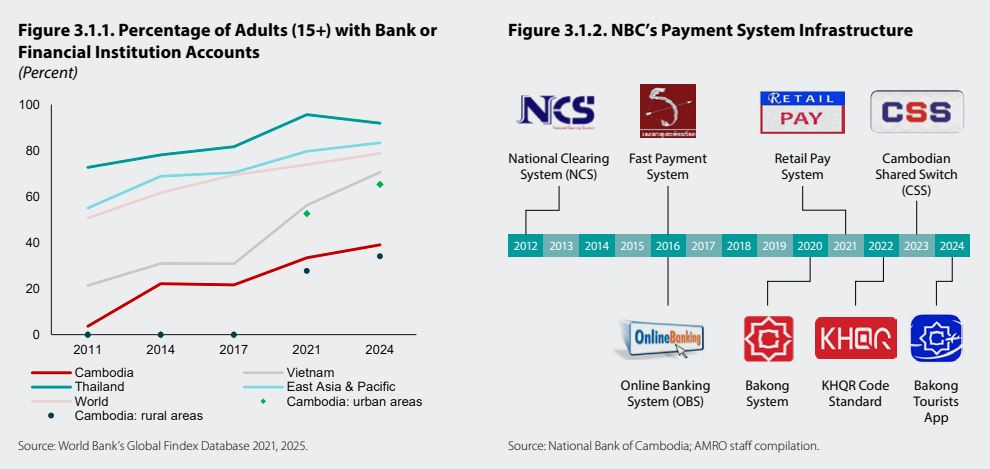

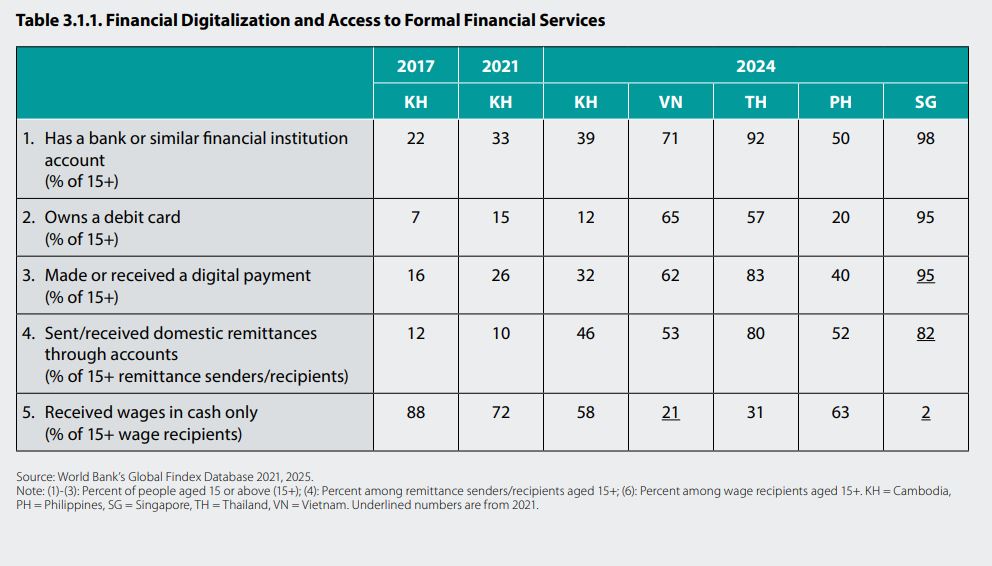

AMRO’s findings underscore how Cambodia has leveraged digital technology to broaden financial participation. The Bakong system—built on blockchain infrastructure and integrated across commercial banks, microfinance institutions, and payment service providers—has become a key enabler of cashless transactions nationwide.

The report noted that the number of e-wallet and mobile payment accounts has risen sharply since 2021, making Cambodia one of the region’s most dynamic digital payment markets.

“The Bakong system continues to advance financial inclusion, demonstrating how digitalization can enhance access to banking services in emerging markets,” the report said.

AMRO further observed that Bakong has improved cross-border payment efficiency, lowered transaction costs, and reduced dependence on the U.S. dollar in everyday commerce—an important step in the country’s long-term de-dollarization strategy.

Balancing Innovation and Risk

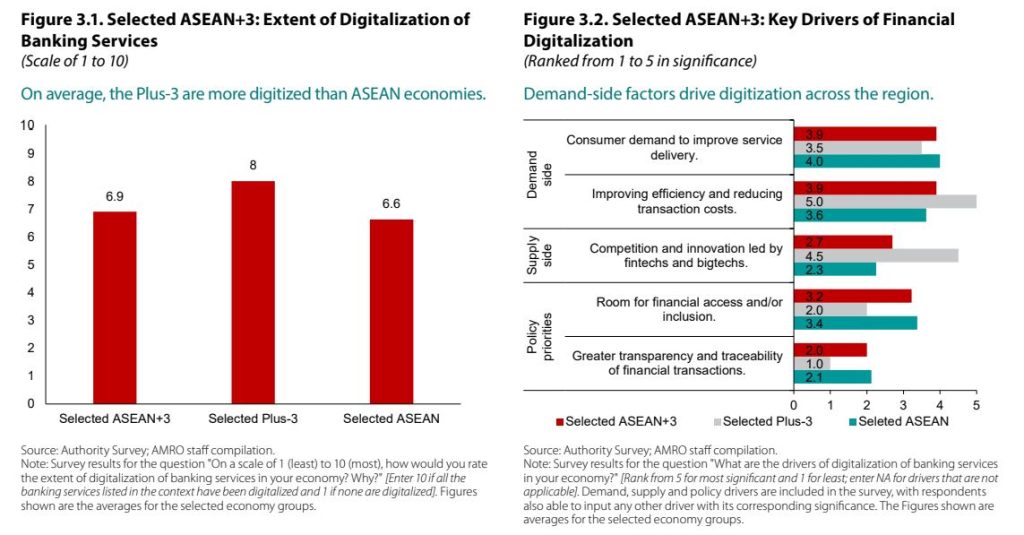

While commending Cambodia’s achievements, AMRO cautioned that digitalization introduces new risks for financial stability. The report pointed to cybersecurity vulnerabilities, operational disruptions, and the expanding role of non-bank technology firms as emerging challenges that require close oversight.

“Operational risk remains the most significant among ASEAN+3 economies,” the report warned, urging regulators to strengthen monitoring and risk management frameworks as digital finance scales up.

The analysis recommended that the NBC and other regional authorities adopt a holistic regulatory approach—balancing innovation, competition, and consumer protection—to ensure sustainable growth in the digital finance sector.

Strong Fundamentals Support Stability

AMRO’s broader assessment found that Cambodia entered 2025 from a position of relative financial strength, backed by well-capitalized banks, solid liquidity, and robust foreign reserves. Although the Kingdom remains exposed to external demand shocks, particularly in manufacturing and exports, its domestic banking sector has shown resilience amid global volatility.

Across the ASEAN+3 region, overall debt levels edged higher in 2024, led by corporate and government borrowing. However, Cambodia’s debt profile remains manageable, with the report noting that its financial institutions have maintained strong capital adequacy ratios despite moderating credit growth.

Moreover, the depreciation of the U.S. dollar throughout 2025 has helped ease imported inflationary pressures, giving Cambodian policymakers room to maintain accommodative financial conditions.

Outlook: Regional Integration and Digital Readiness

Looking ahead, AMRO urged ASEAN+3 economies—including Cambodia—to deepen regional financial cooperation and reduce dependence on the U.S. dollar as a funding currency. Strengthening local capital markets and expanding financial buffers will be key priorities.

AMRO Chief Economist Dong He emphasized in the report’s foreword that Cambodia’s experience highlights the importance of managing innovation within a strong regulatory framework.

“Cambodia’s progress with digital payments demonstrates how technology can drive inclusion and stability, but it must be accompanied by prudent regulation and regional coordination,” he wrote.

As global uncertainty continues, Cambodia’s digital banking transformation stands out as both a driver of inclusion and a safeguard of financial stability—positioning the Kingdom among ASEAN’s most forward-looking emerging economies.