Cambodia Investment Review

The ongoing border conflict between Cambodia and Thailand is expected to cause a significant short-term impact on Cambodia’s GDP and broader economy, with Thailand also facing a high risk of recession, according to a recent analysis by Mekong Strategic Capital. Despite the near-term challenges, Cambodia’s longer-term growth outlook remains strong, underpinned by an eventual rebound in tourism, expected government reforms, and a growing skilled labor market.

Cambodia’s Growth Outlook Adjusted Downward Amid Border Conflict

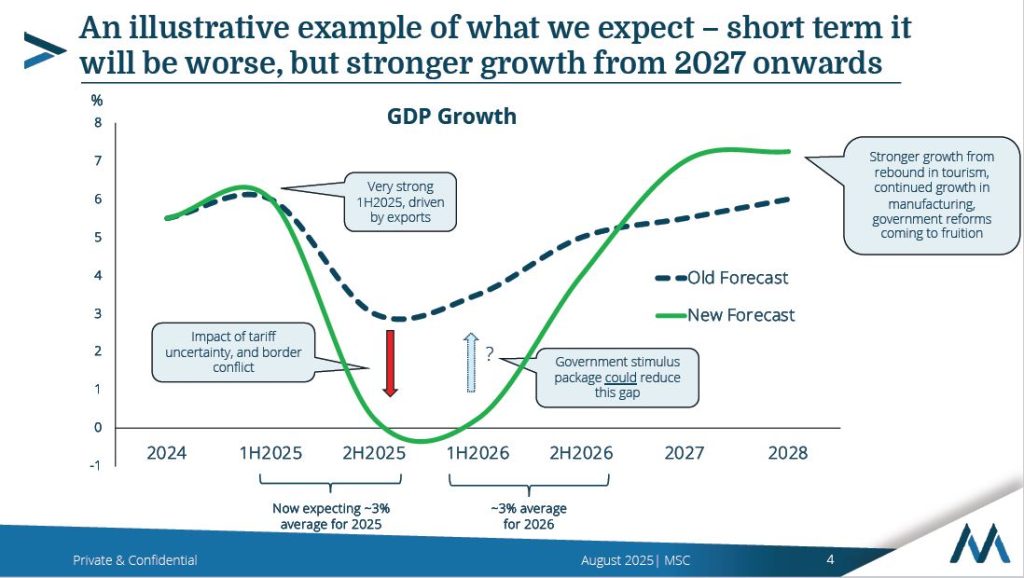

Mekong Strategic Capital’s latest forecast anticipates Cambodia’s GDP growth slowing to around 3% in 2025, down from an earlier expectation of around 5%. This revision reflects the multifaceted economic fallout from the conflict, which escalated rapidly to become the region’s most significant economic risk.

Read More: Mekong Strategic Capital: Cambodia’s 2025 Outlook Shows Strong Start but Risks Loom Large

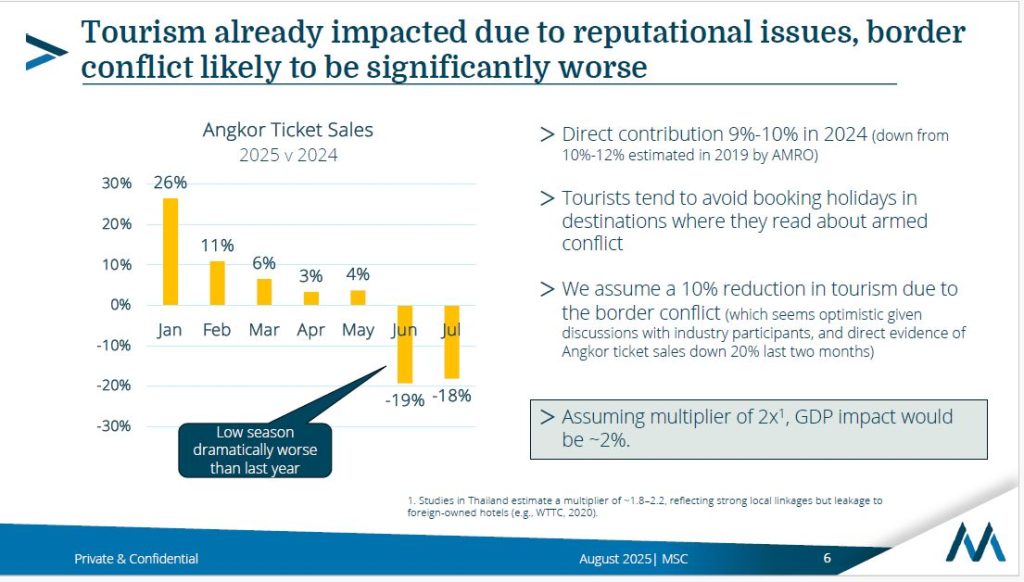

Key areas affected in Cambodia include tourism, remittances, supply chains, and foreign direct investment (FDI). The tourism sector has seen a sharp decline in Angkor ticket sales, down nearly 20% over recent months, reflecting reputational challenges that Cambodia has faced. Mekong Strategic estimates at least a 10% reduction in tourism spending, which would translate to a 2% GDP impact when factoring in multiplier effects.

Remittances, a critical component of Cambodia’s economy, are also expected to fall significantly as an estimated 750,000 Cambodian workers have returned from Thailand since the conflict began. A 25% fall in remittances would result in approximately $375 million in forgone remittances, equating to an estimated 1.5% GDP loss.

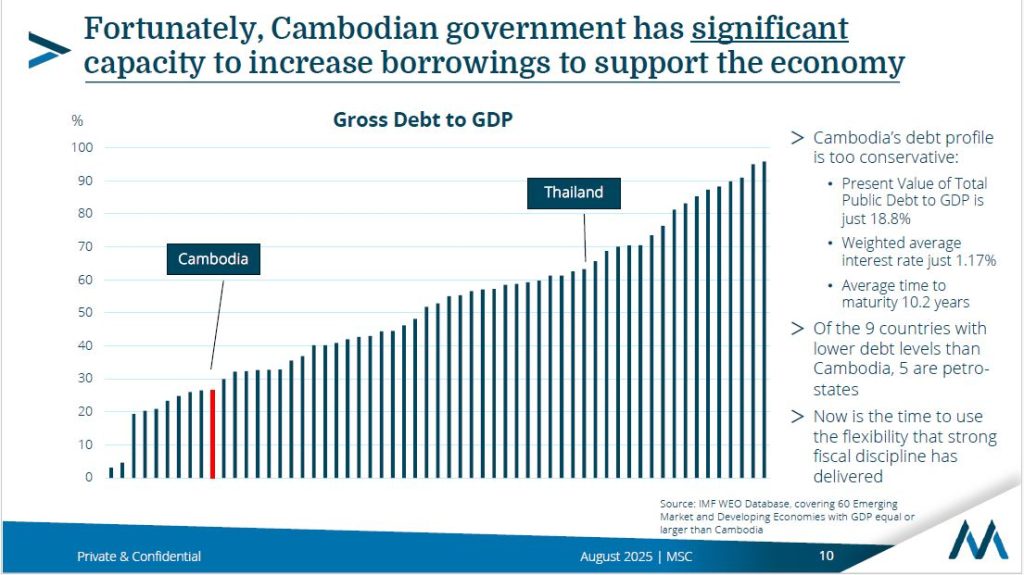

Despite these challenges, Mekong Strategic Capital highlights Cambodia’s relatively low government debt of 27% of GDP and strong fiscal discipline as buffers. The Royal Government of Cambodia (RGC) is encouraged to implement targeted fiscal stimulus and accelerate reforms to mitigate the short-term impact.

Thailand Faces Higher Recession Risk

Thailand, with a lower pre-conflict GDP growth estimate of around 2% for 2025, faces even greater economic vulnerabilities. The country’s higher government debt (63% of GDP) and household debt levels (90%) limit its capacity to cushion economic shocks. Mekong Strategic Capital predicts Thailand is more likely to enter a recession, driven by a sharp contraction in tourism and labor force losses.

Tourism, accounting for 9-10% of Thailand’s GDP, is expected to decline by 5%, contributing to a 1% GDP reduction. Additionally, the abrupt loss of 750,000 workers returning to Cambodia—a nearly 2% reduction in the labor force—could cut Thailand’s GDP by another 1%.

Tariffs: Limited Impact on Cambodia, Greater Strain on the US Economy

Mekong Strategic Capital’s analysis suggests that recent reciprocal tariffs imposed by the US, now at 19%, are unlikely to materially divert manufacturing away from Cambodia or significantly impact its GDP. Earlier estimates at a 36% tariff level projected a 3% GDP impact over three years, but the moderated tariff aligns with levels imposed on Cambodia’s competitors, reducing potential disruption.

Conversely, the US economy may experience negative effects from tariffs beginning in the second half of 2025, potentially dampening consumer demand and affecting imports from Cambodia and other export-dependent countries.

Long-Term Growth Prospects and Policy Recommendations

Despite near-term headwinds, Mekong Strategic Capital forecasts stronger growth for Cambodia from 2027 onward. This rebound is expected to be fueled by a recovery in tourism, sustained manufacturing growth, and effective government reforms. The firm underscores the importance of the RGC’s continued commitment to fiscal stimulus, infrastructure investment, and regulatory improvements.

Recommended policy responses include:

- Accelerating small-scale infrastructure projects and larger investments to attract FDI

- Providing income support for returnees from Thailand

- Reforming the commercial court system and digitizing government services

- Simplifying the tax system to increase certainty and reduce logistics costs

- Launching international marketing campaigns to restore tourism confidence

Key Takeaways

- The next 12 months present significant economic challenges for Cambodia and Thailand, with recession risks elevated

- Cambodia’s long-term growth outlook remains positive, supported by government reforms and labor market expansion

- Fiscal stimulus and reform acceleration are critical to mitigating short-term impacts and unlocking future growth

This analysis builds on Mekong Strategic Capital’s previous reports and aligns with findings from international organizations such as the IMF and World Bank. As the regional situation evolves, investors and policymakers will be watching closely for signs of recovery and opportunities.