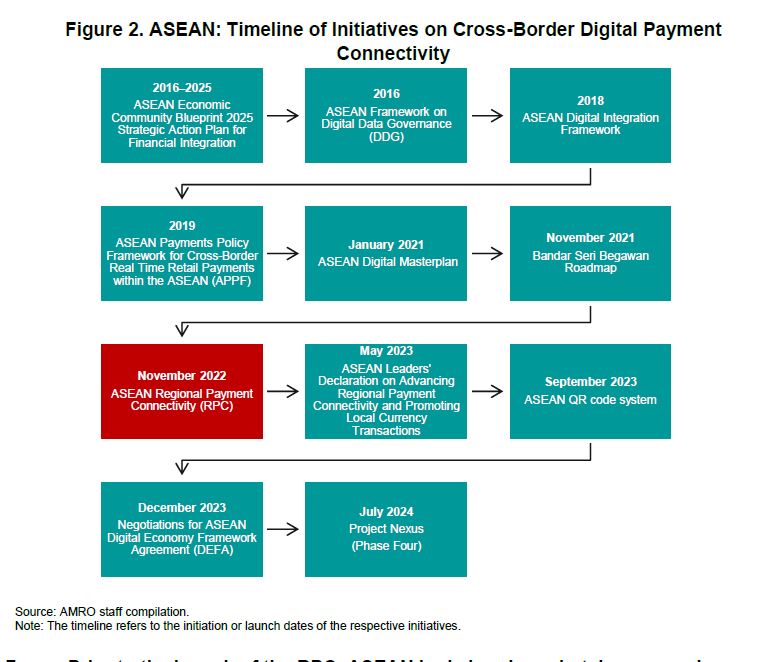

Cambodia’s inclusion in the ASEAN Regional Payment Connectivity (RPC) initiative has been spotlighted in a new policy report by the ASEAN+3 Macroeconomic Research Office (AMRO), titled Powering Payments: The Role of Technology in ASEAN’s Regional Payment Connectivity Initiative. Released in June 2025, the report details the evolving digital payment landscape in Southeast Asia and emphasizes how emerging economies like Cambodia are leveraging technology to integrate with broader regional systems.

The RPC initiative, which Cambodia officially joined in April 2025, is a multilateral effort to enhance cross-border payments across ASEAN. AMRO’s report outlines how digital infrastructure upgrades, coupled with regulatory cooperation, are enabling faster, cheaper, and more inclusive financial transactions—especially for micro, small, and medium-sized enterprises (MSMEs) and cross-border consumers.

Cambodia’s Integration into the ASEAN Payment Grid

Originally launched by the ASEAN-5 (Indonesia, Malaysia, the Philippines, Singapore, and Thailand) in 2022, the RPC has now expanded to nine member states with Cambodia’s entry. The initiative is built around linking national fast payment systems through real-time networks and QR-code compatibility.

KHQR, Cambodia’s universal QR code standard, plays a central role in the country’s integration. It is already operational with several regional partners, including Thailand, Vietnam, Malaysia, and Lao PDR. Cambodia has also partnered with Alipay+ to enable payments from users across China, Korea, Singapore, and beyond.

AMRO’s report highlights that these developments not only enhance retail transactions but also reduce transaction fees, improve financial transparency, and support broader financial inclusion goals. For Cambodia, where cash transactions still dominate and cross-border remittances remain critical, the shift represents a meaningful leap forward.

Enabling Financial Inclusion and Currency Diversification

A key objective of the RPC—also echoed in the AMRO report—is to encourage the use of local currencies for regional payments. This supports the ASEAN Leaders’ Declaration on Advancing Regional Payment Connectivity and Promoting Local Currency Transactions, which Cambodia endorsed during the 2023 ASEAN Summit.

For local MSMEs and remittance receivers, interoperable QR-based systems help address long-standing barriers, making cross-border transactions more affordable and accessible. These developments support the broader agenda of financial inclusion in Cambodia, as championed by the National Bank of Cambodia.

Regional Cooperation and the Road Ahead

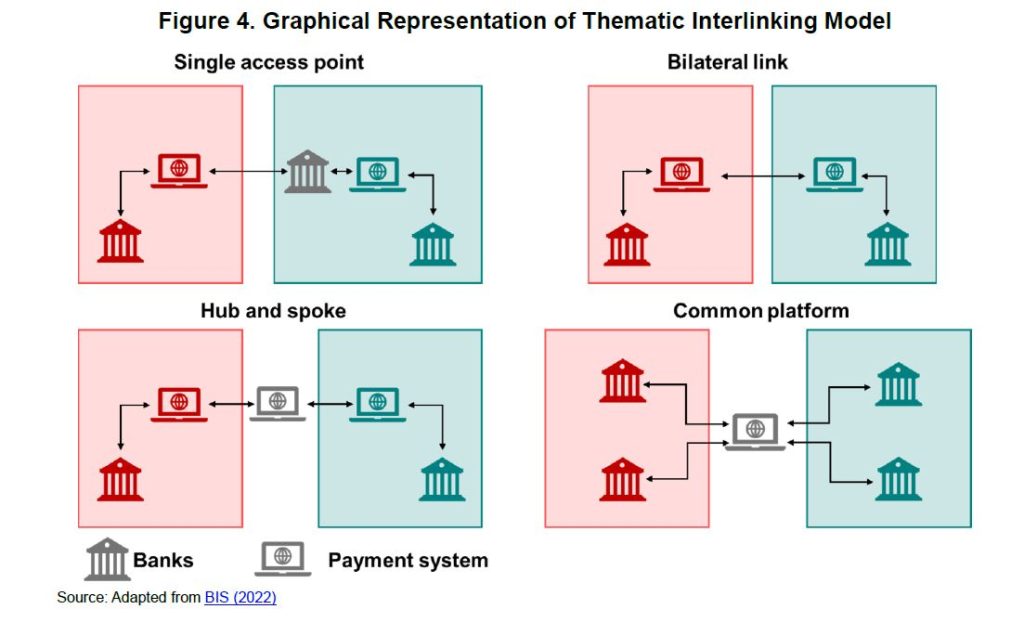

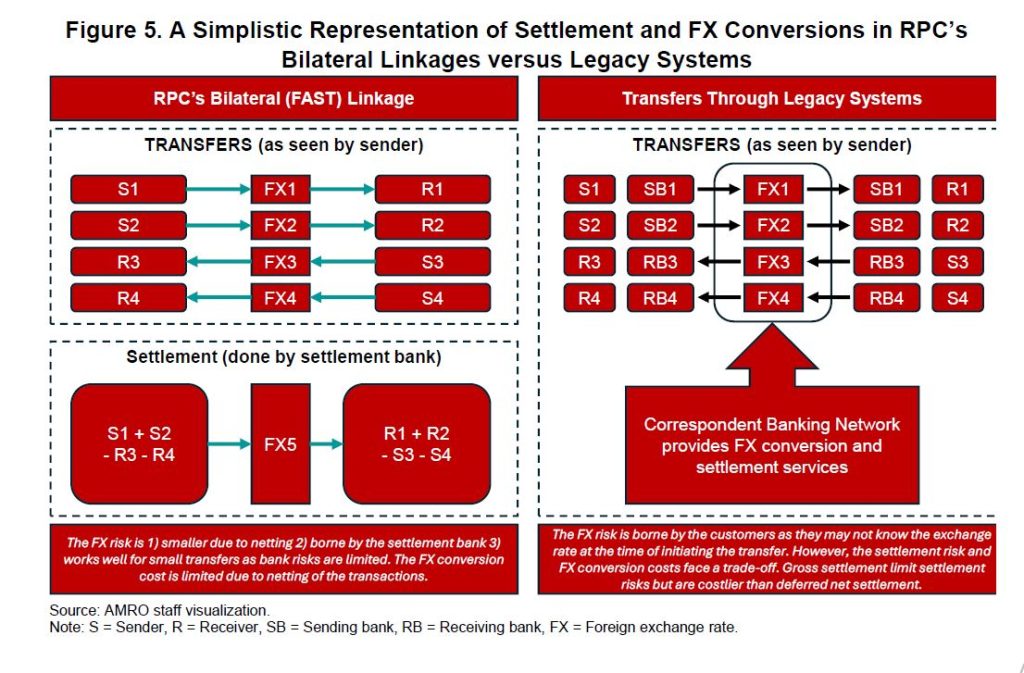

The AMRO report also draws comparisons with global payment systems such as TARGET Instant Payment Settlement (TIPS) in Europe and PAPSS in Africa—both of which offer centralized management models. In contrast, ASEAN’s RPC continues to operate on a decentralized, bilateral model, where each member negotiates and maintains individual payment links.

To stay aligned and scalable, Cambodia must continue harmonizing its domestic systems with global standards like ISO 20022, which the National Bank of Cambodia has already adopted for both its Bakong system and KHQR.

The report also references Project Nexus, a multilateral initiative by the Bank for International Settlements Innovation Hub (BISIH), which could become a future model for ASEAN. Instead of multiple bilateral links, countries would connect to a single hub. Cambodia’s growing digital maturity positions it as a likely participant in future expansions of such platforms.

Conclusion: Cambodia Steps Forward in ASEAN’s Digital Future

The AMRO report underscores Cambodia’s rising profile in the region’s digital economy. By joining the RPC and enhancing its payment infrastructure, Cambodia is not just modernizing its domestic financial system—it is cementing its role in ASEAN’s push toward a unified, inclusive, and digital financial future.

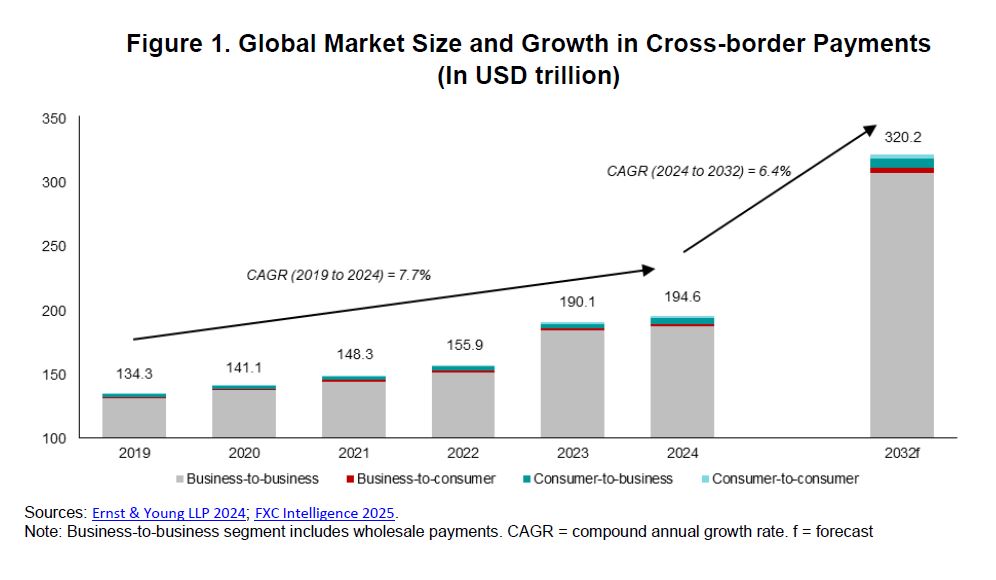

With the ASEAN digital economy forecasted to reach USD 2 trillion by 2030, initiatives like the RPC will be critical to unlocking that growth. Cambodia’s proactive participation—underpinned by technology, policy, and international collaboration—signals its readiness to help shape Southeast Asia’s evolving fintech landscape.