Cambodia Investment Review

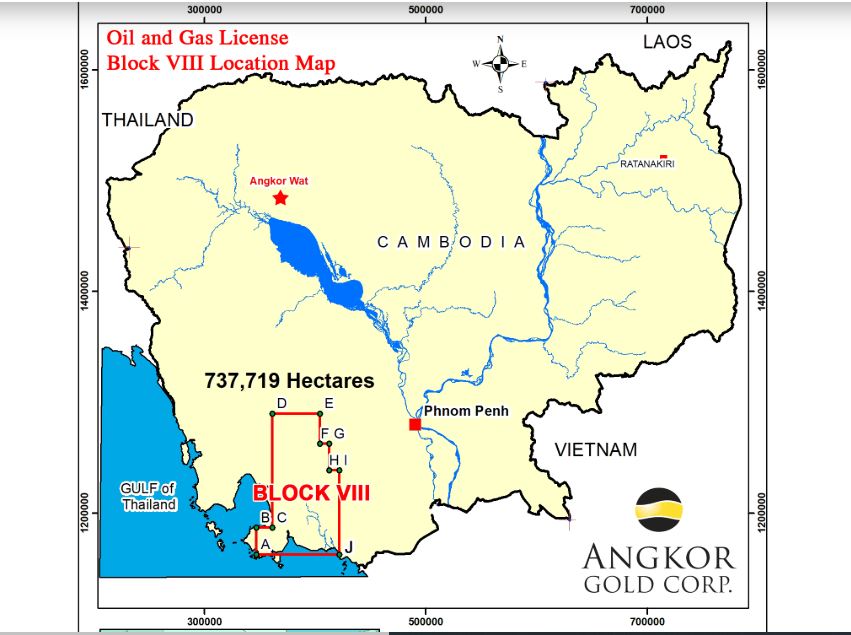

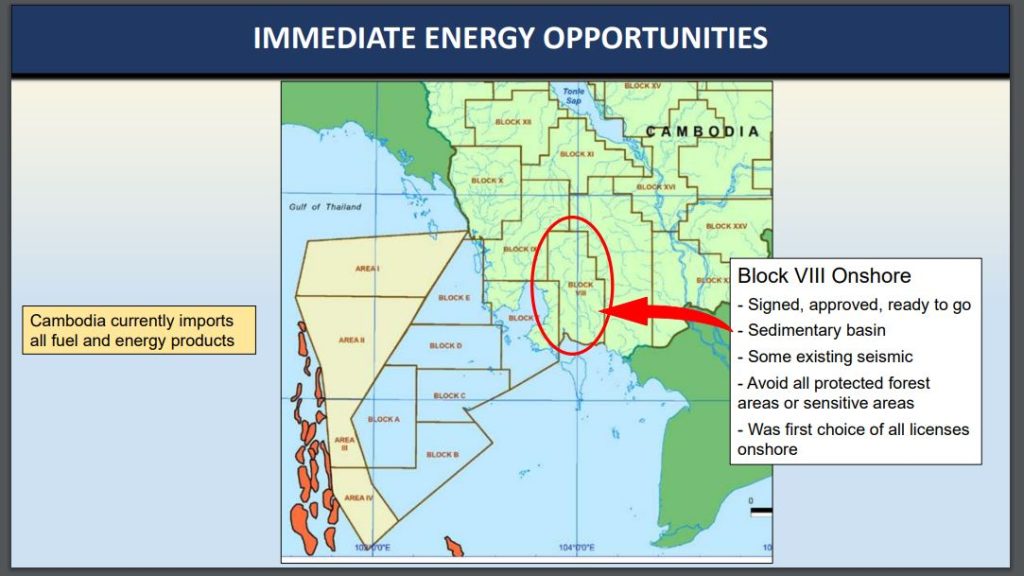

Angkor Resources Corp. (TSXV: ANK), a Canada-listed company, has announced that its Cambodian subsidiary, EnerCam Resources Co. Ltd. Cambodia (ECC), has received official approval from Cambodia’s Ministry of Mines and Energy (MME) to advance its onshore Block VIII oil and gas project.

The approval, granted on March 9, 2025, allows EnerCam to proceed with exploration activities aimed at confirming commercial oil resources in Cambodia. Following the announcement, Angkor’s stock has experienced a significant rally, rising 165% year-to-date to reach CAD 0.26 as of March 18, 2025—up from CAD 0.10 at the start of the year.

Project to Support Energy Independence and Economic Growth

Angkor CEO Delayne Weeks expressed optimism about the project’s potential impact on Cambodia’s economy and energy sector.

“Our goal is to prove commercial oil resources that could lead Cambodia to produce its own energy, reducing dependency on imports,” Weeks said. “This project could drive vocational education and GDP growth by creating new industries in areas like transportation, steel fabrication, refineries, and environmental management.”

The Block VIII project could mark Cambodia’s first-ever onshore oil production, setting the stage for long-term energy independence and positioning the country as a potential oil exporter in the future.

Exploration Plan and Seismic Survey

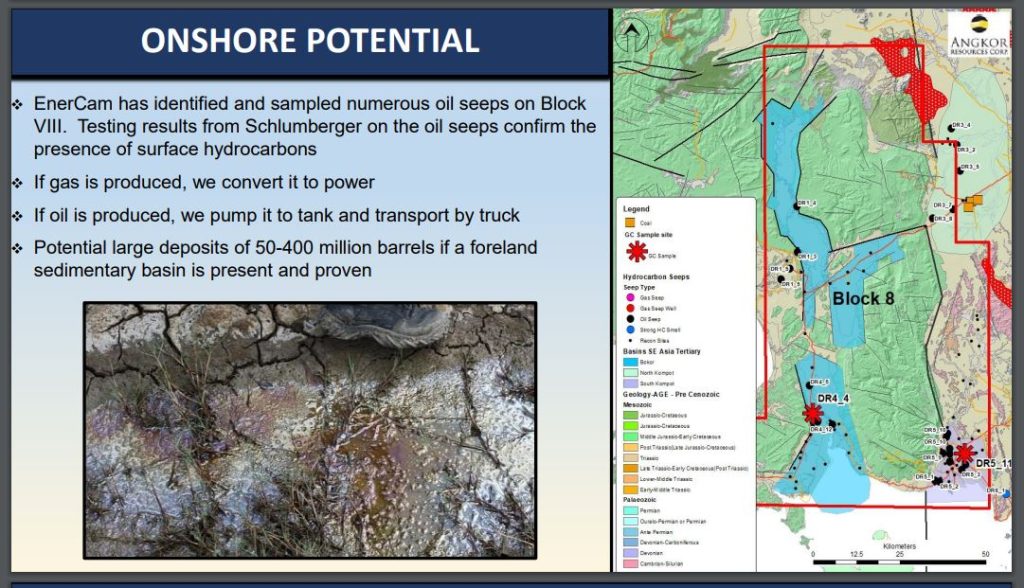

With approval secured, EnerCam will begin an Environmental Impact Assessment (EIA) immediately. This will be followed by acquiring 350 kilometers of 2D seismic data in late spring, with analysis scheduled during the rainy season. Based on the results, the company will decide whether to move directly into exploratory drilling or conduct further seismic work, potentially including 3D imaging.

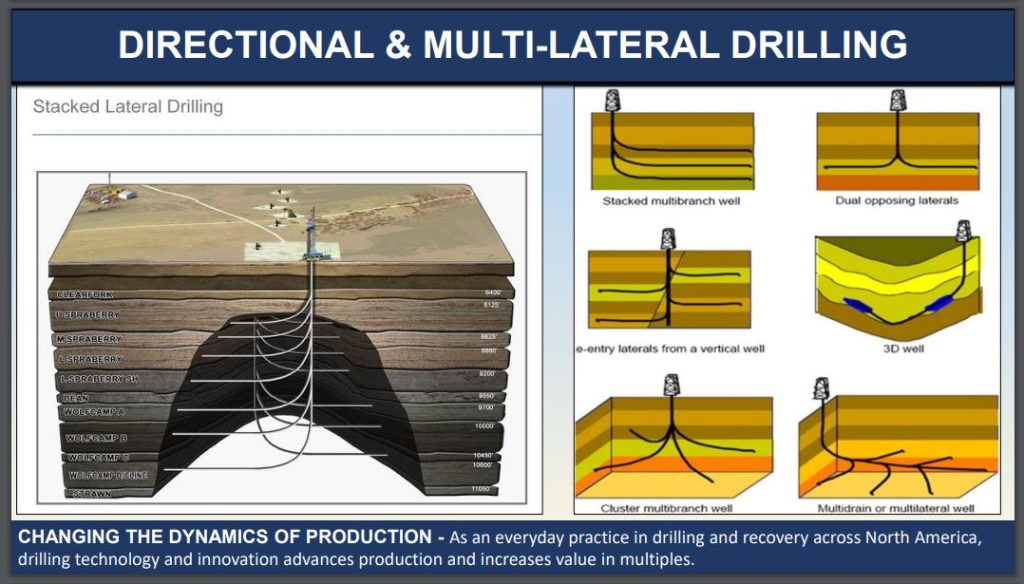

No exploratory oil or gas wells have been drilled onshore in Cambodia to date, making the project a significant milestone for the Kingdom. Initial exploratory wells will be drilled vertically or directionally based on seismic interpretations.

Terms of the Production Sharing Agreement

The project is governed by a 30-year Production Sharing Agreement (PSC) with the Cambodian government, which includes:

- A 12.5% royalty on gross oil sales

- A corporate profit tax of 30%

- Obligations for training local engineering staff and government personnel

- Minimum annual work commitments with deposits made to ABA Bank, owned by the National Bank of Canada

EnerCam has also committed to annual administrative and surface rental fees, capacity development contributions, and a signing bonus as required by the MME.

After years of preparatory work, Angkor strategically relinquished ecologically sensitive areas from the original license, retaining a 3,729 square kilometer zone that includes key oil seep prospects. “Our team prioritized the most prospective areas while reducing costs and focusing on targets with the highest potential,” Weeks noted.

Fast-Tracking the Program with New Investment

EnerCam recently secured additional funding through a strategic alliance with 358140 Alberta Ltd. The agreement is expected to accelerate the project’s exploration and development timeline—initially set for six years—to potentially less than half that duration.

A major focus of the project is workforce development, with plans to train Cambodian nationals for future oil and gas sector employment.

EnerCam Cambodia was incorporated in January 2020 to meet local licensing requirements for natural resource projects. The company will oversee all exploration, development, and production activities in Block VIII.

Investor sentiment towards Angkor Resources has surged following the project announcement. The company’s stock price climbed sharply, reaching CAD 0.26 on March 18, 2025—a 165% increase year-to-date. The rally gained momentum after the March 13 update, when shares jumped from CAD 0.20.

Separately, Angkor Resources announced it has granted 1.5 million stock options to a director and two consultants, exercisable at CAD 0.15 per share. The director’s options are valid until March 2030, while the consultants’ options expire in March 2027.