Cambodia Investment Review

Knight Frank Cambodia has released its H2 2024 Cambodia Real Estate Market Report, highlighting the country’s continued economic expansion, a significant rise in `industrial inquiries, and steady foreign direct investment (FDI) inflows. The report reveals a sharp increase in manufacturing relocations to Cambodia, driven by global trade realignments and geopolitical shifts following the U.S. presidential election.

Economic Growth and Export Performance

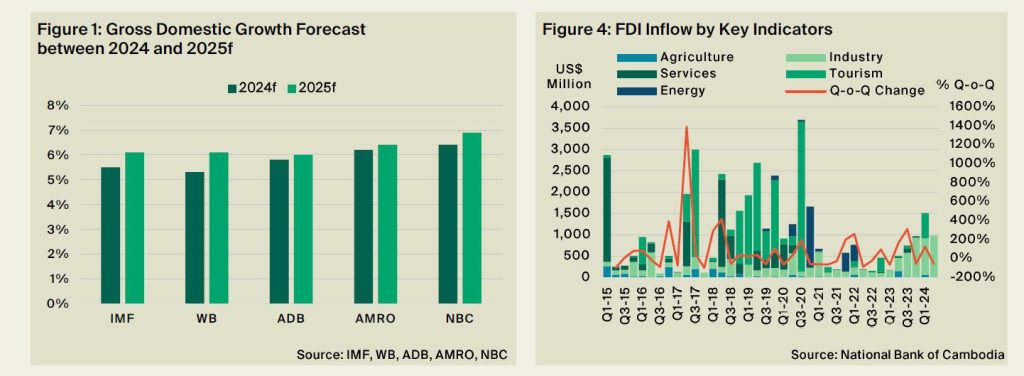

According to Knight Frank Cambodia’s H2 2024 report, Cambodia’s economy grew at 5.5% in 2024, supported by strong external demand, robust export growth, and a full recovery in international tourism. The country’s exports rose 16.8% year-on-year, reaching $23.93 billion in the first 11 months of 2024, with the United States remaining Cambodia’s largest trading partner at $9 billion, followed by Vietnam ($3.2 billion) and China ($1.6 billion).

The tourism sector also rebounded, with international arrivals surpassing pre-pandemic levels at 6.7 million visitors, strengthening demand across the hospitality, retail, and commercial real estate sectors.

Investment activity remained strong, with foreign direct investment (FDI) projects reaching $1.13 billion, up 24.3% year-on-year, and domestic investment surging 244.4% to $1.31 billion.

Surge in Industrial Inquiries as Firms Seek Alternatives to China

A key highlight of Knight Frank’s H2 2024 report is the sharp increase in industrial inquiries, particularly from companies looking to relocate from China amid shifting global trade policies and supply chain disruptions.

“We have observed a significant rise in industrial inquiries following the U.S. presidential election. Many companies are exploring Cambodia as an alternative manufacturing hub, particularly as Vietnam faces increasing logistical challenges and higher operational costs,” said Ross Wheble, Country Head of Knight Frank Cambodia.

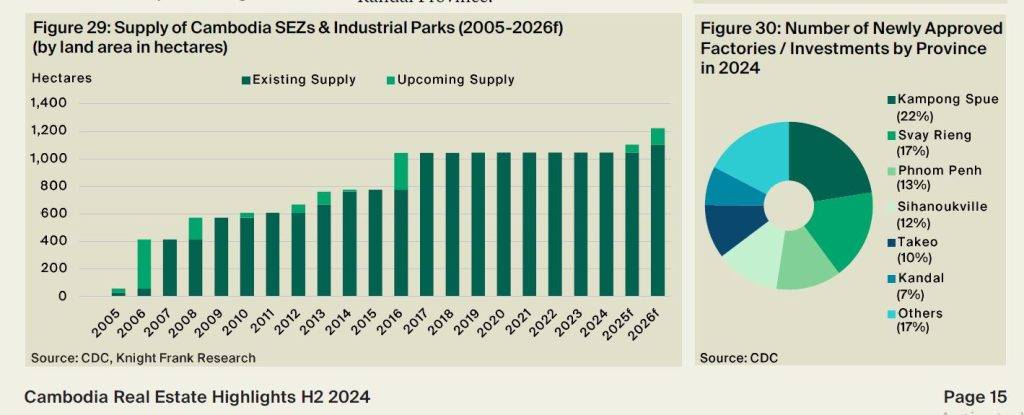

The manufacturing sector accounted for 69% of newly approved investment projects in 2024, as Cambodia’s cost-competitive workforce and investor-friendly policies continued to attract foreign enterprises.

The Special Economic Zones (SEZs) in Phnom Penh and Kandal Province played a critical role in attracting new investments. Key SEZs include:

- Phnom Penh Special Economic Zone (357 hectares) – Home to over 120 manufacturing facilities.

- Sovannaphum SEZ (205 hectares) – Strategically located along National Road 1 for industrial expansion.

- Goldfame Park Shun SEZ (80 hectares) – Specializing in light manufacturing.

Notably, Toyota’s new assembly plant is set to commence operations within Phnom Penh SEZ, reinforcing Cambodia’s growing role in global supply chains.

Real Estate Market Trends: Industrial, Office and Condominium Sectors Show Strength

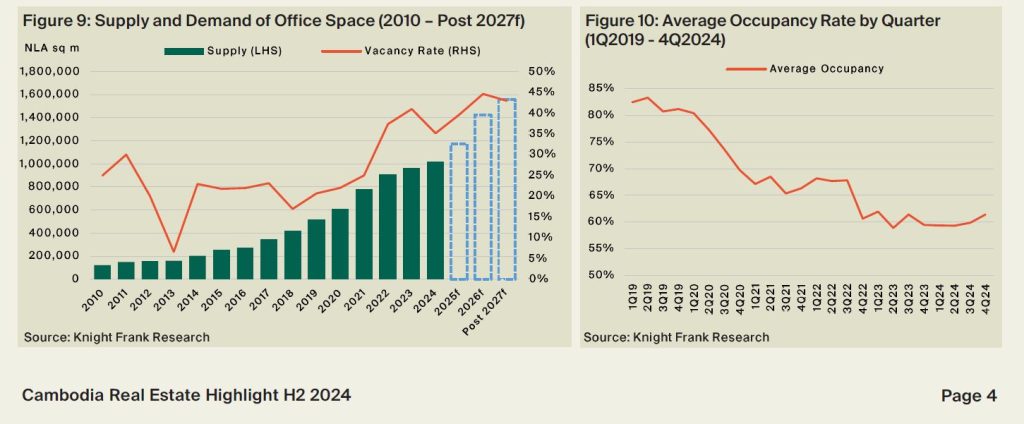

While Cambodia’s landed residential real estate sector faces corrections, the industrial, office and condominium segments have shown signs of improvement. The Phnom Penh office market grew by 5.5% in 2024, adding 51,441 square meters of net lettable area (NLA), as more international firms established operations in the Kingdom, whilst the first quarter sales rate of newly launched condominium projects hit 29%, the highest level since H1 2019. This was largely due to a significant pricing correction during the past five year, indicating that it is not an oversupply of condominiums in Phnom Penh but an oversupply of overpriced projects.

Read More: Knight Frank Report: Cambodia’s Data Centre Market Set for Exponential Growth

“There is steady demand for premium office space in Phnom Penh, especially from international firms. Developers must focus on balancing supply with actual occupancy rates,” Wheble added.

Meanwhile, the retail sector continues to face challenges, with occupancy rates falling to 64.5%, down 3.5 percentage points from H2 2023, reflecting a shift toward e-commerce and experiential retail models.

Outlook for 2025

Looking ahead, Knight Frank forecasts Cambodia’s GDP to grow between 5.5% and 6.0% in 2025, with continued industrial expansion, export growth, and tourism recovery. FDI inflows are expected to remain strong, driven by increasing interest in Cambodia’s industrial and logistics sector. .

“Cambodia is positioning itself as a key regional investment destination. With a competitive labour force, favourable policies, and improving infrastructure, we expect continued growth in the industrial and logistics sectors,” Wheble concluded.

As multinational firms reevaluate their supply chain strategies, Knight Frank’s H2 2024 report underscores Cambodia’s increasing significance as an industrial and investment hub in Southeast Asia.

For further information, please contact:

Ross Wheble

Country Director, Knight Frank Cambodia

📧 ross.wheble@knightfrank.com

📞 +855 (0) 23 966 878

About Knight Frank Cambodia:

Knight Frank is a global leader in real estate consultancy, offering expert market analysis, investment advisory, and property solutions across Cambodia and the Asia-Pacific region. Visit www.knightfrank.com.kh for more insights.