Cambodia Investment Review

At the EuroCham Transportation & Logistics Forum 2025, a comprehensive survey on Cambodia’s logistics costs, conducted by the General Department of Logistics (GDL) under the Ministry of Public Works and Transport (MPWT), provided a detailed analysis of the country’s transport and logistics landscape. The survey, led by Mr. Sor Yilin, Director of the Department of Logistics Monitoring and Evaluation, aimed to evaluate cost structures, time efficiency, and logistics service levels across multiple transportation modes and trade routes.

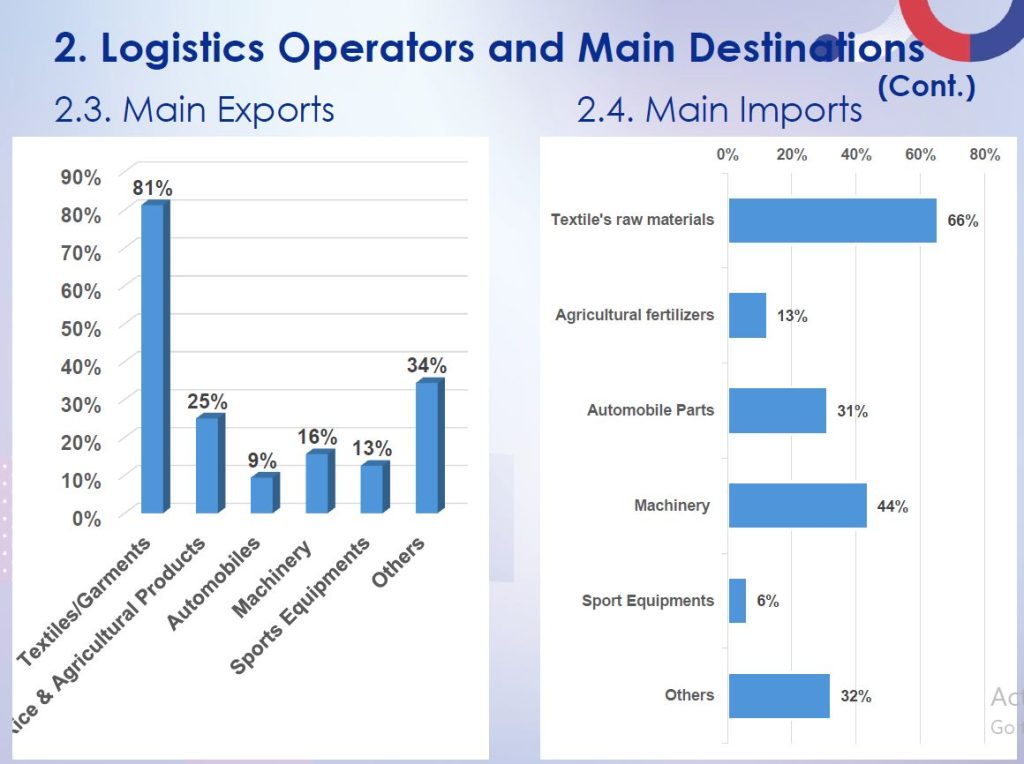

Logistics Operators and Main Destinations

The survey revealed that logistics companies dominate the sector (63%), followed by freight forwarders (25%) and shipping lines (19%). The primary destinations for Cambodian exports include China (66%), Thailand (50%), Japan (50%), and Europe (59%), highlighting the growing trade relationships between Cambodia and these key markets.

Read More: DFDL Cambodia Launches Comprehensive Customs Guidebook for 2025

Transport Modes and Costs

The survey assessed the cost and efficiency of transport across various routes and methods. Shipping remains the most utilized transport mode (84%), followed by trucking (72%) and air freight (50%). Rail transport (6%) was noted as an underutilized mode, despite its potential to reduce costs.

For cross-border trade, the cost of exporting and importing a 40-foot container varied across major checkpoints:

- Bavet border: Export ($416), Import ($381)

- Prey Vor border: Export ($234), Import ($244)

- Poipet border: Export ($546), Import ($402)

For domestic transport, the cost of moving a 40-foot container was:

- Phnom Penh – Sihanoukville (Road: $287, Rail: $165)

- Phnom Penh – Poipet (Road: $700)

- Phnom Penh – Vietnam border (Bavet) (Road: $410)

For international shipping, transporting a 40-foot container from Cambodia costs:

- Singapore (3 days, $508)

- Yokohama (17 days, $1,933)

- Shanghai (13 days, $1,175)

- Los Angeles (36 days, $8,255)

- Rotterdam (36 days, $8,655)

Logistics Service Performance

The study assessed three key dimensions of logistics services:

- Cost (25%): Identified as a critical factor for operators.

- Time (31%): Delays in transport remain a significant issue.

- Reliability (44%): A major concern, particularly regarding customs processing and infrastructure.

The quality of road infrastructure, port services, and logistics reliability were rated moderate, with major concerns surrounding tracking systems and customs processing efficiency.

Challenges and Opportunities

The survey outlined key barriers to logistics efficiency:

- High transport costs, particularly for cross-border shipments.

- Inadequate rail infrastructure, limiting cost-effective alternatives to road transport.

- Border crossing delays, impacting export-import times.

- Limited availability of warehousing and distribution centers.

On a positive note, the Cambodian government has initiated several improvements to streamline logistics:

- Phnom Penh-Sihanoukville Expressway to enhance domestic connectivity.

- Expansion of port facilities at Sihanoukville and Phnom Penh Autonomous Ports.

- Reduction of port fees and electronic data interchange (EDI) implementation.

Future Outlook

The General Department of Logistics is set to release updated reports on logistics costs, time efficiency, and service quality in 2024 and 2025. The government aims to further reduce logistics costs and improve infrastructure, aligning with Cambodia’s goal of achieving upper-middle-income status by 2030.

As Cambodia strengthens its logistics sector, public-private partnerships will play a key role in addressing inefficiencies and enhancing the country’s position as a regional logistics hub.