Cambodia Investment Review

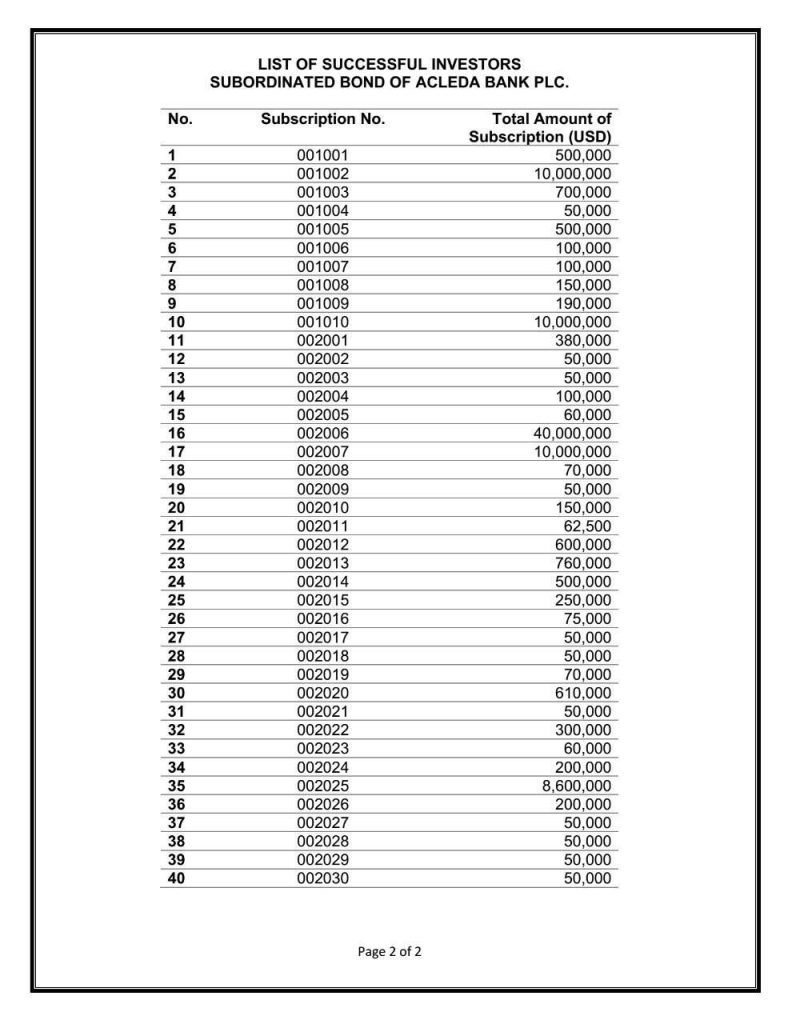

ACLEDA Bank Plc. has completed the first tranche of its subordinated bond issuance, raising USD 85.8 million. The issuance is the largest transaction in Cambodia’s capital market to date, contributing to the development of the country’s financial sector.

Underwritten by RHB Securities (Cambodia) Plc., the bond issuance was finalized on January 22, 2025, following approvals from the National Bank of Cambodia and the Securities and Exchange Regulator of Cambodia. The bond offers a fixed coupon rate of 8.5% per annum with a seven-year tenure. The total proposed issuance is capped at KHR 400 billion (approximately USD 100 million), with the final tranche scheduled for subscription in March 2025.

Supporting Long-Term Capital Raising

Ranarith Iv, CEO of RHB Securities (Cambodia) Plc., highlighted the role of subordinated bonds in helping banks meet their capital requirements and loan growth. “Subordinated bonds are financial instruments commonly used by banks worldwide to strengthen their capital base,” he explained. “Our objective is to contribute to the development of a domestic market that allows banks to raise long-term capital efficiently.”

Iv noted that the transaction required navigating regulatory approvals and addressing Tier 2 capital criteria. The bond attracted a broad range of investors, including commercial banks, insurance companies, and both local and foreign individual investors.

Implications for Investors

According to Taihy Try, a spokesperson for the Cambodia Securities Exchange (CSX), the bond issuance provides another option for portfolio diversification in the market. “Investors can benefit from holding bonds, which provide fixed coupon payments, alongside stocks that offer dividends and capital gains,” he said. Try also noted that ACLEDA Bank’s stock price is currently seen as undervalued, presenting additional opportunities for investors.

The bond issuance is expected to enhance ACLEDA Bank’s ability to meet its funding needs and support Cambodia’s economic growth. It also represents a step forward for the country’s capital market, demonstrating its potential to facilitate larger-scale fundraising initiatives.

ACLEDA Bank’s successful bond issuance reflects growing investor confidence in Cambodia’s financial sector and offers a framework for future bond offerings in the domestic market.