Cambodia Investment Review

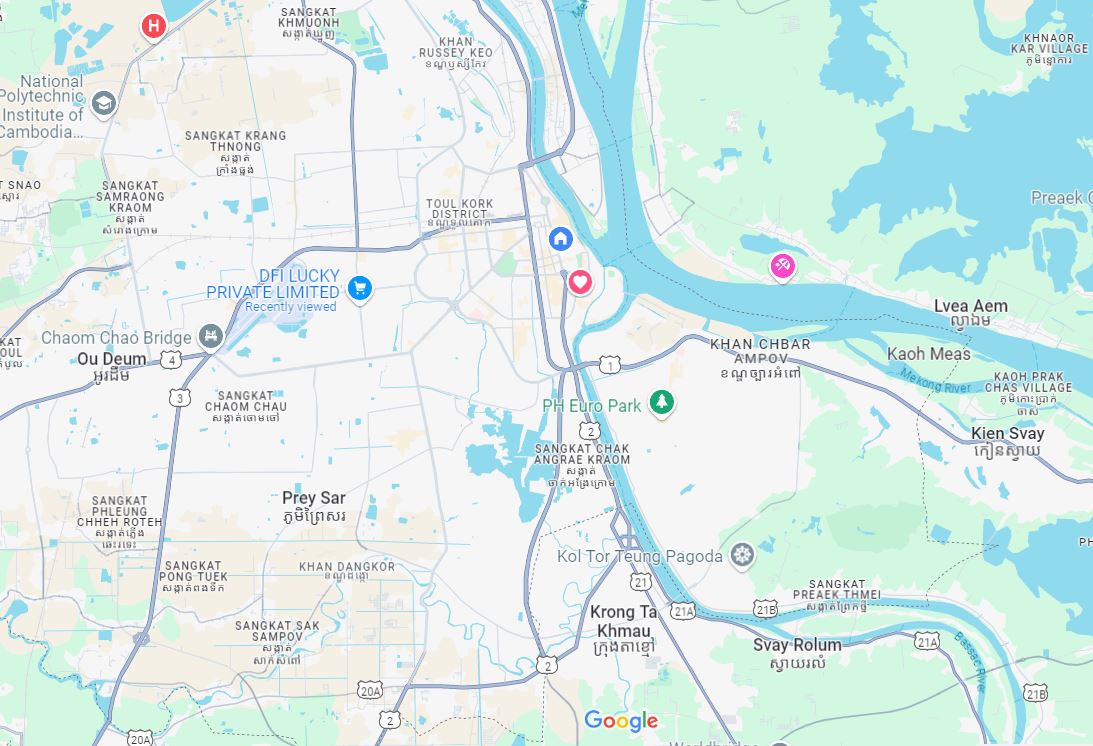

Phnom Penh’s land prices continued to vary significantly across districts in the second half of 2024. The latest data by CBRE Cambodia reveals varying land prices across different districts, with central areas like Daun Penh and Chamkarmon remaining high-demand zones, while emerging districts such as Russey Keo and Kamboul offered lower-cost options for residential and commercial development.

Central Location Retain Values Due to Scarcity

In Daun Penh, one of the most commercially vital districts, average land prices have held steady, ranging from $3,000 to $8,500 per square meter. This area continues to see demand from both local and international developers, drawn by its prime location near government institutions and business centers. Key communes such as Srah Chak and Phsar Thmei are seeing a boost in development, contributing to the area’s high land value.

Read More: CBRE Report Highlights Unique Dynamics of Cambodia’s Real Estate Market in 2024

Similarly, Chamkarmon district, home to a mix of residential and business properties, reported land prices ranging from $2,500 to $5,500 per square meter. The district’s central location, well-established infrastructure, and continued growth in both commercial and residential sectors have made it a prime destination for real estate development. Tonle Basak and Toul Tumpung are among the communes driving the growth in this district.

Meanwhile, Toul Kork and Sen Sok have seen growing interest from developers, with land prices average around $2,500 to $3,500 in Toul Kork and $900 to $1,300 in Sen Sok. The growth of interest in these areas is attributed to expanding infrastructure and a growing population, both of which have made these districts become more viable for mixed-use developments. Toul Kork is especially appealing due to its proximity to Phnom Penh International Airport and major roadways, making it a favorable spot for mid-range residential and commercial projects. Similarly, Sen Sok has attracted considerable interest from developers due to its vast availability of land and ongoing infrastructure improvements.

Residential Developments More Popular As Transportation Links Improve

On the more affordable side, Chroy Changvar and Dangkao offer land at lower prices compared to the central districts. In riverfront Chroy Changvar commune, land is priced between $1,500 to $2,500 per square meter, and in Dangkao, prices range from $200 to $600 per square meter. While still in the early stages of urban development, both districts are seeing growing demand for residential spaces, with Chroy Changvar benefiting from its proximity to the Mekong River and Dangkao becoming a popular choice for affordable residential developments due to its improving transportation links.

At the furthest peripheries, Russey Keo and Kamboul districts reported some of the lowest land prices in the city. Russey Keo saw prices averaging $800 to $1,000 per square meter, while Kamboul averaged $80 to $150 per square meter. Though still largely rural, these areas are gaining attention from developers as Phnom Penh’s urban sprawl extends outward. Russey Keo in particular has experienced a surge in demand for residential projects, driven by the increasing population and the gradual rollout of infrastructure projects.

Phnom Penh’s Continues To Show Resilience & Adaptability

Kinkesa Kim, Managing Director of CBRE Cambodia, commented on the findings, stating, “Phnom Penh’s real estate market continues to show resilience and adaptability. The varied land prices across districts reflect the city’s diverse investment opportunities, catering to both high-end and budget-conscious investors.”

Despite the current economic slowdown and challenges in the real estate market, there are signs of cautious optimism. Kinkesa Kim noted, “While the market is experiencing a slowdown, the fundamentals remain strong. The ongoing infrastructure projects and government incentives are expected to support the market navigate this challenging time. However, we anticipate a period of stabilization in central locations and some corrections in peripheral locations.

Kim also highlighted the importance of strategic investments and careful planning during this period. “Investors should focus on areas with strong growth potential and infrastructure support. The market correction we are witnessing is a healthy adjustment, ensuring long-term sustainability and preventing overheating.”

As Phnom Penh’s real estate sector grows in both established and emerging districts, developers and investors are taking note of the opportunities across the capital. With land prices in the central areas expected to remain high due to scarcity and continued demand for residential and commercial spaces, peripheral districts represent more affordable, yet promising, investment opportunities as the city’s urbanization continues to expand.