Cambodia Investment Review

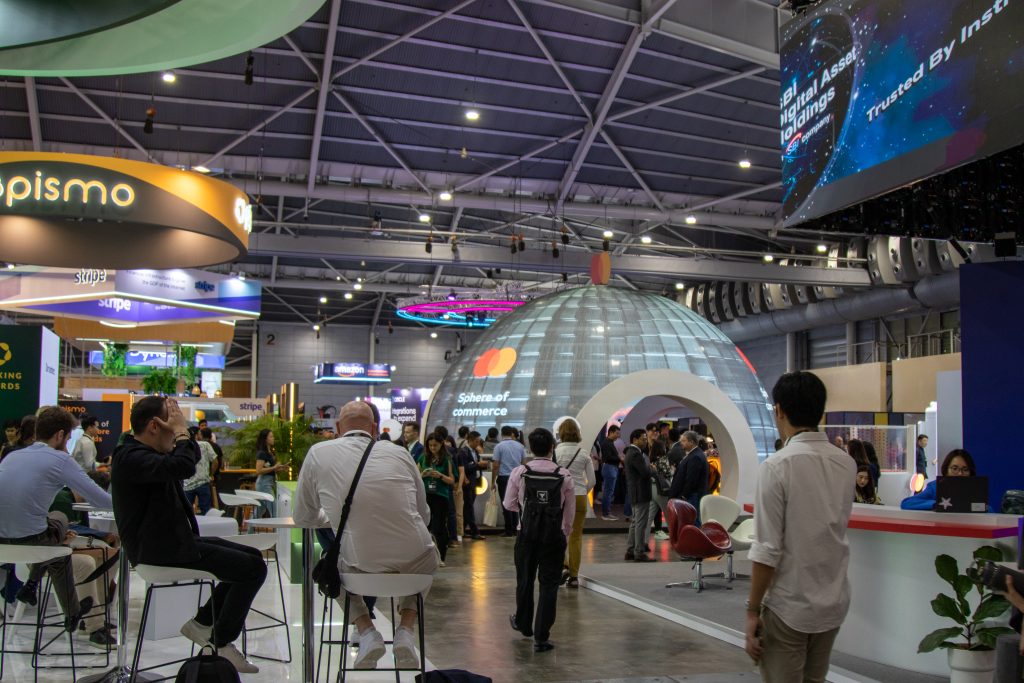

Cambodia made significant strides in the digital finance arena at the Singapore FinTech Festival (SFF) 2024, which took place from November 6-8, 2024. The festival’s ninth edition saw 65,000 participants from 134 countries and regions in attendance, which included around 40 delegates from Cambodia representing various financial institutions.

A key highlight was a panel discussion moderated by Pat Patel, Executive Director of the Global Finance & Technology Network (GFTN), which H.E. Dr. Chea Serey, Governor of the National Bank of Cambodia (NBC) took part in, alongside the Minister of ICT and Innovation of the Republic of Rwanda and senior representatives of Ant International, Amazon and GCash.

Read More: CamTech Summit 2024: Celebrating Five Years of Fintech Innovation and Sustainability

Accelerate Financial Inclusion of Small and Medium-Sized Enterprises

The discussion focused on strategies to accelerate financial inclusion of small and medium-sized enterprises (SMEs) globally through digital financial services. Dr. Serey touched on how launching the Bakong digital payment infrastructure during the COVID-19 pandemic had a positive impact on SMEs, as it not only made the transition to online business easier, but also allowed many SMEs to get access to crucial financial services.

“Every shop, every small street vendor now has a QR code, and this is very important, because, yes, it’s easier to make payment, but the fact that these SMEs have decided to open bank accounts also helps them to be more visible to the banks,” shared Dr. Serey. “I’ve interviewed some banks, and they’ve decided to lend to those SMEs, particularly during times of challenge, based on their self-employment revenue and what they see in the account transactions… This is why we really want to encourage digital payments, not just for the payment itself, but also as it provides access to other financial services within financial institutions.”

Regarding what the Cambodian government and the NBC are currently working on to further enhance access to finance for SMEs, Dr. Serey mentioned the newly established SME Bank and Credit Guarantee Scheme, new cross-border payment partnerships with regional FinTech giants like Alipay+, and the Financial Transparency Corridor (FTC) partnership that the NBC has established with the Monetary Authority of Singapore (MAS).

A follow-up meeting and workshop on the FTC was also held between key stakeholders, including the NBC, MAS, Liquid Group, Proxtera, UNDP, and other participating financial institutions. From the Cambodian side, this meeting was attended by H.E. Ouk Sarat, Deputy Governor of the NBC, and representatives of the five participating Cambodian banks – ABA, Wing Bank, ACLEDA Bank, Sathapana Bank and Phillip Bank.

Discussions centred on the progress made since the MOU signing on the FTC, identifying what main challenges persist, and outlining plans to further support SMEs through digital financial solutions. Overall, the FTC collaboration aims to leverage technology to enhance financial inclusion and drive economic growth in both Cambodia and Singapore.

Other Notable Cambodian-Related Developments At SFF 2024

- Mastercard’s unveiling of ‘Pay Local’ – This new service allows travellers to link their Mastercard credit or debit cards to local digital wallets, including Bakong in Cambodia. Following the conclusion of the SFF, it was also announced on November 11 that tourists can now link their Mastercard to the Bakong Tourists App, which was launched by the NBC in August.

- Liquid Group’s launch of roamQR – This cross-border payment solution is set to expand to Cambodia in Q1 2025, facilitating seamless QR code payments between countries.

Reflecting on Cambodia’s presence at SFF 2024 as well as the country’s deepening ties with Singapore in the FinTech space, Sophoan Rath, Chairman of the Association of Banks in Cambodia (ABC), shared that he believes Cambodia stands to benefit a lot from this ongoing partnership.

“Singapore has been a trading hub in the region for a long time, it is a regional financial centre, and is now emerging as a regional digital and FinTech hub – Cambodia can benefit from the linkage with Singapore through access to new technologies, investors, capital and investments,” said Sophoan.

He further highlighted the unique benefit Cambodia’s young digital payment infrastructure offers to foreign investors.

“When investors come to Singapore, it’s not just for Singapore itself. Investors are looking to invest in the region, and Cambodia can potentially become one of the investment destinations… or countries for FinTech companies to [establish and] bring new technologies. Because one of the benefits we have is that our banking industry is still in an early stage compared to other more mature markets, so we don’t have a legacy system to address. This means Cambodia could, in fact, leapfrog to the latest technologies being created,” Sophan added.

Overall, SFF 2024 provided an ideal regional platform for Cambodia to showcase its commitment to digital finance and strengthen international partnerships to accelerate its ongoing FinTech journey.