Cambodia Investment Review

Phnom Penh’s real estate market is shaped by a distinct set of conditions that make it unique in Southeast Asia, according to CBRE’s Cambodia Market Report 2024. Low barriers to entry, limited regulation, and a “villa culture” are among the primary factors influencing both office and residential property trends in the capital. These conditions create opportunities but also pose challenges, as developers and investors navigate a fragmented and emerging market.

Unique Characteristics of Phnom Penh’s Real Estate Market

One of the most striking characteristics of Phnom Penh’s real estate market is the low barriers to entry for developers. The city’s lack of stringent regulations around zoning, building design, usage, and height restrictions allows developers a degree of flexibility not often seen in neighboring markets. However, this also contributes to fragmented decision-making, where developments can vary greatly in quality and focus.

Another unique factor is Phnom Penh’s villa culture, which has persisted despite the city’s growing urbanization. Unlike other Southeast Asian capitals that emphasize high-rise residential developments, Phnom Penh has maintained a strong preference for low-rise, expansive villas. This preference affects the development of both residential and office spaces, where high-density, vertical developments are not as common.

Additionally, the market is characterized by a small pool of multinational corporations (MNCs), which impacts demand for office spaces. The city has a relatively small number of large-scale office space users, keeping the demand niche. While global trends such as work-from-home (WFH) have reshaped real estate needs in other cities, the WFH movement has not gained significant traction in Phnom Penh, keeping office space demand relatively stable.

The absence of large-scale public transport systems like MRT, BTS, or MTR also contributes to the city’s unique development. Without these transportation networks, Phnom Penh’s expansion has been more horizontal than vertical, and commuting remains highly car-dependent, further reinforcing the villa culture.

Limited Regulation and Speculative Development

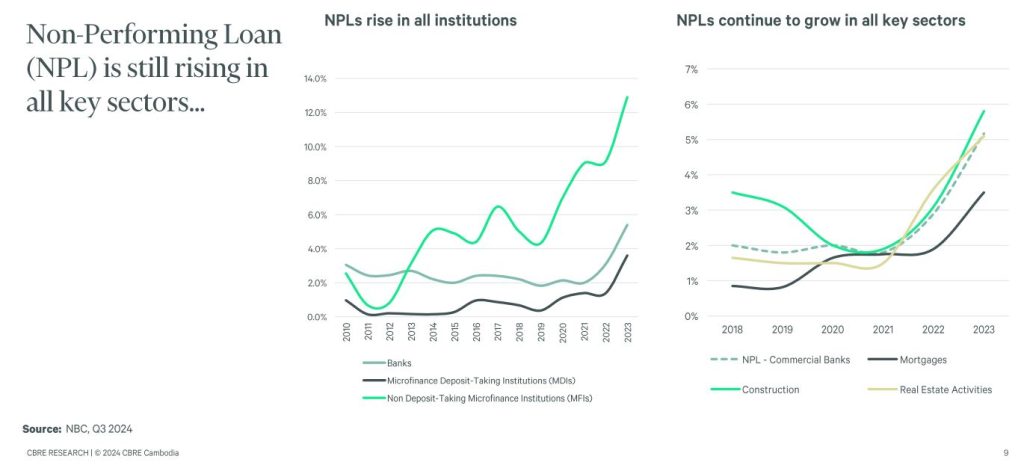

Phnom Penh’s regulatory environment provides developers with a high degree of flexibility, but it also limits oversight. There are few regulations on developers’ obligations, which has led to speculative building projects. Many developments have been fueled by historically easy access to credit and construction loans, contributing to rapid, but sometimes unchecked, growth. The lack of clear obligations for developers has also resulted in varying standards across projects, from luxury high-end developments to more speculative and lower-quality builds coupled with delays in the construction and delivery of materials.

One particularly unique aspect of the market is the absence of a Khmer word for “pre-commitment” in real estate, affecting how developers and buyers engage in securing future spaces. This linguistic gap reflects the still-evolving nature of the property market, which is in its early stages of professionalization compared to other regional markets.

Key Indicators for 2024

The CBRE report includes several key indicators that provide insights into the broader market trends in Cambodia:

- GDP Growth Rate: Estimated at 5.8% for 2024, indicating a positive overall economic outlook despite global uncertainties.

- International Tourist Arrivals: Reached 2.6 million by May 2024, demonstrating a recovering tourism sector that may impact hospitality-related real estate.

- Approved Investment Value in Construction: For Q1 2024, approved investments total $786 million, showing a decline year-on-year, which may signal more cautious investor sentiment.

Office and Retail Spaces: Fragmented but Stable

The office market in Phnom Penh continues to evolve, with an estimated 61.8% occupancy rate. Demand for large office spaces remains limited, in part due to the small number of MNCs operating in the city. Additionally, prime office quoting rents have declined slightly, now sitting at $27.00 per square meter, reflecting the fragmented nature of demand and the lack of a significant WFH culture in the city.

The retail market faces similar conditions, with an occupancy rate of 58.7% and prime retail quoting rents at $22.10 per square meter. The retail sector has been adjusting to changing consumer preferences, including the rise of e-commerce, but the market remains fragmented and relatively undersized compared to neighboring capitals.

Residential and Industrial Growth

Phnom Penh’s condominium market has continued to grow in supply, with more than 2,200 new units launched in the first half of 2024. High-end condominiums are being quoted at an average price of $2,718 per square meter, reflecting demand from the expat community and investors looking to capitalize on Cambodia’s urbanization.

The industrial sector is also expanding, with 120 hectares of new land launched for special economic zone development. The cost of a 50-year land lease has reached $61.00 per square meter, indicating growing interest in Cambodia as a manufacturing and logistics hub for the region. This growth has been driven by the country’s strategic location and improving trade connectivity, though the sector is still in its early stages compared to more developed industrial markets.

Phnom Penh’s Real Estate at a Crossroads

According to the CBRE Cambodia Market Report 2024, Phnom Penh’s real estate market is in its first significant cycle, marked by rapid expansion but also speculative growth. The city has historically benefited from easy access to construction financing, which has fueled a boom in development. However, as the market matures, there is growing recognition of the need for more structured and sustainable growth practices.

The city’s lack of big tech players, as seen in more developed markets, limits demand for high-tech office spaces and slows the push toward modern real estate solutions. Additionally, there is still little discussion or movement towards environmental, social, and governance (ESG) principles or sustainability in property development. This could present both a challenge and an opportunity for Phnom Penh, as more global investors increasingly prioritize ESG-compliant projects.

Phnom Penh is at a crucial juncture. Its unique market conditions provide a wealth of opportunities for developers and investors, but also pose challenges that need to be addressed as the city grows. Whether Phnom Penh can transition from speculative, fragmented development to more sustainable and structured growth will determine the future trajectory of its real estate sector.