Cambodia Investment Review

Cambodia’s beer market is set to attain remarkable growth, driven by a combination of factors including a growing middle class, rapid urbanization, and a vibrant tourism industry. These elements are fueling a surge in beer demand, with the market expected to reach a valuation of US$ 2,232.5 million by 2032, up from US$ 1,059.8 million in 2023. This growth is projected at a compound annual growth rate (CAGR) of 9.03% during the forecast period from 2024 to 2032, according to the latest research by Astute Analytica.

Read the full report by Astute Analytica here.

The market dynamics in Cambodia reflect changing consumer preferences and economic influences. While traditional lager beers continue to dominate, there is a noticeable shift towards craft and premium offerings. Local consumers are increasingly favoring unique, high-quality products, which has led to a burgeoning craft beer industry. Popular styles such as IPAs, stouts, and ambers are becoming more common, with notable local brewers like Riel Brewing, Flowers Microbrewery, and Cerevisia driving this trend by offering a wide selection of beers, including experimental and seasonal batches.

Shifting Consumer Preferences and Economic Influences

Despite the robust growth, the market faces significant challenges. Intense competition, limited distribution networks, and the necessity for consumer education to appreciate diverse beer styles and justify higher price points are key hurdles. Moreover, high taxes on beverages pose additional constraints. However, these challenges also present opportunities for businesses willing to innovate and cater to the evolving tastes of Cambodian consumers.

Read More: Heineken 0.0 to Debut in Cambodia Amid Shifting Consumer Trends

The per capita alcohol consumption in Cambodia has seen a significant rise over the years, increasing from 2.6 liters per annum in 2005 to approximately 6.6 liters per annum in 2018. This increase reflects the recorded consumption from production, import, export, and sales data. Local brands such as Angkor Beer remain popular among Cambodian consumers, alongside other widely available brands like Anchor, Singha, Tiger, and various European brands such as Heineken and Carlsberg. Establishments like Embargo in Phnom Penh offer a diverse selection of both local and international beers, contributing to the market’s diversity.

Economic factors such as retail prices and export trends also influence the beer market’s growth. For instance, the export price of beer from Cambodia was $0.95 per kilogram in 2021, the highest in the last five years. The retail price range for Cambodian beer is between $0.66 and $1.36 per kilogram. The increasing per capita consumption and the popularity of both local and international brands underscore the market’s potential for further growth and development.

Cambodia Is Characterized By A Preference For Lager Beer

The expansion of the craft beer scene is notable, with innovative flavors and styles gaining popularity among consumers. The influence of tourism on the beer market is significant, as visitors seek to try local and craft beers, further driving demand. Additionally, a favorable regulatory environment, with government initiatives supporting the growth of the beer industry, provides a conducive backdrop for market expansion.

The beer market in Cambodia is characterized by a preference for lager beer, which generated over US$ 672.47 million in revenue in 2023. Lagers’ prevalence can be attributed to their crisp, refreshing taste, which is particularly appealing in Cambodia’s hot and humid climate. The cost-effective production process of lagers, combined with the scalability of brewing operations, keeps prices competitive. Local breweries, such as Cambodia Beer and Angkor Beer, produce lagers extensively, contributing to their availability and popularity.

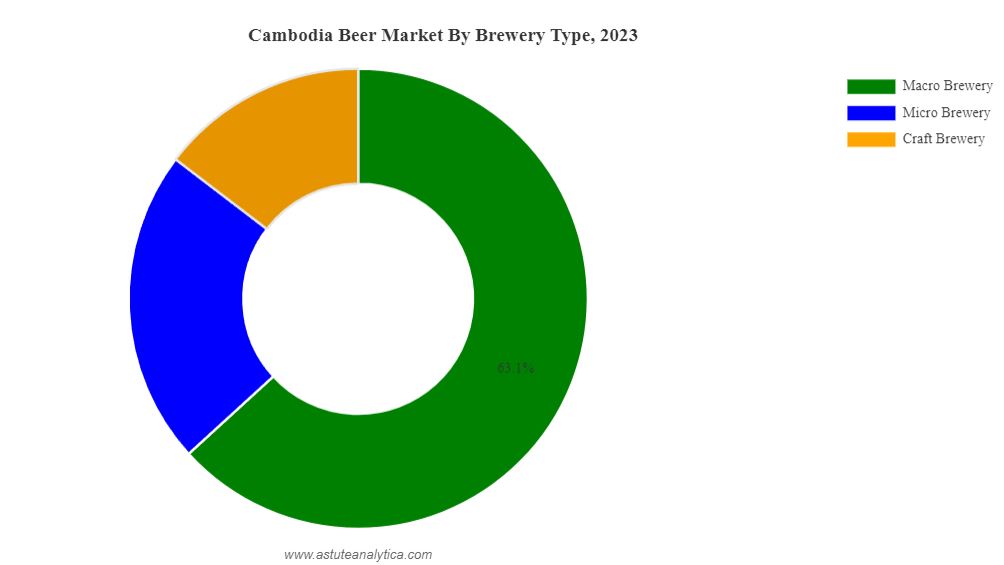

Macro breweries hold a significant share of the Cambodian beer market, accounting for approximately 63% of the market share and producing over 10 million barrels of beer annually. Leading breweries like Cambrew Ltd., Cambodia Brewery Limited (CBL), and Khmer Brewery are major players, contributing to the economy and employment. These breweries have extensive distribution networks covering over 90% of the country, ensuring wide availability of their products. They also invest heavily in marketing and facility expansion, with substantial investments directed towards modernizing their brewing operations.