Cambodia Investment Review

The Royal Government of Cambodia’s introduction of the Law on Competition on October 5, 2021 with an aim to regulates activities that affect competition and oversee with the establishment of the Cambodia Competition Commission (CCC). The CCC aims to promote fair business practices, support new businesses, and ensure consumers have access to diverse and cost-effective products and services.

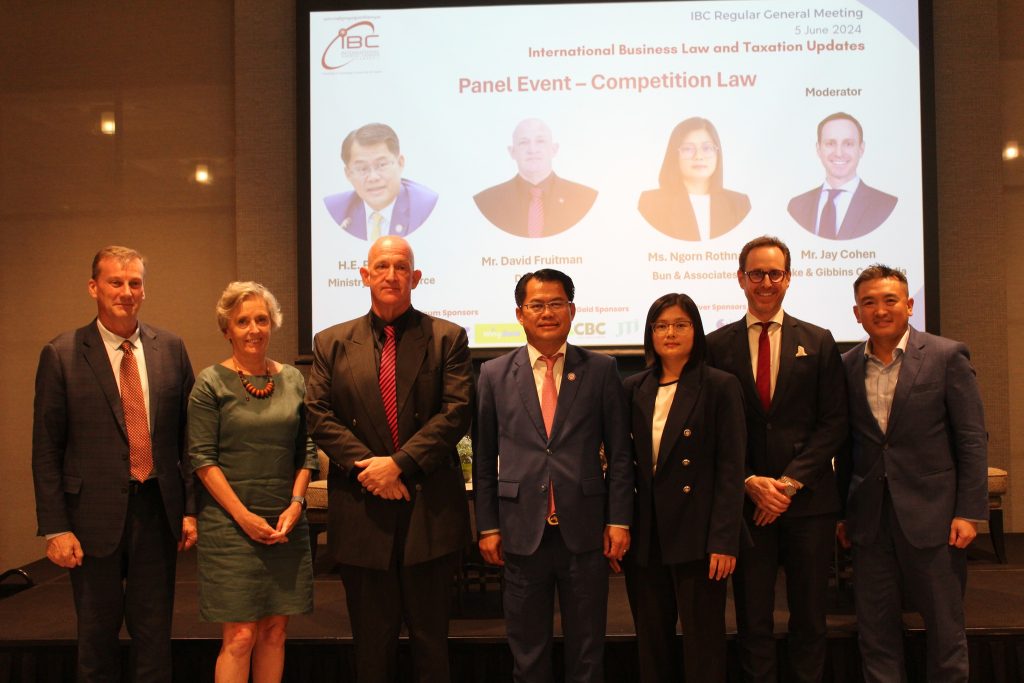

David Fruitman, regional competition consultant for DFDL and Sarin & Associates, spoke with CIR Leader Talks about the impact of the new law on the market. While there are currently no case studies, Fruitman provided detailed insights into key provisions and compliance steps for businesses under the new Competition Law.

He also emphasized the distinct approaches required for mergers and acquisitions (M&As) compared to anti-competitive conduct, such as anti-competitive agreements and abuse of dominance.

Understanding Key Provisions and Compliance Steps

“For any prospective acquisition, merger, or joint venture, businesses must first determine whether the proposed transaction constitutes a Business Combination under the Competition Law,” Fruitman explained. “This often involves assessing whether there is an acquisition of control as defined under Sub-Decree 60. If the transaction is not a Business Combination, the merger provisions of the Competition Law do not apply, although other provisions may still be relevant.”

Fruitman highlighted the importance of understanding notification thresholds, which vary by sector, including general business, banking and financial institutions, insurers, and securities businesses. These thresholds relate to transaction value as well as the value in Cambodia of the parties’ (and their affiliated group of entities) assets, revenues, or input purchase turnover.

“Business Combinations that meet the relevant thresholds may be subject to pre-merger or post-merger notification. Pre-merger notification can impact the transaction timeline, requiring the preparation of a notification dossier and undergoing primary and, potentially, secondary reviews by the regulator,” he noted. “Some Business Combinations, such as intra-group transactions, may qualify for simplified notification, involving a shorter review process.”

Fruitman also stressed the need for businesses to consider whether their transactions could significantly lessen, prevent, or distort competition in the Cambodian market. “If so, the transaction may be prohibited under the Competition Law or approved only with conditions,” he said.

Addressing Anti-Competitive Conduct

Regarding anti-competitive conduct, Fruitman advised businesses to adopt a two-stage approach to compliance. “First, review existing policies, agreements, and conduct to ensure they are not engaged in prohibited practices, with a particular focus on dealings with competitors and minimum resale price maintenance. Second, develop a compliance and education program to raise awareness among employees and management about potential concerns under the Competition Law,” he recommended.

Addressing implementation challenges, Fruitman acknowledged the difficulties posed by the lack of explicit market, financial and market share information. “Companies should base their initial evaluations on potential market implications and their own market power on their market knowledge, in many cases this will prove sufficient, but a more in-depth approach may be warranted when the initial assessment is unclear or the relevant market has not been properly considered,” he explained.

Enhancing Transparency and Efficiency

Fruitman also emphasized the role of the CCC in enhancing transparency and efficiency. “The Competition Law mandates that CCC decisions be published, but further guidance and transparency are needed. The CCF, the directorate of the CCC, is currently working on guidelines related to the merger provisions, and we hope for additional guidance on anti-competitive conduct in the future,” he stated. Fruitman highlighted the need for the guidelines to help businesses understand notification thresholds and the review process.

Finally, Fruitman noted that “Timeframes and most relevant regulations in relation to the merger regime are largely in place, but we expect amendments as experience grows. “An annual report on the regulator’s activities, legislative issues, and priorities would significantly enhance transparency. Even more advocacy, outreach, and education from the CCC would be beneficial,” he concluded.

As Cambodia continues to adapt to its new competition framework, businesses will need to navigate these regulatory requirements carefully to ensure compliance and maintain competitive practices in the evolving market environment.

For more information from DFDL Cambodia on how this law could impact your business contact here.