Cambodia Investment Review

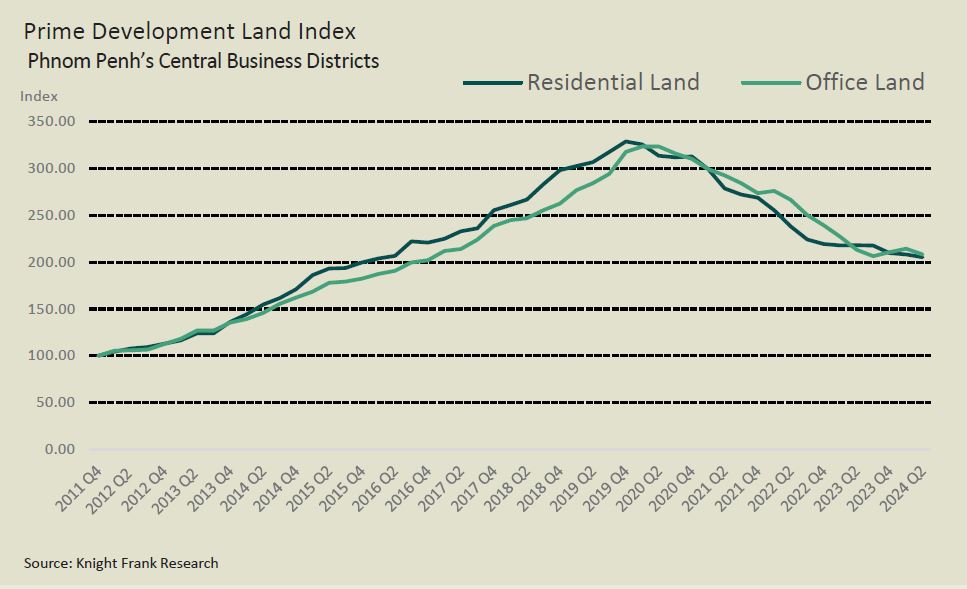

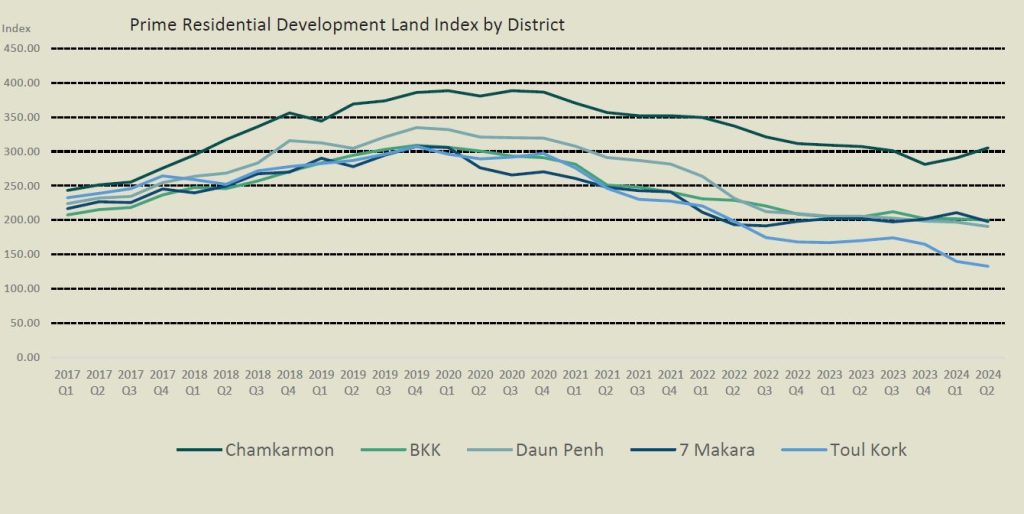

The inaugural Prime Phnom Penh Development Land Index by Knight Frank, launched for H1 2024, reveals a continued trend of stabilization in the city’s prime development land market, despite ongoing economic challenges and subdued transaction activity. The report, which will be updated quarterly, provides valuable insights into the price movements of prime residential and office land across Phnom Penh’s central business districts.

During the first half of 2024, Phnom Penh’s land market experienced low activity levels, mirroring the trends of 2023. This period was marked by a cautious global macroeconomic outlook, geopolitical uncertainties, and domestic factors such as the impact of Cambodia’s general election in July, rising inflation, high interest rates, and a general oversupply in the market.

Knight Frank’s report indicates that prime residential development land prices decreased by 1.4% from Q1 to Q2 2024, while prime office development land prices saw a more significant decline of 2.9% in the same period. Annually, the prices for prime residential and office land decreased by 5.8% and 2.4%, respectively.

Report Suggests Market Is Showing Signs Of Stabilization

Despite the declines, the report suggests that the market is showing signs of stabilization. “While the short-term prospect poses challenges, the ongoing market correction presents opportunities for developers to acquire more affordable land for development,” said Hakim Ly, Associate Director of Research & Consultancy at Knight Frank Cambodia.

Read more: Trust Regulator of Cambodia Awards Valuation License to Knight Frank

Ross Wheble, Country Director of Knight Frank, commented on the launch and market conditions: “The release of our H1 2024 report comes at a crucial time for the Phnom Penh development land market. Despite the challenges, there is a clear indication that the market is beginning to stabilize, offering new opportunities for investors. We anticipate that as economic conditions improve, we will see increased activity in the latter half of the year.”

The stabilization is partly attributed to the market nearing the bottom of its downward cycle, offering attractive opportunities for investors. With land prices significantly lower compared to pre-pandemic levels, there are now good chances for investors to acquire land at discounted rates. However, the uncertain macroeconomic and geopolitical environment, along with high interest rates, continues to impact investor sentiment in the short term.

Looking ahead, Knight Frank expects an increase in investment activity during the second half of 2024, driven by growth in exports, rising international tourist arrivals, higher levels of foreign direct investment (FDI) into Cambodia, and an uptick in domestic activities.

Global Challenges Have Also Influenced The Cambodian Economy

Persistent global challenges have also influenced the Cambodian economy across all sectors, including the land sector. As of Q2 2024, average prime residential and office land prices declined by 34.5% and 35.7%, respectively, compared with Q2 2020 prices, when the COVID-19 pandemic first began to impact the market.

Despite these challenges, the real estate market in Cambodia is projected to expand. According to Statista, the market volume is expected to grow by 1.6% per annum between 2024 and 2028, reaching a value of $639.50 billion by 2028, dominated by residential real estate which accounts for 92.3% of market volume.

The methodology behind the Prime Phnom Penh Development Land Index involves a repeat residual valuation method, which considers what a reasonable developer would pay for development land based on potential scheme values minus costs and required profits. This approach ensures that the index accurately reflects the prime development market for each sector.

Overall, while the market remains cautious, there is a consensus that the ongoing correction provides a strategic opportunity for developers and investors to secure prime development land in Phnom Penh at competitive prices, paving the way for future growth and development.