Amazadia

Amazadia Publisher, Kay Kimsong, spoke with Chief Bank’s Chief Executive Officer, Dr. Soeung Morarith, who outlined that his Bank is now accelerating banking digital transformation to help its clients access the best banking service in the Kingdom.

With Cambodia heading toward a cashless society and the sudden rise in the demand for digital payment, Dr. Morarith said that a digital banking agenda has always been one of the high priorities for Chief Bank.

Read more: Trust at Chief Bank, where ethical banking builds success

“We are now actively working on our innovative approaches by investing in cutting-edge solutions to digitally distribute our ethical financial services to all Cambodians and to make them simple, convenient, and secure to contribute to promoting financial inclusion in Cambodia,” he said.

Strong digitalization effort

Part of Chief Bank’s digitalization effort is becoming a member of the National Bank of Cambodia’s innovative Bakong payment system (KHQR) and Fast Payment network, which offers alternative options for transactions such as deposits and withdrawals, as well as transferring, sending and receiving money via e-wallets.

Read more: Chief Child Account a Good Financial Plan and Lesson for Children

The bank has collaborated with Wing (Cambodia) Specialised Bank in a digital partnership across the country to give customers greater convenience when repaying their loans. It is also seeking out long-term partnerships and collaborations with other financial institutions, agents and others to deliver higher-value of financial services to its customers.

“In addition, we are going to launch our own credit and debit card products and so on in the very near future,” Dr. Morarith said. “The bank is undertaking branch network expansion in the areas of greatest potential in Phnom Penh and in the main provincial towns, where the financial supply is lower and demand is higher, together with a digital strategy expansion and agent banking to complement its existing distribution channels.”

With the expansion of the branch network, Chief Bank can offer holistic and end-to-end products and services to customers in high-potential areas in Phnom Penh and the main provincial towns.

Customers can access microloans

Currently, Chief Bank has five branches in Phnom Penh – Boeung Kak branch, Chbbar Ampov branch, Olympic branch, Preah Norodom branch and Aeon Mean Chey branch, all in prime locations across the capital.

“While the bank is investing heavily in digital transformation, we are thinking differently, in terms of microfinance products to ensure competitive advantage,” Dr. Morarith said. “Our flagship development is to be our micro-lending app, called “Chief Easy”.

Chief Easy, will be the first digital micro-lending app of Chief Bank. Customers can apply for the loan anywhere, anytime and we will accept applications from all provinces in Cambodia up to USD5,000 without collateral via their smartphone with competitive interest rates with a loan tenure of up to 36 months.

Especially, new customers and existing clients who settled the previous Chief Easy loans on time can enjoy 2% lower interest rates. Customers will receive a quick response within 24 hours of working days.

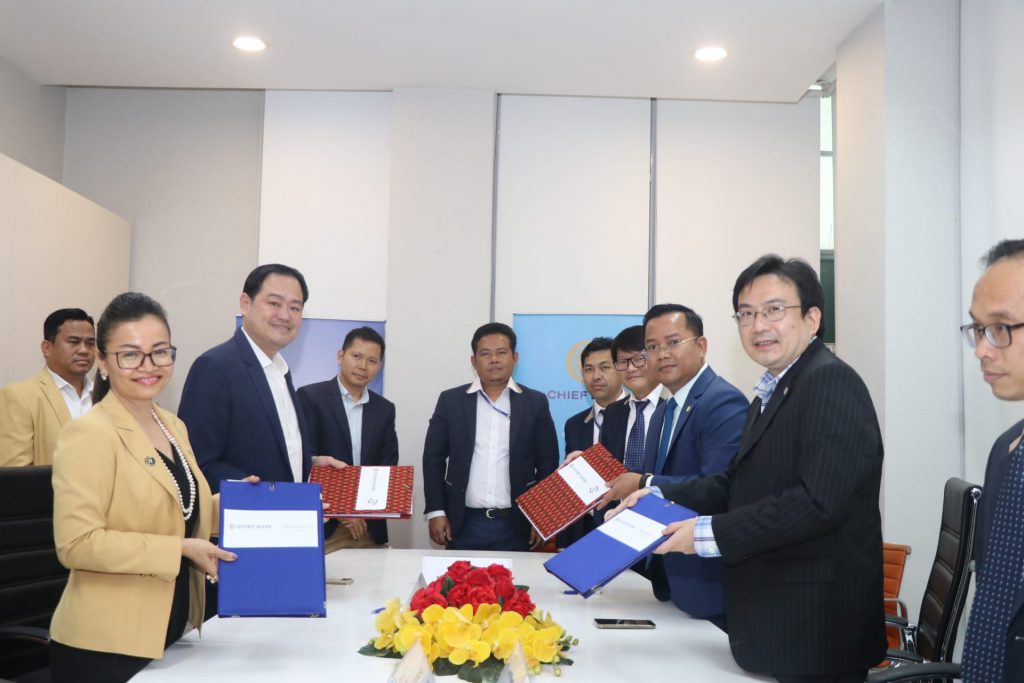

“Recently, Chief Bank was working and signing MOU with its’ clients as of companies/cooperation to provide their staff to apply for loans up to 5,000usd without collateral from Chief Bank’s digital micro-lending app called “Chief Easy” with a special interest rate,” Dr. Morarith said.

Dr. Morarith explains that with Chief Bank’s micro-lending app, customers will be able to assess their eligibility for a microloan through the digital banking system and be able to apply for a microloan from the bank digitally.

“At Chief Bank, we have been actively working to further refine our existing products and services and rolling out new products and services to satisfy our clients’ growing needs,” he said.